Let’s all welcome a new corporation to Trenton!

Wow, you don’t get to say THAT everyday!

Maestro Technologies has moved into 1 West State Street, and our Christmas Mayor Eric Jackson, not one to ever miss a photo opportunity if he can help it, was there to cut the obligatory ribbon. The front page of the company website now proudly shows its new home in Downtown Trenton,

I wish the company, which works in Big Data Management and Cloud Computing among its business lines, every success in the City. Congratulations!

Of course, Maestro only moved to Trenton rather than its initial preference of Wilmington, Delaware, because the State of New Jersey gifted the company with some hefty economic incentives to do so. Trenton Times reporter Kevin Shea writes in his piece today that the State incentives total over $17 Million Dollars over the next ten years, in the form of annual $1,735,500 credits against the company’s yearly state tax payments.

It remains to be seen whether the economic return to the State of New Jersey will exceed that investment of $17,355,000. There’s a lot of skepticism as to whether New Jersey’s incentive programs are a good deal. And that’s even if the programs were to be well and efficiently run, which has tended not to be the case.

But, Trenton has scored a major relocation, and we have a new downtown tenant and corporate neighbor. Well done!

Let me make a point here that Mr. Shea did not include in his Times Article. In addition to the NJ State Tax Credits of $17+ Million Dollars, the City of Trenton has skin in this game too. Almost $1.2 Million Dollars worth over the next 20 years.

Readers of this space will recall that I discussed back in December 2013 and in subsequent columns how New Jersey’s “Economic Opportunity Act of 2013,” as well as another Act in 2014, put the burden of partly paying for these tax incentives on the shoulders of communities least able to pay for them, such as Trenton. In my first piece, I quoted the NJ Office of Legislative Services own fiscal summary of the Act of 2013 as to the impact on Trenton and other communities:

The Garden State Growth Zone (GSGZ) property valuation exemption will result in significantly reduced property tax revenues for the cities of Paterson, Passaic, Trenton and Camden to encourage potential development which may not occur without GSGZ incentives. [Emphasis mine – KM]

This impact of “significantly reduced property tax revenues” came about due to the fact that capital property improvements performed by companies under the terms of the incentive programs would be liable for ZERO local property tax payments for each of the first ten years after the improvements would be made, and then phased in gradually over the next ten years, at an incrementally increasing 10% annually from Years 11-20.

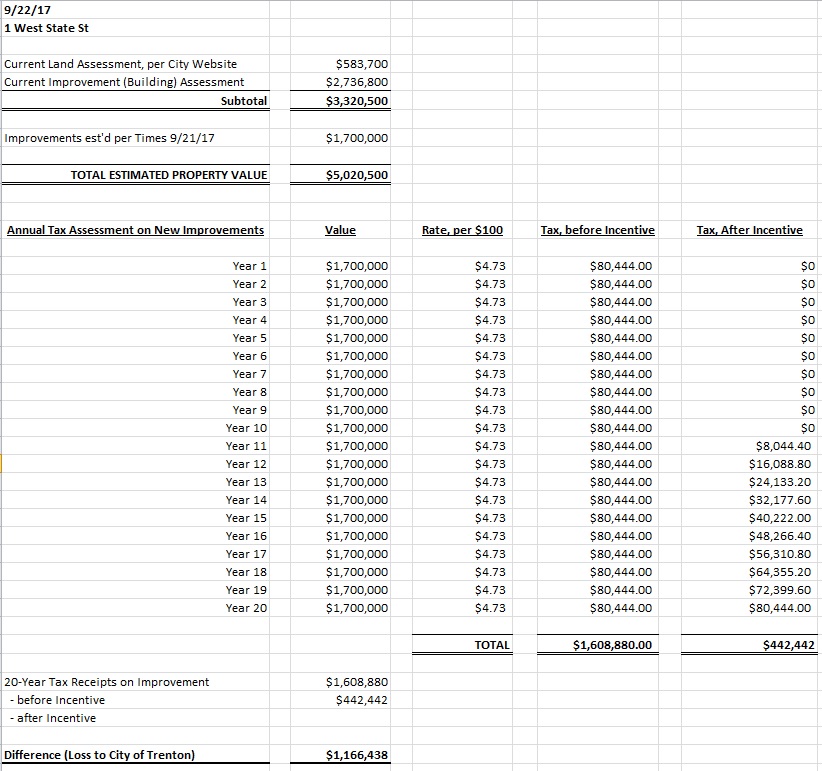

Let’s look at the specific case of Maestro to see how that will impact Trenton. According to the article in the Times, “The company said earlier in the year it plans to make a capital investment of $1.7 million.” That would be added to the current (as of 2015) value of the 1 West State property of $3.32 Million, as recorded on the City’s website. And I use the estimated 2017 tax rate of $4.73 per $100 of value, as calculated by Appraisal Systems Inc. (ASI) during its citywide property revaluation process. That rate will surely change over the next twenty years (let’s all hope, not by TOO much!), but it will work for this exercise.

OK, let’s see what tax payments to the City would look like with and without the incentives.

According to this exercise, Maestro would have paid the City of Trenton at least $1,608,880 without the State incentives, and will pay around $442,442 under the current incentives legislation. That’s a difference of $1,166,438, and the City won’t even see first dollar on the lower amount for over ten years.

Please recall, this was not a bug of the legislation, it was a deliberately designed feature.

Look, I am not saying that we’re better off without Maestro moving to Trenton. I do wish the company great success here, and I hope that success lures other companies in. I’d like nothing better! The $442,442 we hope to see from this deal is money we wouldn’t have earned had Maestro not come to town. Anything is better than nothing.

Today, I want to point all this out for a few reasons.

First, I want to remind Trentonians who read accounts such as Mr. Shea’s in the Times that the State of New Jersey is not the only party to have made an investment in this Maestro project. Trenton has almost $1.2 Million in opportunity cost here, and that’s big money to a town such as ours. It needs to be acknowledged.

Second, I want to use this news to make the argument that towns such as Patterson, Passaic, Trenton and Camden should not be harmed by economic incentive programs of the State of New Jersey. The new Legislature and new Governor next year should make it a priority to amend the Economic Opportunity Acts of 2013 and 2014 to eliminate the loss to local property tax revenues under these programs.

Do we really think that, in this particular case, Maestro would have left New Jersey for Delaware because $17,355,000 in incentives weren’t enough? Would it have really killed the deal if didn’t include Trenton’s investment of $1.166 Million? Would that really have been the deal breaker? Unless someone who is has specific knowledge of this deal comes up and says differently, I will insist that it wasn’t.

Stop penalizing towns such as Trenton. Amend the law!

And finally, I want to once more point out that the City of Trenton’s Director of Housing and Economic Development does not seem to understand that the City contributes – and contributes significantly – to the bundle of business incentives offered to companies by the State of New Jersey.

As reported in this space months ago, on March 21 of this year Mayor Eric Jackson and several city officials attended a meeting of the Cadwalader Heights Civic Association. I was present for that meeting, which included Diana Rogers, the Economic Development Director. At that meeting, she definitively stated that no city resources were being used as part of the state incentives. All incentives came from the State, she said. The day after that meeting, I sent her an email asking her to confirm her statement. To date, I have received no reply.

Diana Rogers is 100% wrong in her conception of the City’s participation in the State’s economic incentive programs. That is, if her position is still the same one she described in March. I hope it’s not, but I am not holding my breath.

So, once again, I welcome Maestro Technologies to Trenton! Please, just remember that we – all of us in the State of New Jersey, and even more so those of us in the city of Trenton – have invested a lot in your future.

May you have great success!