|

|

“Energy cannot be created or destroyed. It can only be transferred from one form to another or moved. Energy that is ‘wasted’, like the heat energy from an electric lamp, does not disappear. Instead, it is transferred into the surroundings and spreads out so much that it becomes very difficult to do anything useful with it.”

What’s true in the physical world is sometimes true in the public world. Even though politics often seems to operate on its own set of rules, sometimes it can be seen to act in the same fashion as the rest of the universe.

That’s surely true of the example above. Energy that is not used by an electric bulb to illuminate is just wasted in the form of heat, and that energy “spreads out so much that it becomes very difficult to do anything useful with it.”

Trenton’s West Ward City Councilperson Robin Vaughn is, in her first months in office, using her energy to produce much more heat than she does light, and it is just as wasteful. She risks becoming just another inefficient, dim, bulb.

Case in point: two days ago, out of the blue, on her Facebook page she called for the immediate resignation of fellow Councilperson Marge Caldwell-Wilson for, in her words, “all the apparent reasons.” Reasons which, not at all apparent, somehow relate to the Ms. Caldwell-Wilson’s presence on the Board of the Trenton Downtown Association (TDA).

Today’s Trentonian has a summary account of Ms. Vaughn’s charges, and the ruckus it created online, for further background.

I won’t recap all of Ms. Vaughn’s arguments, because I just don’t find them credible, given the complete lack of evidence provided by her, and the absence of any demonstrated support of her position by anyone in authority. But I think it is important to understand what the Councilwoman is doing here, and how ludicrous it is.

Ms. Vaughn raises on her Facebook page a vague charge of “conflict of interest” against Ms. Caldwell-Wilson without stating exactly what that conflict of interest is supposed to be. She provides no reference for her judgment, no authority, and cites no ordinance nor the City’s Ethics Code. I suppose the violations are supposed to be self-evident?

She does point to the fact that TDA is not one of the Boards and Commissions listed in the City’s Ordinances to suggest that the presence on its board of a sitting Councilperson is inappropriate. But, when presented with proof that the TDA is a legally-constituted “District Management Corporation,” as allowed under State Law as well as City Statute (Section 252-9), deflects from the issue and changes the subject. Her response is telling: ” I have raised the concern to the appropriate authorities. I will await their response and findings.”

I read this as an admission that she does not have any specific complaint or charge. She has an uncertain suspicion that something unsavory is going on, somewhere. She has made inquiries of the proper authorities, but did not take care to wait for a response to those inquiries before making a highly specific and highly volatile charge against one of her colleagues, including a demand for her immediate resignation.

In other words, she smells smoke. Smoke from a fire that she deliberately set. And she’s waiting for the fire department to arrive, while pouring more gasoline on the flames. With all of her energy, she’s only producing heat

The Trentonian story describes her as crying “wolf,” which to me isn’t the best metaphor. In that story, a child cries wolf on occasions when there aren’t any wolves around, only to be ignored when one actually shows up.

To me, the West Ward Councilwoman is an arsonist. She is deliberately making incendiary accusations, producing no proof, or support, or even specifics, for her claims. She is getting people riled up, with many on Facebook agreeing with her and complimenting her, without any real sense of what they are actually agreeing with. She is getting the sole remaining daily newspaper carrying city news to give her free media. She is causing people to react to her, to respond to her charges and insinuations, without being held to provide any specific detail.

We already have a national President who does this sort of thing on a daily basis. We don’t need a copycat in Trenton.

This is not what members on Council are supposed to do. Individual members should not be grubbing for attention and attacking their colleagues. Single Council members can’t do anything productive on their own. They have to learn to count to 4 + 1. That is, they need a majority of 4 Councilmembers to approve legislation, plus one Mayor to sign it. Whatever it is that Robin Vaughn is doing, it’s surely not what West Ward voters intended.

Ms. Vaughn was elected because people had become tired and fed up with her predecessor, who throughout his two terms was perceived as uncommunicative, remote, and low energy. Ms. Vaughn is certainly a high energy successor to Zac Chester. And then some.

But unless Ms. Vaughn starts to direct all that energy to becoming a more productive and collegial member of her body, all that energy will do is produce more heat. Which would be a waste.

With the Labor Day holiday behind us, the lower level of activity during the summer usually seen in Trenton City Hall over the summer seems to be over. City Council meets tomorrow to consider several routine measures of municipal administration as well as several new initiatives from Council members and the Administration.

Some are more worthy than others. A couple of them, frankly, have come out of the blue without any previous discussions, announcements or campaign promises. In the absence of any prior attempt to communicate these initiatives to the public, I would suggest that Council table action this week and give people opportunity to digest what’s on offer here. I know the new Administration and Council are chomping at the bit to get things going, but some of this week’s Docket items reveal Executive and Legislative branches that look like they are in danger of getting a little too far ahead of themselves. I’m looking at only three items out of a 14-page docket, not a huge number. But these three items deserve more explanation from the City than we’ve been given to date.

These three measures would, if adopted: 1) designate the entire city of Trenton as a Historically Protected District; 2) commit the City of Trenton to a lawsuit against several manufacturers of opioid medications; and 3) give major salary bumps to the Mayor, his senior Department Heads and other Administration officials, the City’s judges, and City Council members.

Yeah, right?

Now I can’t today go into detail with a lot of these. But I do want to leave you with some thoughts on each of these, and hope that you may offer your own opinions to your Council members before tomorrow’s 5:30 Session.

The first measure is Resolution #18-532, sponsored by Members Santiago Rodriguez and Marge Caldwell-Wilson. It’s titled “Resolution Recommending Consideration, Authorization and Zoning Board Application to Invoke Historic District Designation Status for the City of Trenton.” Its stated objective is to turn the entire city into a Historic District, to reap the same kind of economic benefits for this city that flow into communities such as Hampton Roads and Williamsburg, Virginia. Seriously.

The Ordinance recognizes that there are currently a handful of designated properties and neighborhoods in the City that are already entered on the State and National Registers of Historic Places, such as “Berkeley Square, Ewing/Carrol, Mill Hill.” The full list of Trenton and other Mercer properties can be found here. The purpose of this kind of designation, according to the website of the NJ Historic Preservation Office, is to help fulfill national priorities as established by the 1966 National Historic Preservation Act which “established a National Register of Historic Places to include districts, sites, structures, buildings and objects of local, state, and national significance.” Now, the main intent of the national Act is to preserve. That is, to keep what is in place. Rebuild, rehabilitate and restore as necessary, yes. But keep things as they are. Historically designated properties have substantial rules restrictions governing how and under what conditions properties are maintained and restored. But the underlying assumption is that the properties as they stand are of such historical and cultural significance to their local state and nation that they are to be preserved in perpetuity. That often puts major obligations on property owners, whether government, private non-profit, or individual homeowner on how they maintain their properties, especially exteriors.

Have you ever talked to a homeowner who lives in a historic district about window replacement? No? Well, freshen up your drink, grab a bite, and get prepared for an earful.

Councilmembers Rodriguez and Caldwell-Wilson would have us believe that the entire City of Trenton – as it stands today – is of national significance and worthy of historic preservation. Their Resolution mentions, quite properly, that this City possesses several valuable Historic Assets, naming among them “Battle Monument, Trent House, Ellarslie Museum,” and others.

But, tellingly, the Resolution’s language states that the City’s Historic Assets are “burgeoning.” Really? That word means “growing or developing quickly.” Is that so? Is the City “growing or developing” its historic assets? Is every building and structure in the City worthy of preservation, as this Resolution implies? Are you sure?

How about the garages on Sanford Avenue about which Councilwoman Caldwell-Wilson in today’s Trentonian is quoted as saying “No doubt those garages have to be knocked down because they are part of the illegal drug dealing that gets done up there.”

Hey, if the entire City is to be treated as a Historic District, those garages will have historic value. The other derelict houses on Sanford Street, too. The legal priority and assumption will be preservation and restoration, not demolition and re-development.

If the entire City had been designated a historic district five years ago, it’s likely that the old Glen Cairn Arms could never have been demolished to make room for a new Nursing School. It likely would have to have been restored within its empty shell. Old mansions on Greenwood Avenue near the train station currently slated for replacement (one of these days?) by high-rise commercial structures would be protected.

This Resolution, although it purports to be non-binding, would deliberately set Trenton on a self-limiting path that would likely foreclose any major redevelopment efforts – or make them exceedingly different – for decades to come. It’s lightyears away from previous plans and initiatives such as Trenton 250.

Trenton has several valuable historic assets. Many of them are already listed on the State and National Register. No doubt others deserve to be so recognized, and no doubt will be. But, honestly, the entire City should not be historically protected. We’re not Colonial Williamsburg.

The next item is Resolution #18-539. This measure is titled, “Resolution Authorizing The City of Trenton and Scott & Scott Attorneys at Law, LLP to Enter Into a Service Agreement Where Scott & Scott Will Represent the City Against Pharmaceutical Manufacturers of Opioid Products.”

Hello? Where did this come from? There’s no doubt that this City has long been ravaged by opioids, of the legal as well as illegal variety. The city’s crime rate and misery rate is fueled by drugs that are both illegally trafficked and legally prescribed.

But I’d like to know more about the objectives of this proposed representation agreement and potential litigation, and have questions about the Resolution as written.

What exactly are the City’s claims against the named companies? Why does this firm recommend filing in NJ State Court and not joining a Federal class action suit underway? Is this proposed action to be taken by Trenton alone, or are there other NJ towns involved? The letter attached to the Resolution states “Scott+Scott may represent other cities, counties, or states in this litigation against the opioid manufacturers and distributors.” OK, who might those be, and do we really want to join them. Why does the firm recommend not suing three distributors “who are frequently included as defendants?” Why this law firm? What is the potential downside of being part of this case? If plaintiffs including Trenton lose, what is the liability for costs and countersuits?

Overall this Resolution, being presented to Council without any prior open and public discussion about the issue, strikes me as a blank check to an unknown law firm, with unknown objectives, unknown liabilities, and unknown benefits.

Council needs to put the breaks on this one until the whole matter can be fully discussed!

Finally, Ordinance 18-47 (Sorry, that’s the best I could get for the time being) is set for First Reading tomorrow, scheduled for Second Reading on September 20.

This Ordinance would set salary ranges for several city officials significantly higher than they are now. For instance, the Mayor’s current range set in 2016, is $121,765-$158,209. If this proposed Ordinance is adopted, the salary range by 2021 would rise to $178,304-$207,001, an increase of 30%, or 10% a year.

I have not made similar calculations for the other classifications in the proposal, because I find it outrageous the Administration is introducing this measure now, again without any prior public announcement or discussion.

I’m sure the Administration will claim they won’t be able to hire quality managerial talent to head departments without competitive compensation. And I can sympathize with that, regarding fulltime Department heads.

But it is the responsibility of the Administration to make the case in advance of a proposal, not to put the matter up for adoption by Council in an up-or-down vote.

Let the Administration explain to the public and to Council how compensation for new hires needs to be improved. Show us how Trenton’s offers differ from other, similar communities. We can be convinced. Ditto with the city’s judges. These are not fulltime jobs, for the most part. We wouldn’t want judges to lose money by working for the city, but let’s hear the case for those on the city’s bench.

Let these arguments also be made in context with the City’s budget. How competitive can we afford to be? That’s the relevant question not being answered in this draft Ordinance.

As far as the Mayor, Council members and Judges are concerned: I think it’s too soon to consider range increases, that were readjusted as recently as 2016. Again, let’s look at the budget and consider what’s affordable. Since there was no shortage of candidates for Mayor and Council this year, we can assume they were not drawn to the jobs by the salaries, nor were they scared away.

They can wait awhile while we work this through the right way

And by “the right way,” I would suggest that, rather than simply setting salary ranges that automatically kick in as a function of the passage of time, let’s find a way of tying compensation packages for Senior Management – from the Mayor to Department Heads – to performance. Let specific goals and targets be set for people, and let them be rewarded for meeting them.

For instance, the Mayor made a campaign promise to renovate 1000 dilapidated houses citywide in 1000 days. Sounds like a plan. If that goal is codified in compensation agreements for the Mayor and other involved heads in Housing and Inspections, and that goal is met, Congratulations! They get a bonus.

If crime rates hit certain targets (sorry), Congratulations! to the Police Director. If Fire Department response times improve along with department safety and injury rates, Congratulations! to the Fire Director.

You get the idea. As of July 1, we installed a new Council and new Mayor. We did not suddenly acquire a new and improved financial situation. So, sure, let’s talk about better City salaries. But let’s tie them to a better City.

Taken together, these three initiatives on City Council’s docket this week – and I acknowledge there may be other problems in the pack, these are the ones I thought worth attention – are flawed. Seriously flawed, and worth voting down in their present form and with what we the public currently know about them.

To the Mayor and Council: the summer is over and I know you all want to get to work. But these three items need work, and are not ready for Primetime. You all got ahead of yourselves here. Go back and fix them, if you think they are worth pursuing.

But before you again consider them – or similar major initiatives – for passage, please do a better job of informing and persuading us of their value. Because you haven’t, with these three proposals.

Well. That’s quite the crowd of candidates running for the Democratic nomination for Mercer County Freeholder! No fewer than nine people are seeking to serve out the remainder of former Freeholder Anthony Verelli’s term, after he resigned to become an Assembly member representing the 15th District. That seat, in turn, became vacant when previous Assemblyman Reed Gusciora became Trenton’s Mayor on July 1.

And that’s only the most recent moves. The 2018 version of Mercer Dominoes got under way in January, when the other 15th District Assembly member, Elizabeth Maher Muoio, resigned her seat to become NJ State Treasurer. That vacancy was filled by then-Trenton City Council member Verlina Reynolds-Jackson.

All three of these people – Reynolds-Jackson, Verelli, and the to-be-named Freeholder Candidate – will have been chosen by county Democratic Committee members, in three separate special conventions held throughout the year. All three will be on the ballot in November for the first time in their new offices, with the Assembly candidates running as incumbents.

They will be joined on the ballot by three other serving Democratic Freeholders running for regular re-election: Ann Cannon, Pat Colavita, and Sam Frisby. There will also be candidates for US Representative: incumbent Bonnie Watson Coleman for those parts of Mercer County in the 12th Congressional District, and Josh Welle in the areas of Mercer in NJ’s 4th District. Heading up the November Democratic ticket statewide in this midterm election year is incumbent United States Senator Robert Menendez.

Overall, it’s shaping up to be a very important election for New Jersey’s Democratic Party, especially so for Mercer County’s Democrats.

It’s not going to be an easy year for them.

That’s kind of counter-intuitive. A little more than two months away, this election is shaping up to be a very good one for national Democrats, as the midterm election is becoming a vote of confidence in a national Republican Party that is becoming the personal vehicle of a deeply polarizing President. A lot can change between now and November, of course, but there are signs of a building “Blue Wave” that will shake Washington as well as several states around the country. New Jersey, dependably Democratic for several national elections, would normally be expected to be a big part of that wave.

Not so fast!

From the statewide top of the ticket on down to the local Mercer races, there are problem areas for NJ’s Democrats that may lead to some major disappointments in November. State Democrats are whistling past the graveyard as they consider Bob Menendez’s prospects of keeping his US Senate seat. Yes, his federal corruption trial on corruption charges ended in a jury deadlock and mistrial. Yes, the US Attorney for NJ dropped all charges against him. Yes, his Republican opponent Robert Hugin is under ethical clouds of his own as an executive in a controversial pharmaceutical company.

None of that matters. Menendez is seriously damaged goods, in a state that is notoriously fickle about its politicians. Remember, Chris Christie wasn’t first elected Governor because voters loved him. Christie won in 2009 because they hated Jon Corzine. Bob Menendez faces that same dynamic this year. He has a real fight on his hands this fall, and that fight will affect all the other down-ballot races statewide, regardless of any other more local factors.

And local factors abound, at least in Mercer County.

For instance. The Freeholder incumbents and candidate will be campaigning this fall under the shadow of the action they are likely to take in September, a pending proposal for salary raises for many County Employees. The Freeholder Board this month passed the first reading of an Ordinance that would increase the salaries of a dozen County officials including Executive Brian Hughes by 2%, retroactive to the beginning of 2018. The second reading and final vote to approve the raises is scheduled for September 13.

The last time the Freeholders passed a measure to increase salaries was in January 2016. At that time, the Freeholders came under criticism, including in this space, for passing a salary increase that they did not run on or discuss in the most recent County election, that of November 2015. At that time I wrote,

“Voters deserve an opportunity to weigh in on a matter such as this, as a check and balance against the ability of public officials to grant themselves unilateral retroactive raises. The manner in which this is being discussed and approved suggests an effort to accomplish this early enough in the new legislative term so that voters may forget about it by the time the next election rolls around.”

Well, here we are. The next election is rolling around in November. Three Freeholders are running for re-election, along with one out of the nine current prospects who will be running to join the Board. This is a perfect opportunity for all of them to run on this issue.

That is, I don’t believe the Freeholders should approve any Ordinance to raise salaries in September, or October.

They should take the issue to the voters, as they definitely did not in 2015. Explain why they think this makes sense, why they support it. If the voters agree, the Freeholders will be re-elected. If not, they won’t.

That’s how representative democracy is supposed to work. In 2016, the Freeholders voted for a raise just after an election, with little accountability at the time for their actions. This time they propose to pass more raises just before the election, again minimizing accountability for the consequences of what might likely be an unpopular decision.

In 2016, the main argument for the propriety of the raises granted that year, as made by Brian Hughes, who “said his salary was flat during the recession years of 2008, 2009, and 2010 while the county’s union employees received raises.” But David Foster of the Trentonian reported that by 2016, the sacrifice made by Hughes and his colleagues in the recession years had been mostly offset:

“Hughes’ starting salary in 2004 was $127,336. In 12 years, his salary has increased nearly 29 percent, which equates to an average annual raise of 2.4 percent, according to figures provided by Mercer County. For comparison, rank-and-file employees from the largest union Mercer County contracts with received a pay increase of approximately 30 percent during that same period.”

The raise of 2016 brought Mr. Hughes’ annual salary to $164,090, according to Mr. Foster’s reporting from then. The measure under consideration now proposes to raise that to $174,133. That comes to a 2-year increase of 6.1%, a little over 3% for each of the 2 years, even though the reported 1-year increase is 2%. From the current reporting, I assume that the percentage increases for the other affected individuals will be similar.

From Isaac Avilucea’s August 9 article, he reports that an earlier draft of the ordinance included raises for the Freeholders themselves, an option that did not make it to the version of the Ordinance under consideration now.

I suppose the Freeholders thought it would be awkward to run for re-election after just giving themselves another raise.

But I think it’s just as awkward to run this Fall just after giving the County Executive and the other dozen officials their bumps.

Why don’t they wait, and make this election a referendum on these raises?

If they win in November, then they can vote on the raise package!

Right now, it strikes me as a difficult and unnecessary uphill climb fore Mercer Freeholders to run on what are bound to be unpopular salary increases, down ballot from a deeply unpopular US Senator.

But, what do I know?

NOTE: Below are remarks as written for last night’s Council meeting. I was cut off at the 10 Minute mark, which is noted below. I swear, when I ran through them they timed at 8 minutes. Oh, well.

The proposed Resolution failed in 2-5 vote. Sponsor Robin Vaughn and Santiago Rodriguez voted in favor.

— # —

Madam President and Council Members – On your docket this evening is Resolution #18-519, intended “To Remove the Memorandum of Understanding (MOU) between the New Jersey Department of Community Affairs and the City of Trenton.”

The issue of the MOU – the document by which the State of New Jersey has memorialized and authorized Transitional Aid Awards to the City annually since 2010 – and the role of the DCA in oversight of the City’s internal financial affairs, have been in the forefront of Trenton discussions for the last few weeks. In his first days in office, the Mayor announced – wrongly, as it turned out – that the requirement for an MOU to accompany Transitional Aid had been waived for Trenton. Oops! Big Oops, actually, at the time, but one that should have quickly passed, in the aftermath of both a chaotic budget process that those in the Statehouse would rather forget, and a City Hall transition barely two weeks after bitter runoff elections.

However, since that brief incident at the beginning of July, the idea of canceling the MOU has been kept alive, and is present on tonight’s docket in the form of this quite meaningless Resolution. I respectfully request your vote against tonight’s measure.

This Resolution is poorly reasoned, needlessly contentious, and badly written. True, that’s the case with far too much writing in government and business; that can be excused. But its principal fault is that is simply meaningless, and meaningless in many ways.

First, by itself it will not authorize or trigger any action that can be taken by the City of Trenton on its own to change the terms of Transitional Aid, a state program instituted by Governor Christie when he unilaterally severed the previous financial ties between the City and State in the form of Capital City Aid.

This Resolution does not oblige the City in any way to any action, neither does it compel the State to do anything. From the State’s perspective, Transitional Aid is a voluntary program for participating communities. Representing the interests of all of the state’s citizens and taxpayers, it has required annual MOU’s as the price of getting the grant since the program’s inception. Whether the amount is $27 Million, as it was in 2011, or this year’s $9 Million, if Trenton wants and needs State money under this program to balance its books , it has to play by State rules. A unilateral City Council Resolution doesn’t do a single thing to change that reality.

I want to be clear. Transitional Aid for Trenton is a flawed program. But put that thought aside for now.

Resolution #18-519 is meaningless for another, more important reason. The MOU mechanism has been described in the press by a sitting councilmember as “one of the crippling factors that has prevented the City of Trenton from thriving economically.” The language of the Resolution definitively states as an unquestionable reality that “Trenton will continue to be unable to generate the necessary investment capital, savings and revenue to improve and build out its service delivery platform and if action is delayed, to get the MOU removed, Trenton will likely continue to be severely fiscally distressed and challenged to effectively deliver services to its population of over 84,000 citizens.”

Whew! This is some claim. This is, of course, nonsense, easily dispoven by pointing to Trenton Pre-Transitional Aid. When the City was receiving over $40 Million in Capital City Aid, it was just as broke, just as “distressed and challenged,” just as dysfunctional. Can’t put the blame on DCA for this, although the State of New Jersey bears a lot of responsibility for several decades of history which have led to our current situation. Again, put that aside for now.

The truth is that Trenton has – as of yet – done nothing to show that it has earned the removal of state financial oversight that’s been the unavoidable cost of this particular program of state financial aid.

Confidence is earned.

Trust is earned.

Respect is earned.

Since your July 1 Inauguration, neither Council nor the Administration can yet point to any accomplishment, plan or policy that has begun to regain all the Confidence, Trust and Respect lost by the City of Trenton over the last several years by its continual failures of action and inaction.

There are efforts and plans under way of course, but none that have yet come to any kind of fruition. Working in opposition to whatever positive momentum that you on your new Council and the new Administration are working to get going is, frankly, a lot of baggage from the past that is doing nothing to earn back what’s been lost.

ITEM: The City website still contains the names of many Directors and Employees throughout City Hall who were on watch when $5 Million Dollars was stolen by a City vendor not so long ago. The Previous Administration failed to demonstrate or even explain that any action – in the form of personnel, policy and procedural change – was EVER taken to prevent another similar theft in the future. To begin to earn back Confidence in city government, the public still needs such demonstrations and explanations that we won’t be ripped off again.

This shouldn’t be a high bar to clear, after all, to show that you’re not leaving all the city’s windows and drawers open and ripe for the picking! But it’s a bar that Trenton stubbornly continues to refuse to clear.

ITEM: Although the Administration has devoted considerable energy and resources to cleaning up the mess at the Trenton Water Works, there still remain much of the same Public Works management – including an ineffective Director – and staffing that have overseen so many failures and violations, as well as a patchwork of contractors and consultants working to advance plans and goals of which we and customers throughout the County are still uninformed.

To help earn back Trust in Trenton’s Water Works, we need to see a positive Plan, as well as frequent and quantifiable, measureable progress in pursuit of compliance with such a plan.

The Administrative Consent Orders signed by the current and previous Administrations and the state Environmental Protection Department have also been the subject of strong criticism this past month, mostly unjustified. As of now, the ACO’s – and the monthly reports they require – are the only current means by which such compliance is being measured and explained, and the only current way by which Accountability up and down the chain of command can be in any way enforced. Until you, or the Administration, or the State, can come up with something better, the ACO’s are the best we’ve got. And the best not just for Trenton, but for all of the TWW customers in Mercer County on whose behalf Trenton is also supposed to act.

ITEM: The City’s record as a responsible and compliant recipient of Federal funding was damaged a few years ago when the US Housing and Urban Development Department canceled millions of dollars in Community Development Block Grants due to the City’s failures in program administration and management. Since 2015 the US Government has designated the City of Trenton as a “high-risk grantee of federal funds.” Has the City rectified that situation? I don’t know. Do you?

ITEM: For the better part of a dozen years, multiple Administrations and multiple Councils have been unable to adopt annual Fiscal Year budgets and financial plans until 9 or 10 months of the budget year have passed, with 9 to 10 months of city monies already come in, and gone out. That’s no way to run a city.

You will earn back Respect for City Council and the Administration by passing four annual, balanced city Budgets on a timely and responsible basis.

“But, but, but…” past Councils and Administrations have cried, “we don’t know what actual Transitional Aid Awards are until late in the Fiscal Year, and can’t complete a Budget until then!”

That’s never been a very satisfactory answer to me. Even if Transitional Aid actual amounts aren’t finalized until several months into a fiscal year, for goodness’ sake there’s absolutely no reason provisional temporary numbers – that we surely already have and DCA already has – can’t be used by the City and accepted by the State to prepare and formally adopt its budgets. If final Aid amounts change, amend the budget! In concept, it’s not that hard a deal!

Which brings me back to the Transitional Aid program. Yes, it’s flawed. Yes, it’s clunky. Yes, it infringes on the city’s autonomy.

[This is where Clerk Harris called me for time. The rest of these remarks were unspoken last night. Bummer.]

Yes, it lumps Trenton in with other Jersey communities and ignores the unique position of this town’s role as host of So Much State Government, a role recognized by the State prior to Chris Christie’s tenure as Governor. Yes to all that.

So, Councilmembers, come up with something better! There is a case to be made for Trenton’s unique position as the host of state government. There are arguments to support a source of regular, dependable and appropriate annual financial support in lieu of property taxes. But, let’s be clear, Transitional Aid is not that program. It never has been and never will be. It may in fact be phased out in the near future, as the very word “Transitional” has threatened since the program’s inception. But that’s not happening yet.

There is too much history and too much precedent with this program statewide to expect the state to waive the MOU requirement. It’s not going to happen. On top of that I simply do not believe that, as of tonight, the City of Trenton has earned that kind of consideration. To argue otherwise, and to adopt a resolution such as the one before you, is frankly not justified at the present time.

Don’t spend your precious months writing, debating and passing meaningless “Make it So” Resolutions such as #18-519. Don’t legislate in the press before you’ve done any meaningful legislating in this room.

Earn back Confidence, Trust, and Respect for this City by demonstrating Basic Competence, by this City.

In general, please, Do more. Talk less.

Prove that you are willing to and capable of doing the heavy lifting required to better the fortunes of the City of Trenton.

Please start by defeating Resolution #18-519.

Thank you.

At my place of work, part of my job is to review, approve and sign every piece of business-related items. Estimates, contracts, purchase orders, expense reports, timecards, checks, etc., etc.

Most of the time it’s very straightforward. I see a bill for $1000. If we ordered the item and that’s the correct amount, great! All good. I put my totally illegible, but I’m sure highly distinctive, signature on the paper, and it moves along.

Sometimes, though, I will see a bill where I am being asked to approve an amount that’s different from what’s on the bill. Why is that? Some goods and services – employee benefits are a good example – are handled centrally by a Corporate department. That department will send out copies of the bill to other corporate departments or shows like mine, with the specific amount each unit is to pay written in.

In those situations, an additional sheet or sheets are attached to the bill that show how that sub-amount was calculated, to the penny. So I know when I approve an amount that’s different from what the bill or contract says, I am confident I know that the different amount is the correct amount.

This isn’t rocket science. It’s standard business practice, anywhere and in any place that’s at all well and transparently run.

You know where I am going with this, right?

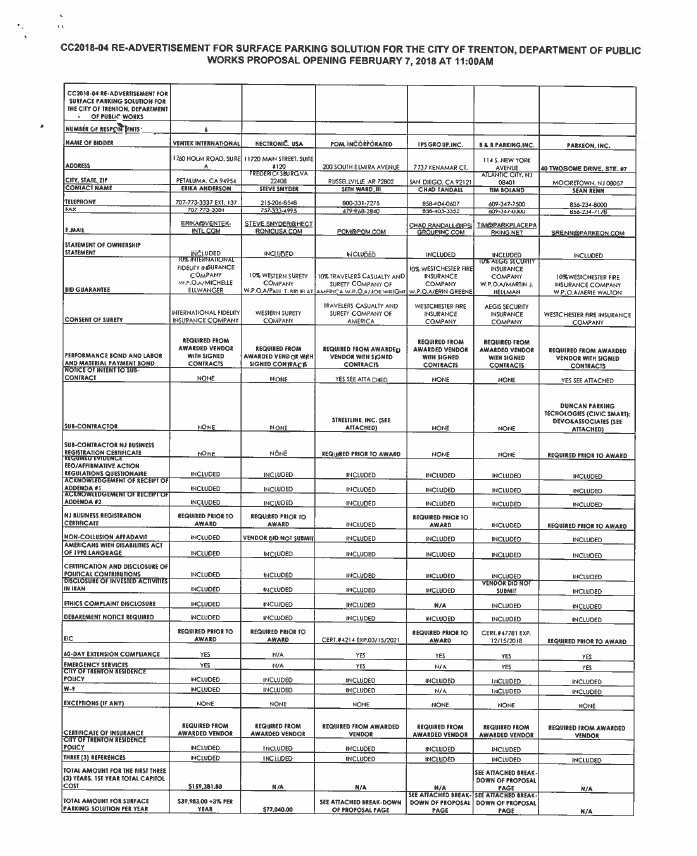

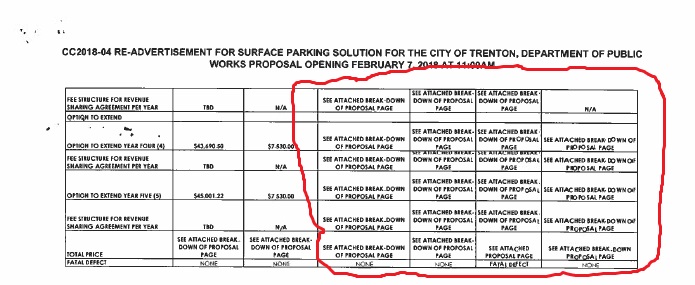

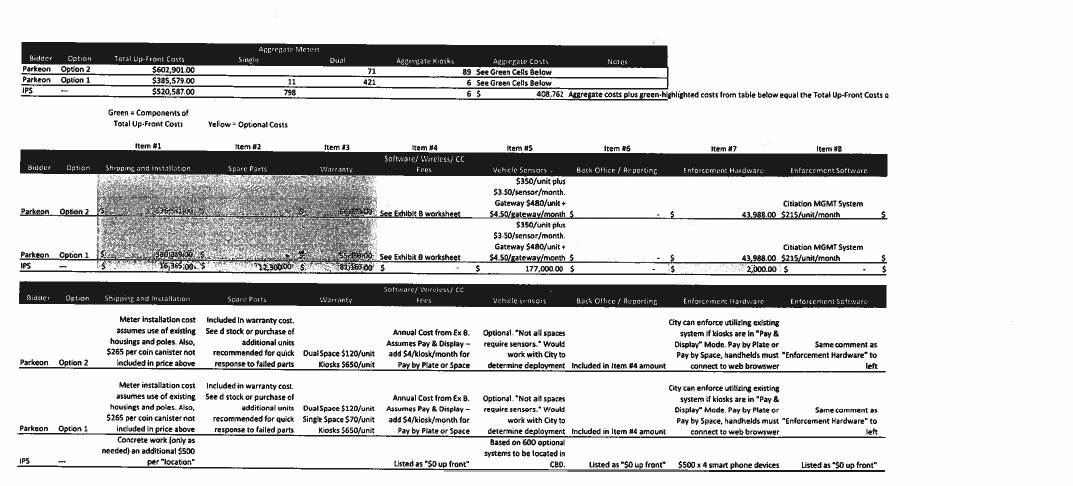

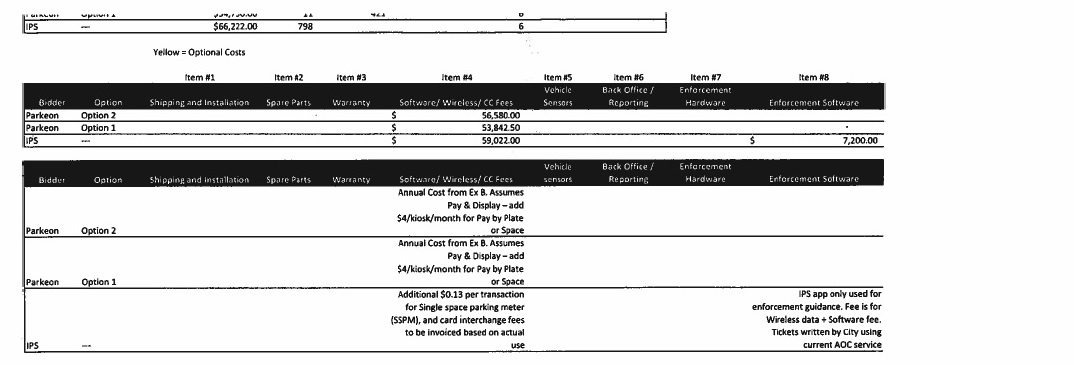

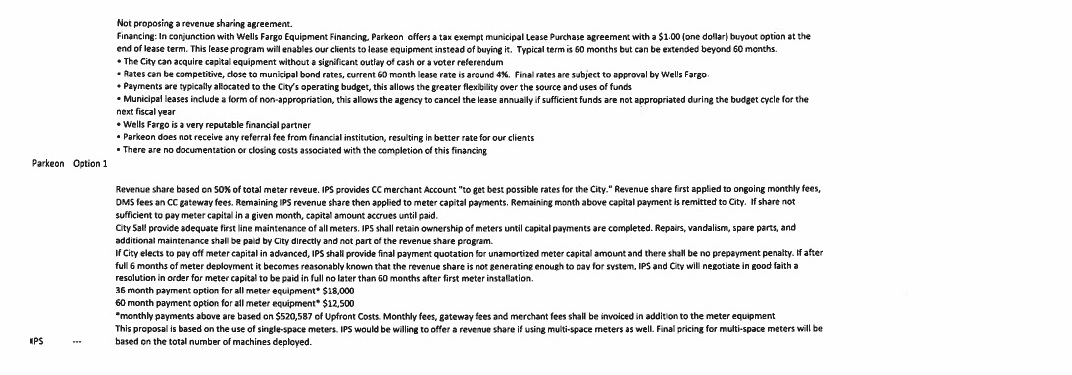

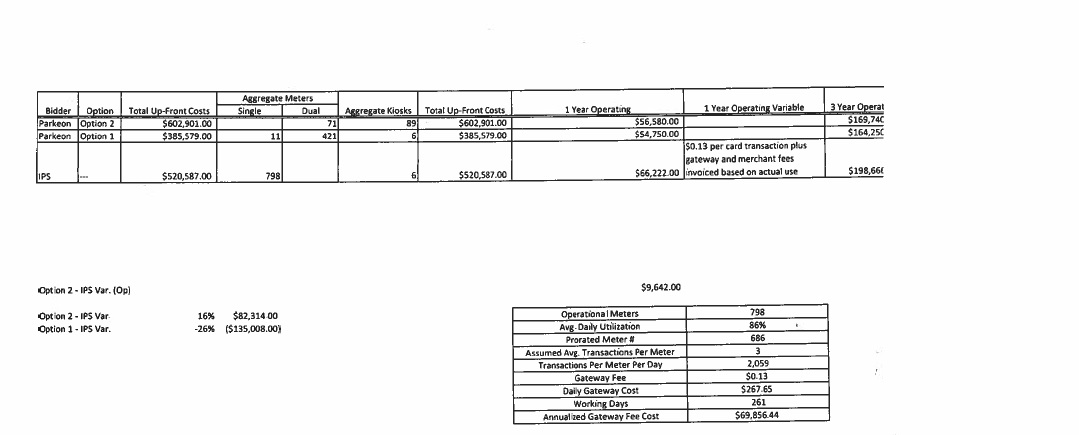

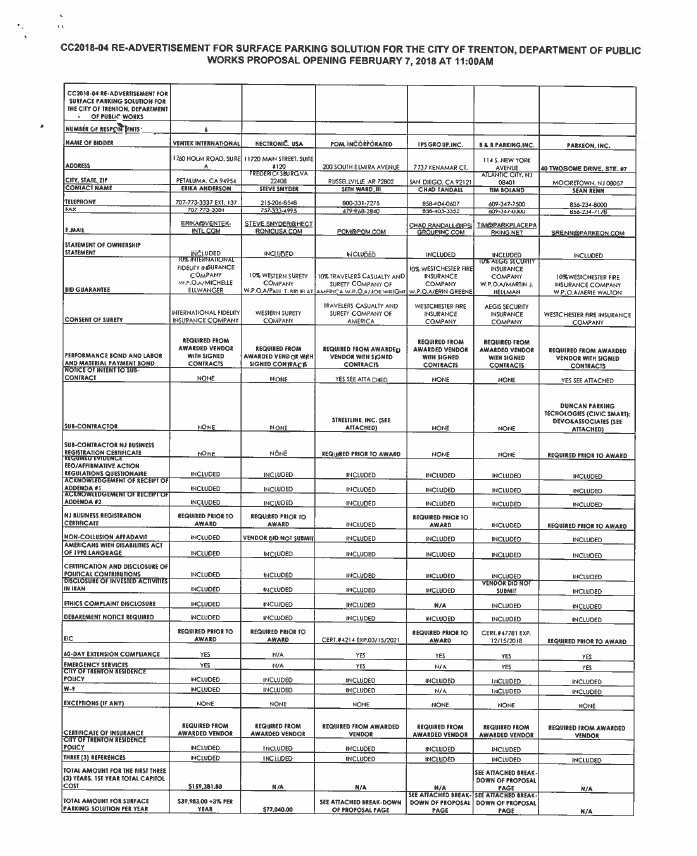

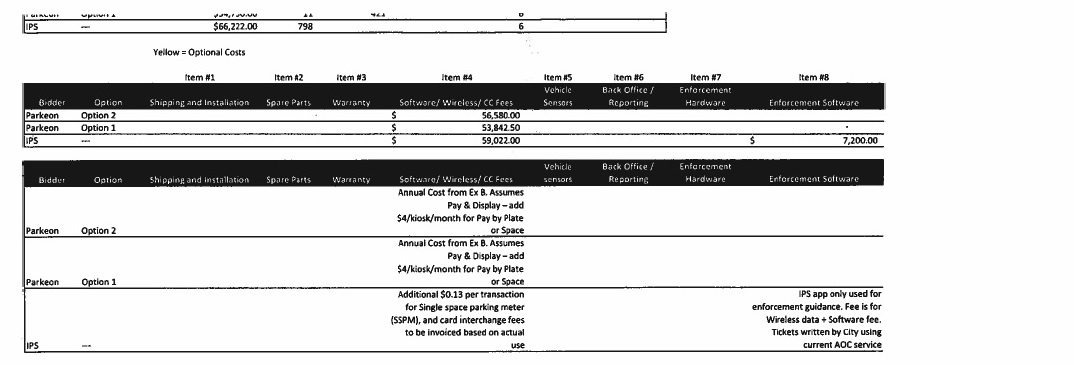

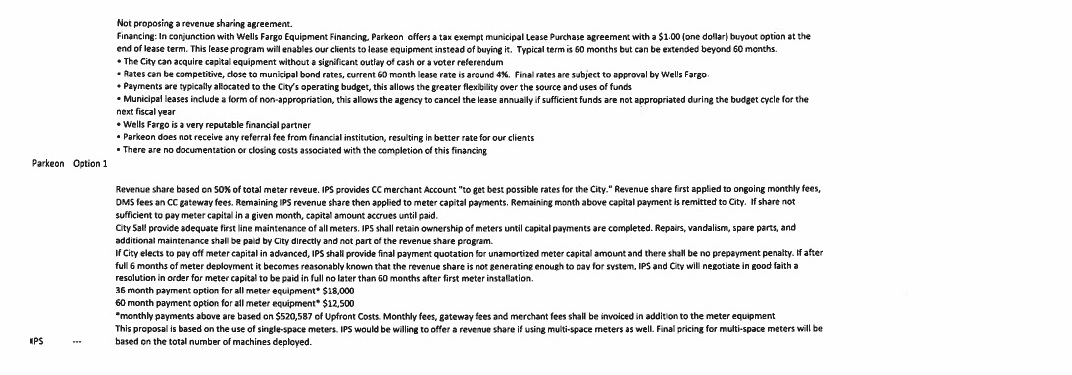

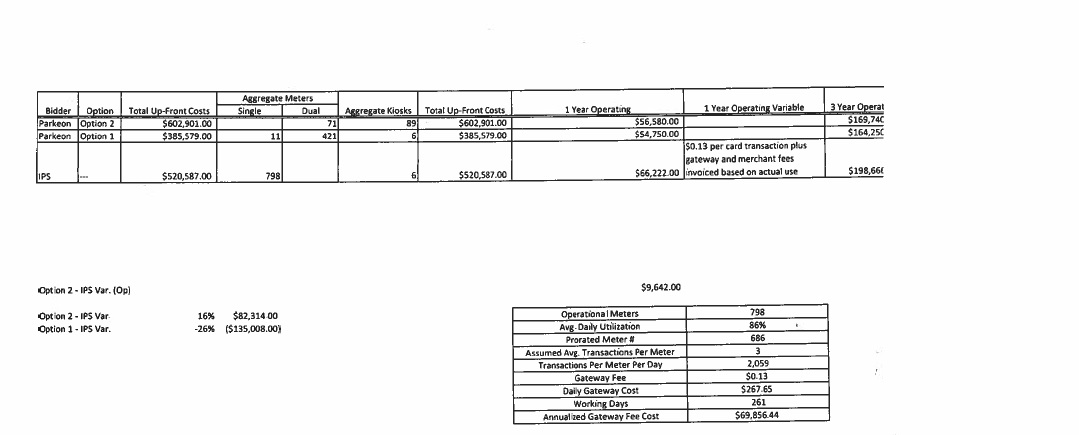

Let’s talk some more about Resolution #18-456, passed unanimously last week by Trenton’s City Council. This item approved the winning proposal, from Parkeon Inc, one of six vendors who submitted proposals in February of this year for new street Parking Meter and Kiosk services to be installed mostly in Downtown Trenton. This Resolution, as discussed at some length yesterday – sorry, sometimes these things do take a couple of thousand words to explain! – did not appear on the official Agenda and Docket for this Council’s final meeting on June 21, and was not accorded the usual prior public notice as called for by the NJ Open Public Meetings Act. You can look at yesterday’s post for more background and information. In short, from the information available as of yesterday and today, I consider the City’s process to evaluate all the submitted proposals and recommend a final selection to have been fatally flawed. The City’s selection of Parkeon may also, due to the fact that the proposed award of a contract to the winning bidder would be made way after the 60-day deadline required by NJ Purchasing Law, be invalid.

Today I want to focus on what the City Council members who voted unanimously – with the exception of the absent Phyllis Holly-Ward – were given to make their decision. Remember they saw this for the first time no earlier than the 5:30 PM time that last Thursday’s meeting started.

Here’s the link to the Resolution, along with the attached materials that was given to each Council member, according to City Clerk Dwayne Harris, who emailed this to me yesterday.

Here are the two pages, Pages 31 and 32 of the package, prepared by the City to summarize and compare all six proposals:

There’s a lot of information on these Summary pages, so I highlighted the areas I want to draw your attention to.

You’ll notice that for most of the cost information that these Summary sheets are intended to, well, you know, Summarize, the reader is asked to go back to the Original Proposals from each company and look for that information.

“But,” I hear you asking, “this wasn’t announced as being on that Meeting’s approved and adequately-noticed Agenda! Council members wouldn’t have known to bring their copies of each proposal. Besides, why didn’t the City provide those numbers on the Summary Sheets?”

Good Question!!

I don’t have an answer to that. Right now. Keep reading!

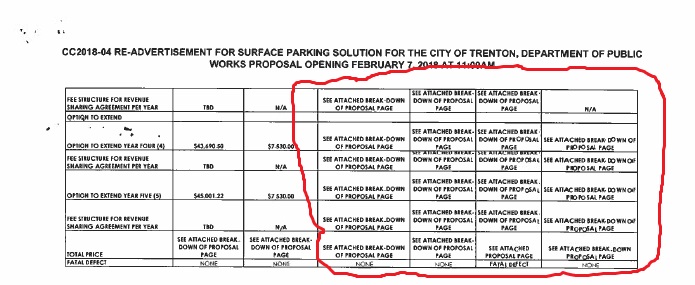

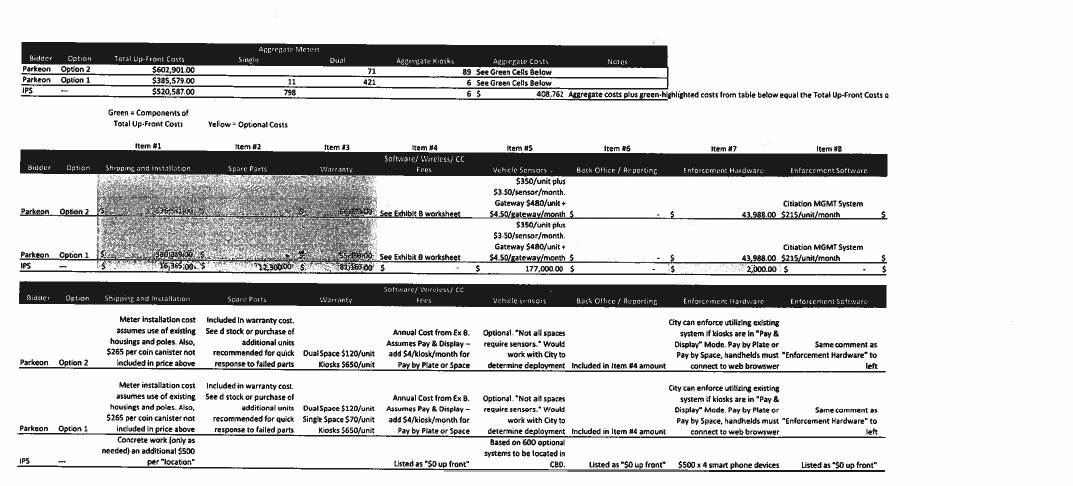

As part of the Resolution package, the City did provide some cost information. Here are Pages 33-36 of the Resolution Package:

Did you follow all the way down here? Good! Did you follow all the way down here? Good!

Did you notice a few things? Such as:

1) These four sheets look to compare cost information for only two vendors: Parkeon and IPS. There are a few numbers for two other vendors, Ventek and Hectronic, on the summary sheet. But for “Total Price” for those two companies, or any cost numbers at all from POM, Inc. (the sixth, B & B Parking, was dropped from consideration because of a Fatal Flaw in their proposal), the Summary Sheets direct the Reader to “SEE ATTACHED BREAKDOWN OF PROPOSAL PAGE.”

2) The first page of the Resolution states it proposes that the City enter into a contract with Parkeon “in an amount not to exceed $1,200,000” for three years, with options to extend for a fourth and fifth year. However, I challenge you to find the figure of $1,200,000 printed anywhere in the sheets above, or in the actual Parkeon proposal (Pages 23-28) itself.

In the sheets above, you can see a figure of $602,901 for what’s labeled “Upfront Costs.” In addition to this, there’s a figure of $56,580 labeled “1 Year Operating,” and what looks like (the last digit is cut off) $169,740 labeled “3-Year Operat” (also cut off).

If you add the “Upfront Costs,” “3-Year Operat” and 2 of the “1 Year Operating” numbers to make a 5-year term, that all adds up to $885,801. That’s nowhere near $1,200,000.

Where’s the rest? Somewhere else in the proposal? Somewhere else in the Summary Sheets? In some other documents that didn’t get attached to the Resolution Package?

Finally, how do any of the numbers on the Winning Bid compare to the other Vendors who submitted proposals?

The answer is, We Don’t Know. And We Can’t Tell. The Summary sheets tell us to “See Attached Breakdown,” and there are none. You can’t figure out what numbers go with what option, and with what vendor.

In other words, this is all a Freaking Mess.

Just as at my job I will not approve any piece of business if the amount I am asked to approve isn’t the same one as printed on that piece of business, and there’s nothing attached to show how the requested amount has been calculated, I would have sent back this Resolution unsigned without a second thought, along with some stern words for the department that asked me to approve it.

There’s simply no way in hell, based on these sheets – or in the Parkeon Proposal – to see where the request figure of $1,200,000 on the Resolution came from.

But every member of City Council last Thursday approved this. Every member of Council thought this was dandy. Every member of Council felt they had all the information they needed to make an informed decision.

All I can say is, Thank Goodness that four of these guys will not be back on Council next year.

As to returning re-elected members Marge Caldwell-Wilson and George Muschal: WHAT THE HELL WERE YOU THINKING?!?!?!?!

I want to say here that I haven’t yet really looked closely at Parkeon’s proposal, nor those from the other vendors. They may likely be just fine and perfectly suited to solve Trenton’s downtown parking problem, after at least five years of no movement or progress at all. I have nothing to say at this point about any of them.

It’s just the way that the Administration and Council handled the matter that was bullshit.

Final point: I asked above, Why didn’t the City provide all the cost numbers on the Summary Sheets? And why did the City want to send the Council members to “SEE ATTACHED BREAK-DOWN OF PROPOSAL PAGE?”

I don’t know for sure. But, along with everything else we know today that’s associated with this Resolution:

- It was a last-minute item added to the June 21 docket without adequate notice;

- The Trenton Downtown Association didn’t know this action would be taken to award a contract;

- There was absolutely no transparency in any of the financial numbers submitted by the six bidding vendors in the materials given to Council at the last minute, and no way to compare bids;

This still seems to me what it did yesterday: an effort by the outgoing Administration to pull a fast one before they leave office at the end of this week.

And, in this matter, each member of this Council utterly failed last week – one last time – in their obligation to protect the public’s interest, and ensure that financial decisions they make and approve are done with care, attention and full transparency.

We still don’t know why. Perhaps now we should try to find out?

The current membership of Trenton’s City Council met for its final session last Thursday, June 21. The Agenda and Docket was pretty fat, chock full of last-minute items requiring action before new Council members and a new Mayor are sworn in this coming Sunday.

One item was not listed on the Agenda and Docket. It was walked into Thursday’s session without adequate public notice. It was Resolution #18-456, which proposed to grant a three-year contract, with options to be extended for a 4th and 5th year, for $1.2 Million Dollars to a Moorestown company called Parkeon Inc. for “parking meters and kiosks” and ancillary items and services to go along with the new parking hardware.

By itself, the last-minute inclusion of a Million Dollar-plus contract in the final Council session of this Council and this Administration should have sent up some red flags among the Council members. Since I didn’t attend the meeting, I don’t know if any of the members expressed any objections or asked any questions during the meeting. I emailed each member yesterday afternoon asking about this Resolution, and asked if there were any special emergency circumstances or other factors which required immediate action on this last-minute proposal. As of 4:00 this afternoon I have received no responses from any member.

Now, it should be said that, as far as I can tell, including a last-minute agenda item without adequate public notice isn’t illegal. Under the NJ Open Public Meetings Act (OPMA), N.J.S.A. 10:4-8 d., “Adequate Notice” is defined in part as “written advance notice of at least 48 hours, giving the time, date, location and, to the extent known, the agenda of any regular, special or rescheduled meeting, which notice shall accurately state whether formal action may or may not be taken” [Emphasis mine – KM]. That qualifier on the agenda – “to the extent known” – leaves a very large loophole for an Administration and Council to drive a truck through. Last-minute stuff happens. It just does. And not just in Trenton.

Even though I haven’t heard back from any Council members, it looks as if this last-minute Resolution for $1.2 Million didn’t seem to bother any of them at all. The Resolution was passed unanimously, 6-0, Member Phyllis Holly-Ward being absent. I asked City Clerk Dwayne Harris yesterday for a copy of the Resolution and the support materials provided to Council last week. The Clerk sent it to me, and it is available at the link provided above.

After looking at the Resolution, and other documents on the City website in connection with this proposal, I think Council should actually taken a closer look at this deal. In fact, I think they should have shot it down. Better yet, the Administration should not have submitted this to Council last week. At all.

If this Resolution and the contract with Parkeon have not been signed by outgoing Mayor Eric Jackson, they will be well advised to put this whole thing on hold, and let the new Council and Administration evaluate and deal with this matter. Properly.

A little background.

Anyone who’s looked to park in Trenton’s downtown knows that it’s pretty screwed up down there, and has been for years. Meters are frequently broken, and enforcement by the City is inconsistent, allowing state workers to park all day in curbside spots meant for short-term use only. Neighborhood merchants, as represented by the Trenton Downtown Association (TDA) have long been upset that potential customers are not giving them their business because they can’t find nearby parking.

This is not a new issue. At least as far back as 2013, the State Department of Community Affairs (DCA) made it a condition for receiving that year’s Transitional Aid Award of $25.4 Million “that the city work with the Trenton Parking Authority and a parking consultant to come up with a new plan, due July 1, to boost enforcement and collection of parking fees,” in the words of a Trenton Times (remember them?) article of the time. I also commented on the issue back then.

However, the City blew off that deadline. The State allowed the Transitional Aid money to go through. And nothing has pretty much happened in the intervening five years.

Well, not exactly nothing. The “plan” we owed DCA back in 2013 was actually written, and published in 2015. However, nothing came of that plan. Spokesperson for the Jackson Administration Michael Walker told the Times in March 2015, “‘We haven’t had a chance to really look at it,’ Trenton spokesman Michael Walker said, declining to comment on the specific findings or recommendations.”

The City never apparently “had a chance to really look at it,” because yet ANOTHER study was done, resulting in ANOTHER plan published in January 2017. This version actually led to a real result.

The City issued a Request for Proposals (RFP) that resulted in 6 bids, which were opened on June 1, 2017. For reasons that I haven’t been able to find out as of this morning, none of those bids were accepted. The City re-posted another RFP, and that led to another round of six bids opened on February 1 of this year. Three of these vendors had also bid last year. And it was one of those three, Parkeon Inc, that the City chose as its recommended vendor and presented to Council last week.

In this post today, I won’t get into the substance of each proposal. I won’t address the qualifications of the company, Parkeon, that the Administration recommended. There may be occasion to do that in the future.

I think the way the City conducted its evaluation is fatally flawed. That’s what I’m talking about in this piece.

The first thing that jumps out is the fact that these proposals were opened by the City on February 1. It wasn’t until June 21 that the City made its recommendation to Council? What happened here?

It’s not at all clear from the documentation that’s available. The text of the Resolution states that Council authorized bidding for Parking services back in 2017, and it mentions that six proposals were opened on February 1, 2018. The Resolution does not mention the first round of bids in 2017, and it is silent on why the first round was rejected.

The Resolution also cites the NJ Local Purchasing Law, N.J.S.A. 40A:11-4.4, as the authority under which the City can enter into this kind of proposal and contract.

However, the Resolution fails to mention a relevant section of the Purchasing Law, 40A:11-4.5 e., which states “Award of a contract shall be made by resolution of the governing body of the contracting unit within 60 days of the receipt of the proposals, except that the proposals of any vendors who consent thereto, may, at the request of the contracting unit, be held for consideration for such longer period as may be agreed” [Emphasis mine – KM].

According to this provision, the City had until April 1 to award the contract. In the text of the Resolution, there is no mention of any reason for the delay until June 21. Neither is there any indication that any or all of the six vendors who submitted proposals consented to any delay.

On the face of it, this should have been reason enough for Council to reject this Resolution. Instead, as mentioned above, Council approved this, unanimously.

I wrote above that the Trenton Downtown Association has for years been involved with the City on this issue, since their concerns about the lack of available parking for customers directly affects their businesses and personal livelihoods. They were taken by total surprise that the City moved on this issue last week, which was not what they had been told. In an email sent yesterday to TDA Board members, local realtor Anne LaBate wrote,

At our meeting last Tuesday [June 19] we discussed the on-going interest on the TDA in being involved as the City moves toward a decision on upgraded parking meters. The TDA Parking Committee had requested that we be included in seeing demonstrations of the technology being considered. That has not happened thus far.

Folks who were in attendance will recall that we were told that this matter was not on the City Council Docket for Thursday’s meeting which would be the last meeting during this Council’s term and so this would be dealt with under the next administration.

In fact, a resolution was walked in to the Council meeting at the last minute and it was voted on with the council accepting the recommendation of the administration. It apparently calls for a $1.2 million expenditure. The Council voted unanimously to approve the contract.

I think we might want to consider a communication from TDA to the mayor and council, asking them to hold off until the downtown business community have been able to participate in a qualitative way in this process. Individuals and business owners can certainly, on our own, communicate with our elected officials. [Emphasis mine – KM]

TDA seems to have been under the specific impression that what the Administration and Council did on June 21, would not have been done. In a phone conversation this afternoon, the Chairman of the TDA Board, Willard Stanback confirmed to me that the June 21 vote to award the contract to Parkeon was entirely unexpected.

For several months, a committee of TDA members had been working with DPW Director Cherry and his department colleagues to discuss the ongoing process. The City had even shared the six proposals received with TDA Executive Director Tom Gilmore. Mr. Stanback told me he had no knowledge of why the first, 2017, round of proposals had been rejected. However, as late as May 30, in a meeting with Mr. Cherry, the City gave TDA no hint that the current contract process would move to conclusion by the end of June.

Mr. Stanback was taken by surprise on hearing of the June 21 vote. He said he called City Clerk Harris on Friday morning. According to Mr. Stanback, Clerk Harris initially didn’t even know a vote on the matter had been taken the night before. In fact, says Mr. Stanback, “No one I spoke to at City Hall knew what had happened until after the fact. ”

But wait, there’s more! The way the City conducted its evaluation of the six proposals looks also to be seriously flawed, at least based on the available documentation.

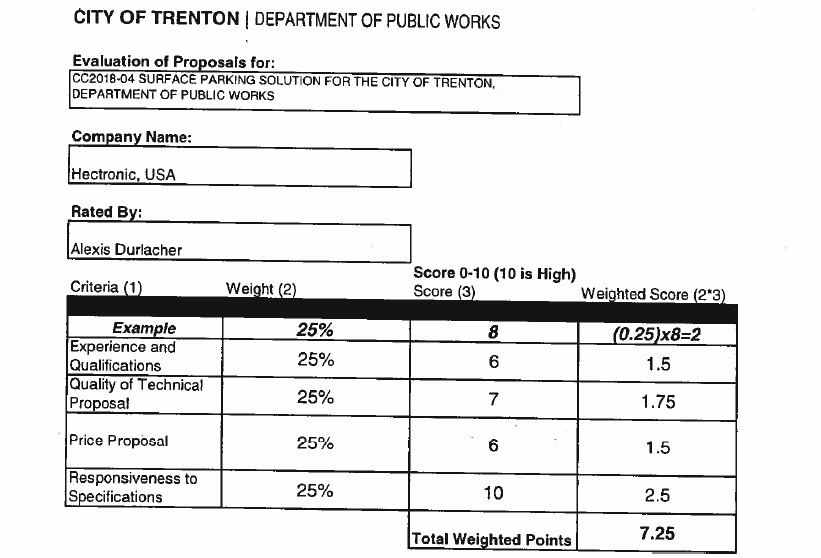

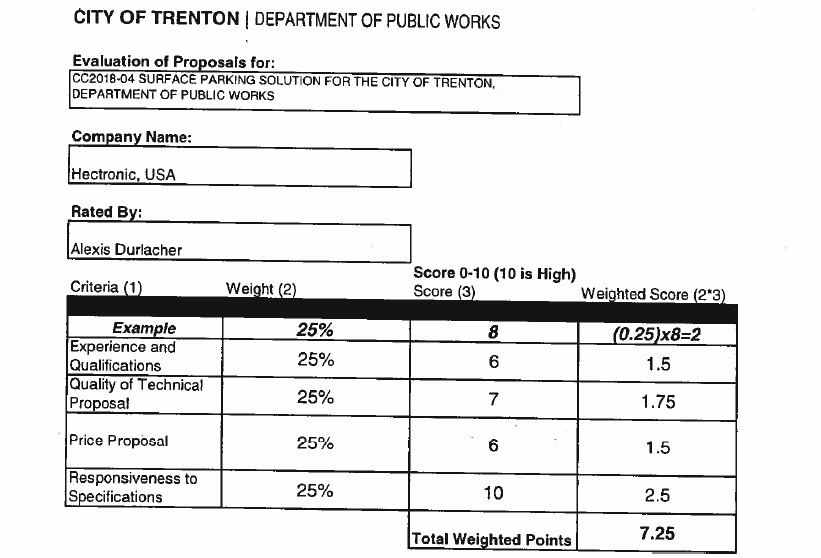

The Department of Public Works, which would supervise this contract and currently headed by Director Merkle Cherry, assigned three Evaluators to score each of the proposals:

- Alexis Durlacher, Trenton PD

- Anthony Santora, Principal Traffic Analyst, Dept of Public Works

- Colin Cherry, Management Assistant, Admin Department, and son of DPW Director Cherry

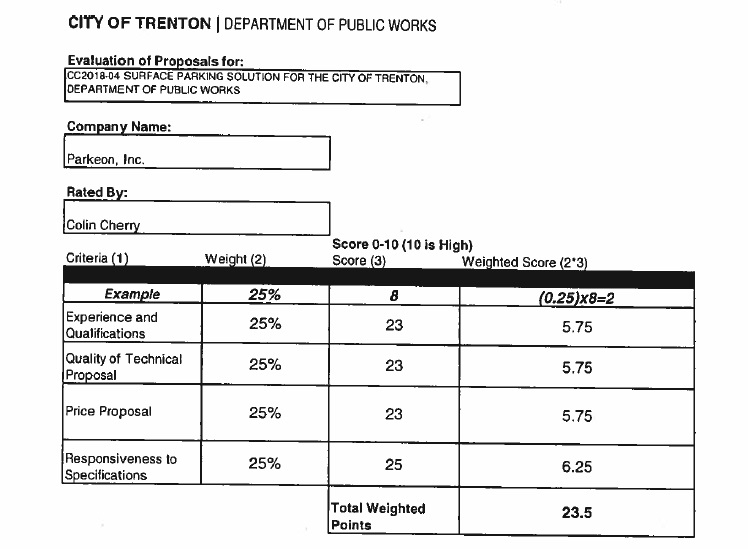

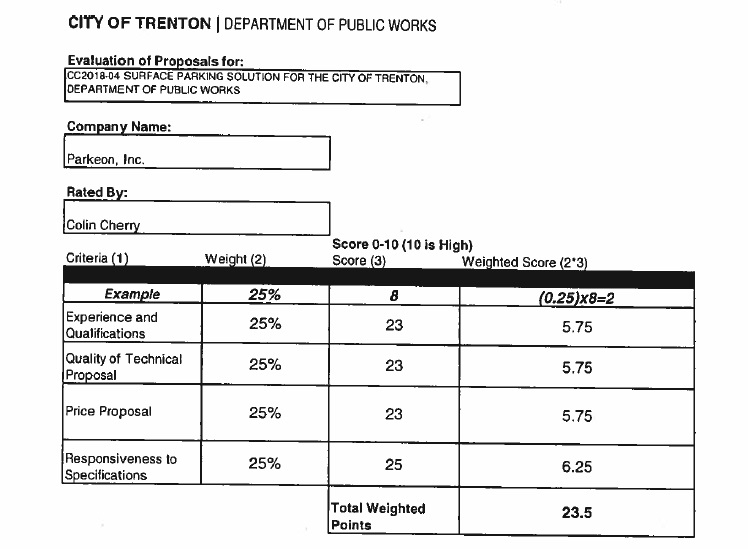

There are problems with Colin Cherry’s score sheets.

First, there is the potential conflict of Interest with the Director’s Son scoring proposals for his father’s department. Regardless of anything else, if a losing bidder or bidders felt they should have scored better, they can always bring a nepotism charge in support of any complaint or litigation. I don’t know how far that would go, but it’s a situation that could easily have been avoided by using another person to evaluate the proposals.

More important is that Cherry’s scoring sheets are wacky. He clearly did not pay attention to the instructions. This is supposed to be a weighted score sheet, with four categories being assigned 25% of the overall weight. Each category was to be assigned scores from 1 to 10, with the maximum score possible in each category being 2.5. A perfect score for a vendor’s proposal would be 10.

Here’s an example of a correct scoring sheet, from Ms. Durlacher (Page 9 of the Resolution):

Pretty simple and straightforward stuff, right?

Well, look at Cherry’s scoresheets (Pages 22-27). His category scores range from a low of 10 up a high of 25. His total scores range from 13.75 up to 23.5. Here’s one of them:

These scoresheets should have been thrown out. When you read “Score 0-10 (10 is High),” how can you give a 25??

I don’t know whether the scoring process would be considered tainted if only two evaluators – instead of three – submitted valid sheets. The Local Purchasing Law is silent on the specific evaluation process to be used. But again, if I were one of the losing bidders, I’d be pretty upset that these scoresheets would have been used to evaluate the proposals.

This is troubling on several counts:

- As I mentioned above, the City would be vulnerable to litigation filed by any of the losing bidders.

- That a Management Assistant of several years tenure could screw up the simple math of these sheets is troubling.

- That no one else in Purchasing or Public Works noticed these flawed scoresheets before submitting them to Council is troubling.

- That the BA didn’t notice these flawed score sheets before submitting them to Council is troubling.

- That no Council member noticed the flawed sheets is troubling.

- That Council agreed to take action on this on Thursday without adequate notice is troubling.

- That all proposals were submitted back in February, and rushed through Council – without objection – is troubling.

- That there is no attempt in the documentation to acknowledge that this Resolution was offered much later than the 60-day time limit authorized by State law, is troubling.

- That these proposals were received in February and no one reached out to TDA about them, is troubling.

- And, as mentioned above, that the screwed-up scoresheets were submitted by the Public Works Director’s son is troubling.

This is yet one more fuckup by this outgoing Administration and Council. Based on what is available in the public record, it sure looks to me like the City was just trying to pull a fast one in getting this fatally flawed proposal process completed and get a contract signed and on the books before the end of this week and the end of their term.

What we don’t know is why.

And we don’t know why this Council signed off on this Resolution without any opposition. Their last act in office was to rubber stamp this very sketchy proposal this Administration slid in under the wire. The only returning Council Members, George Muschal and Marge Caldwell-Wilson, ought to have known better.

But you know what? That’s really not that important right now.

What is important is that – despite the unanimous approval by the outgoing Council – this deal be stopped, at least for the time being, until the fatal flaws in the evaluation and execution of this proposal can be reviewed and fixed by the new Council and Mayor.

Eric Jackson should let this deal die along with his term in office.

NOTE: This is the piece I had planned to run yesterday, before I got sidetracked by fascinating and very relevant financial information (yes, that’s not a contradiction in terms!) about the Trenton Water Works. There is further info on that, below. But first:

Thursday, Trenton’s City Council is scheduled – at what will be the final session for this Council and the Eric Jackson Administration – to deliberate the Second Reading of a number of Bond Ordinances which, if all are passed, will increase the long-term debt obligations of the Trenton Water Works by $18.7 Million Dollars, and that of the City of Trenton by $7.3 Million Dollars. These Ordinances were easily passed First Reading on June 5; there’s no reason to believe that this Council won’t give their final, lame-duck approvals on Thursday.

We don’t know any more about the capital projects being funded by these Ordinances; no one in the City or on Council has responded to my questions, or replied to my comments made at the June 5 meeting. But we do know a little more about the overall debt burden that the City and its associated utilities is carrying.

Since the City will be discussing the Trenton Water Works twice this week, tomorrow at an open public forum at City Hall and in a presentation at Thursday’s Council meeting, I thought this it would be timely to discuss these items today, in the hope that some of you readers might be able to ask a pointed question or two at these sessions.

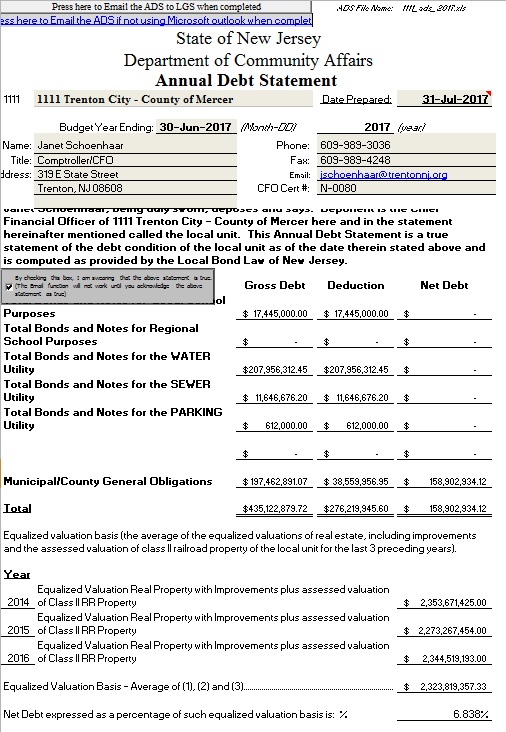

Each year, every municipality in the State of New Jersey files a number of forms with the Office of Local Government Services of the Department of Community Affairs (DCA). These forms provide the State with snapshot pictures of the financial status (I was going to use the word “health,” here, but hey! it’s Trenton we’re talking about, the Sick Man of Mercer County. “Status” it is). These forms are all available for public examination and review, here. One of these forms is called the Annual Debt Statement and Debt Limit Calculation. It’s an Excel spreadsheet that summarizes the debt load of the municipality by each Fiscal Year ending on June 30. It also provides a great detail in separate tabs. The DCA website contains the Trenton forms for the recent Fiscal Years of 2013, 2014, and 2015 (The links will take you directly to copies downloaded from the State website). The two most recent filings, for 2016 and 2017, aren’t on the State website. The City of Trenton released those (those have been uploaded as well) to me in response to an Open Public Records Act (OPRA) request. These forms give us a pretty good look at the overall debt of the City.

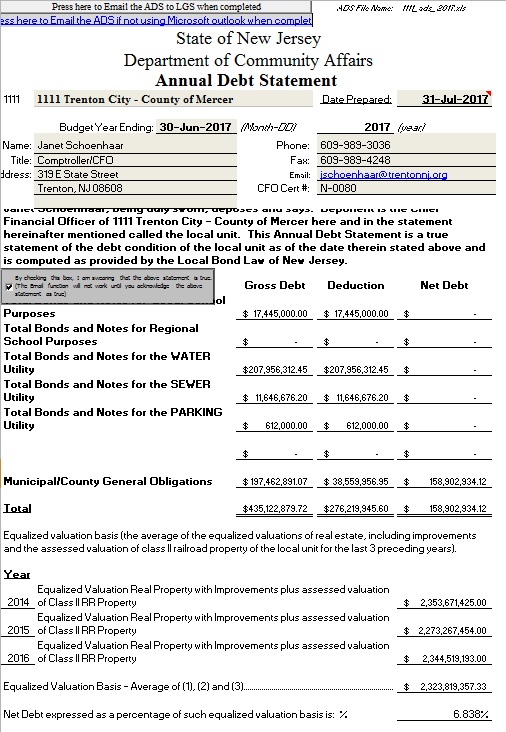

First, here’s a look at the front page of the most recently prepared Debt Statement, the one dated July 31, 2017 for the budget year than ended June 30 of that year. What does it tell us?

Let’s start with the end. As the Bond Counsel for the City of Trenton, Everett Johnson, explained to City Council on June 5, in New Jersey the statutory maximum debt to be carried by a municipality is supposed to be 3.5% of the total Net Taxable Valuation of a municipality’s total taxable property. It is assumed by the State of NJ that carrying debt above that 3.5% threshold will jeopardize a town’s finances, as more tax revenue goes toward long-term debt service, leaving less available to pay for more current expenses, such as payroll.

We see above that Trenton’s Net Debt is 6.838%, almost double what the State allows and considers a “safe” amount of debt. Mr. Johnson said on June 5 that Trenton has for decades exceeded the statutory limit, because so much of Trenton’s real estate is property tax-exempt. That’s certainly been true for the five years of data we look at today.

In 2013, Trenton’s debt load was 5.902%. In 2014, 6.476%. 2015’s number was 6.855%. And in 2016, the number was 6.360%.

One other very important statistic to take from these forms: On the 2013 form, the three-year average of Trenton’s total taxable property was calculated to be $2,739,777, 815. That total had declined to $2,323,819,357 by 2017. That is a drop in Trenton’s property value over just four years of $415,958,458, or 18%.

To repeat: Trenton’s property value has declined $415 Million Dollars from 2013 to 2017. With a declining tax base, that means there is less revenue that the City can raise for its own operating budget. It also means that every additional long-term debt obligation that the City floats to borrow money will drive that debt-to-valuation ratio ever higher.

And, lest we forget, the City’s shrinking value of taxable property means that commercial property owners and homeowners who already took a beating in last year’s revaluation will feel increasing heat and pressure applied by city government anxious to squeeze as much revenue out of what still has value as they can.

On June 5, I reminded Council that,

At the time of the last issuance of $40.6 Million in General Obligation Bonds, in November of last year, Moody’s bond rating service noted the City of Trenton’s low underlying rating of Baa1, and stated “The rating further reflects the city’s very high fixed costs, and outsized debt burden while also incorporating improved finances.”

Council members, the City was criticized for its “outsized debt burden” in November. Tonight you seek to increase that burden by nearly $27 Million Dollars. What will this do to the City’s underlying ratings, and how will that ripple through to likely large increases to the City’s costs of borrowing?

The Bond Ordinances that Council will likely approve on Thursday will only increase our “outsized debt burden.” By itself, the $7.3 Million general City Bond Ordinance will boost the Net Debt percentage from 6.838 to 7.152%. And that’s even before figuring in any more reductions to Trenton’s property values over the last year.

Trenton’s finances are going in the wrong direction.

One other note on Trenton’s debt, before moving to the Water Works.

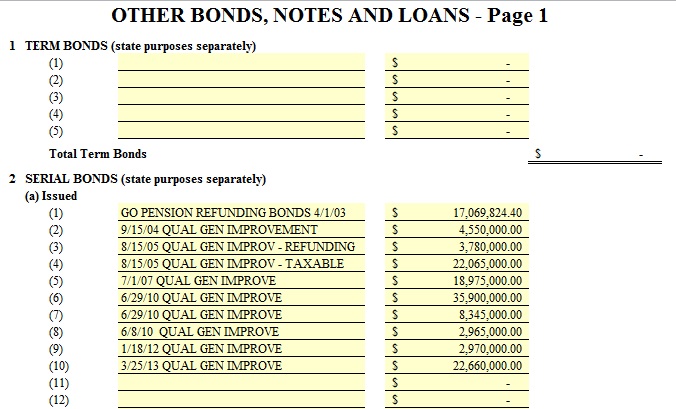

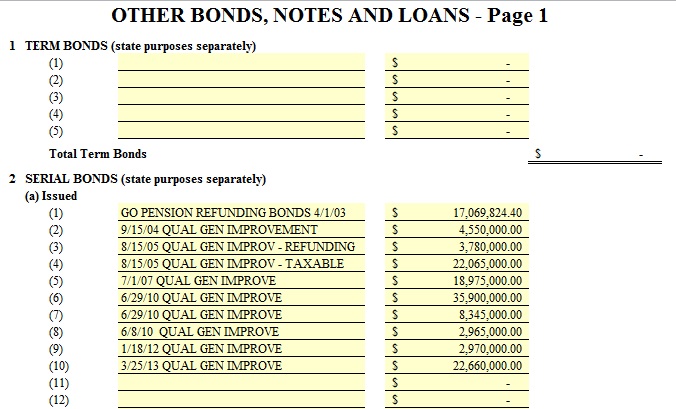

On the tab in the 2017 report labeled “muni bonds issued,” there is a list of the current bond issues which the city is currently servicing:

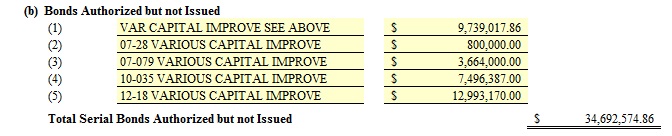

These different issues total out to $139,279,824. Right below that is a list titled, “Bonds Authorized but not Issued” [Emphasis mine – KM].

This list totals $34,692,575. Seeing this list leads to a number of questions, which I hope someone will ask of Council and the Administration on Thursday (I won’t be able to attend). Such as, This list totals $34,692,575. Seeing this list leads to a number of questions, which I hope someone will ask of Council and the Administration on Thursday (I won’t be able to attend). Such as,

- If there is previously-authorized authority to issue another $35 Million in bonds, why is there a new request for $7.3 Million?

- Some of these bond authorizations seem to be several years old, with numbers suggesting 2007 and 2010 for some of them. If these bonds have never been issued, should they be canceled? Will doing so improve the city’s bond ratings?

- And finally, the same question I asked on June 5: Are all of these proposed projects and expenses, to be paid for with this new borrowing, really necessary right now? Why not hold off until the new Council and Administration can review them?

- In other words, and to cut to the chase: What’s the rush???

— # —

Now, an update to the Water Works. Yesterday, I posted links to five years’ (Fiscal Years ending June 30 for 2013 through 2017) worth of Debt Statements prepared by the City and submitted to the NJ Department of Community Affairs. In each of these Statements, in the form of Excel Spreadsheets, there are tabs providing summary financial information about other City entities that incur debt obligations under their own authority, such as Trenton Public Schools, the Sewer Utility, and the Trenton Water Works (TWW). These statements indicate that, far from being nearly insolvent – the impression given by the fact that the utility has for decades scrimped and starved the utility of needed manpower, maintenance, and capital investment – the water utility serving nearly a quarter million Mercer County residents in the City and outside has consistently earned substantial annual surpluses. By one simplistic measure, TWW outperforms some of America’s most profitable corporations, such as Apple, Google, and JP Morgan/Chase.

I thought that was amazing information, and posted it. Alert reader Iana Dikidjieva posted a comment on Facebook in which she said, “I always just read the audits.”

Well! Dang! In yet another of the nooks and crannies of the Trenton City website, a dozen years worth of financial reports and financial statements as reviewed and vetted by the city’s outside independent auditor Mercadien are posted for all the world to see. As I said yesterday, who knew? Not me, certainly! Thanks, Iana!

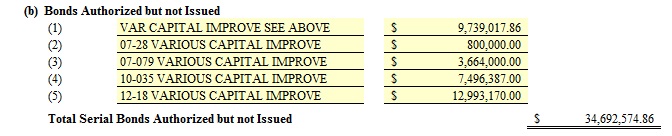

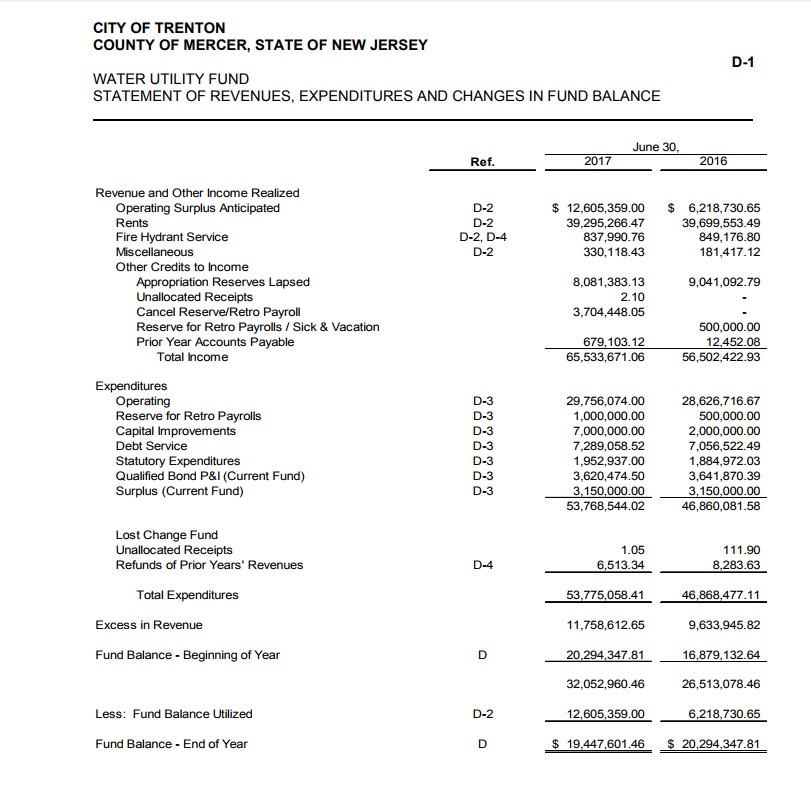

In this excerpt (page 99) of the 2017 Audited statements, you can see an Income Statement for the Water Utility, with much more detailed information than contained in the annual DCA Debt Statements I looked at yesterday. The format is different, and the date of the audit report – December 29, 2017 – is five months later than the Debt Statement’s July 31 date. It also reflects any post-Debt Statement adjustments made by the City or its auditors.

Yesterday, I stated that “The operating surplus – some might call it the “profit” for the Water Works – was $15,345,040. The operating margin (surplus as a percentage of total income) was 28.3%.” On this audited statement, the “Excess in Revenue” for the fiscal year ended June 30, 2017 is stated as $11,758,613. That’s about $3.6 Million lower than included on the July 31 Debt Statement. However, as a percentage of the annual revenue TWW earned (which I use as the “Total Income” figure of $65,533,671, less the “Operating Surplus Anticipated” line at the top of $12,605,359; that’s not actual customer billing or other revenue), the net margin for the Water Works with these numbers is 17.9%. Looking at the numbers for the 2016 fiscal year, appearing right alongside, the net margin is 19.2%.

Those are not the stratospheric percentages I calculated yesterday. but still a mark of impressive financial performance by a utility that hasn’t provided nearly the same level of customer service and water safety! Even with a lower net margin, it is clear that the Trenton Water Works – from its own annual operating resources – can legitimately afford to spend more on hiring needed personnel, paying competitive salaries, and boost operating repairs and preventive maintenance.

This cache of Audited Financial Statements for a dozen years is bound to reveal other nuggets of useful information. I thank Iana Dikidjieva for pointing me to it.

I will finish by saying that it would have been nice these last couple of months, going back to the February 1 City Council meeting when I criticized Council and Public Works Director Merkle Cherry for not having TWW financial statements available at what was supposed to be a comprehensive presentation on the condition of the Water Works, had someone said, “You know, we have the last dozen years of that data, audited too, on the City’s Website!” That would have been very useful and relevant information to have.

But, no one did. Perhaps Director Cherry nor anyone on Council didn’t know those reports were there?

If so, that’s another good reason I won’t be sorry to see so many of them leave in ten days.

This week, Trenton’s City Council is scheduled – at what will be the final session of this Council and the Eric Jackson Administration – to deliberate the Second Reading of a number of Bond Ordinances which, if all are passed, will increase the long-term debt obligations of the Trenton Water Works by $18.7 Million Dollars, and that of the City of Trenton by $7.3 Million Dollars. These Ordinances were easily passed First Reading on June 5; there’s no reason to believe that this Council won’t give their final, lame-duck approvals on Thursday.

I was going to write a piece about the City’s debt burden, and how these proposed measures will only further stretch the City’s fragile finances even further. I will write that piece, but not right now.

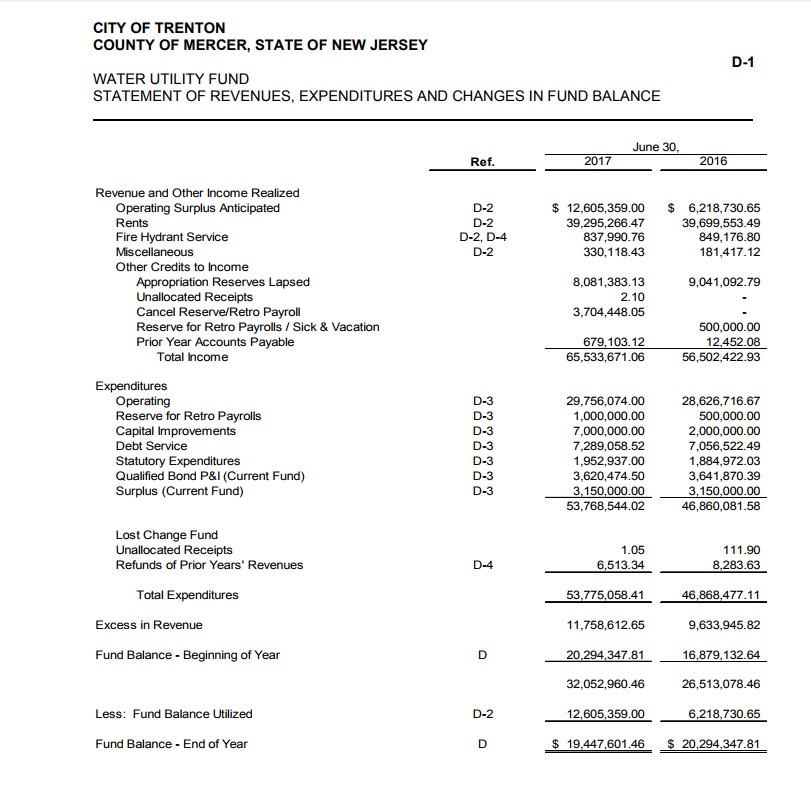

Today I want to write about the Finances of the Trenton Water Works (TWW). Because today, we know a lot more about the financial operations of that utility than we knew yesterday. And that’s because what are essentially financial operating statements for TWW have been hiding in plain sight for years, located in a tabbed section of an Excel spreadsheet that’s filed by the City with the State at the end of every budget year. Since the City will be discussing the Trenton Water Works twice this week, tomorrow at an open public forum at City Hall and in a presentation at Thursday’s Council meeting, I thought this it would be timely to discuss these items today, in the hope that some of you readers might be able to ask a pointed question or two at these sessions.

Do I have your attention now? OK, then!

Each year, every municipality in the State of New Jersey files a number of forms with the Office of Local Government Services of the Department of Community Affairs (DCA). These forms provide the State with snapshot pictures of the financial status (I was going to use the word “health,” here, but hey! it’s Trenton we’re talking about, the Sick Man of Mercer County. “Status” it is) of each local community in the State. These forms are all available for public examination and review, here. One of these forms is called the Annual Debt Statement and Debt Limit Calculation. It’s an Excel spreadsheet that summarizes the debt load of the municipality by each Fiscal Year ending on June 30. It also provides a great detail in separate tabs. The DCA website contains the Trenton forms for the recent Fiscal Years of 2013, 2014, and 2015 (The links will take you directly to copies downloaded from the State website). The two most recent filings, for 2016 and 2017, aren’t on the State website. The City of Trenton released those (those have been uploaded as well) to me in response to an Open Public Records Act (OPRA) request.

These forms give us a pretty good look at the overall debt of the City, which was my original topic today. They also provide more information about the annual operations of the Trenton Water Works than the public has realized is publicly available for years.

The Debt Statement filed with DCA contains tabs where separate debt information for schools and municipal utilities, since those entities and authorities often issue and carry their own debt.

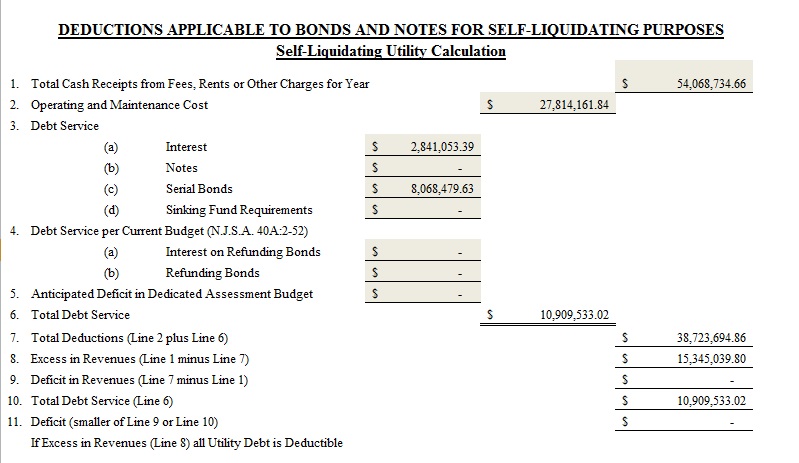

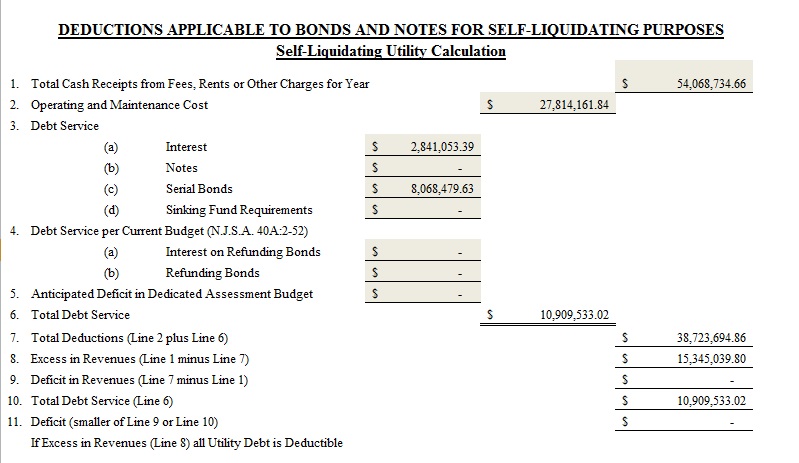

Here’s the 2017 page for the Trenton Water Works, found in the “utility I” tab.

See those numbers in the section called “Deductions Applicable to Bonds” etc. etc?

Item #1 – “Total Cash Receipts”?

Item #2 – “Operating and Maintenance Costs”?

Item #6 – “Total Debt Service”?

And… wait for it… Item #8 – “Excess in Revenues”

Ladies and Gentlemen, what you see before you is the closest thing to a separate Income Statement for the Trenton Water Works that we are likely to get for at least another long while. They are simplified, and don’t provide much detail. Put that aside for now. Here, stated very simply, are the numbers that TWW customers and Trenton resident have been looking for, for years! And here, they are, buried in an obscure spreadsheet on the NJ DCA website. Who knew?

Simply expressed, in the fiscal year ending June 2017, TWW brought in $54,068,735 of income, most if not all in customer billing. Operating expenses totaled $27,814,162, and debt payments $10,909,533.

The operating surplus – some might call it the “profit” for the Water Works – was $15,345,040. The operating margin (surplus as a percentage of total income) was 28.3%.

That, Ladies and Gentlemen, is amazing. Let me put that in a little perspective.

In 2016, the operating margin for Apple was 21%.

J.P. Morgan/Chase Bank’s margin was 23%.

Alphabet(that’s Google to you and me)’s margin? 22%.

Trenton Water Works beats those companies!!!

2017’s result was no fluke for the Water Works:

- In 2013, TWW earned a surplus of $11,051,207 on revenues of $46,572,608, a margin of 23.7%.

- In 2014, the surplus was $10,551,000 on revenues of 43,398,424. yielding a margin of 24.3%.

- For 2015, TWW earned a surplus of $14,716,827 from revenues of $44,759,726. The margin that year was an incredible 32.9%.

- Oddly, there are no numbers on the 2016 form. Given the other years looked at, I think it’s safe to say TWW probably had another good year.

Dear Readers, don’t let ANYONE tell you that Trenton’s Water Works isn’t profitable!

The numbers filed with the State for five years don’t lie. Or, I hope they don’t!

Seeing this kind of history proves without a doubt that the problem with the Trenton Water Works is not with its business model, but with its management.

The reason its operating margins have beaten Apple and Google for the last five years is mainly because the utility hasn’t spent what it should have to keep the place running well.

It didn’t hire the numbers of trained and experienced staff it needed to keep operations running smoothly and error-free.

It didn’t pay competitive salaries to those staff it did hire.

It didn’t spend the amount of money on repairs and capital equipment and pipe replacement that it should have.

THAT’s how you beat Apple’s margin! And also how you strangle a water system!

We know the City of Trenton has for years taken these amazing surpluses TWW has earned, and used them to cover the City’s horrid budget numbers. Some of that is fine and legitimate. The level at which Trenton skimped on spending money on the Water Works – at the considerable expense of its customers – was entirely excessive and inappropriate.

The numbers are here, and the numbers are clear. Trenton Water Works makes plenty good money.

Now, it’s time to spend some of it!!!

Make sure the City hears this from their citizens and customers all over Mercer County. Tomorrow night, and Thursday night.

Trenton’s people are strong, unfortunately because they are given so many occasions requiring strength in order to cope.

We’re in the national and international headlines this week, because of what happened at Art All Night early Sunday morning. One dead, a score injured. By gunfire, the 21st-Century’s equivalent of cholera, typhoid, smallpox, or plague in earlier eras: fearful scourges periodically visited upon the public at large that we only know how to contain – more or less – not cure.

Attention is already fading. The injured have been treated. Some have already been released from hospital, and the worst injured have had their conditions upgraded from critical to stable. As the circumstances and motives of the shooters begins to be seen more clearly, there’s been a collective sigh of relief that this was not a deliberate act of mass assault by a mentally-ill “lone wolf.” There’s even more relief that this was not, God forbid, “Terror.”

Tell that, by the way, to the hundreds of people who scrambled for their lives Sunday morning, or who were locked in place for hours while police secured the Roebling Works, making sure there was no further and imminent danger from other gunmen. They were pretty terrified.

The shock and outrage over what happened this weekend, that’s propelled this shooting to front-page news, is due primarily to the venue at which this crime took place. Art All Night is an event that showcases the best of Trenton: its wide range of artistic creativity across all kinds of expression, and a positive energy that propels this annual celebration for 24 hours once every year. It’s one of a very, very few high profile events which draws crowds of visitors into Trenton from all over the tristate region. For the previous 11 years, it’s been produced without serious incident, certainly without the kind of violence seen Sunday night. Something like this wasn’t supposed to happen at Art All Night. Certainly no one who was there expected anything like it.

It’s an Art Show, for goodness’ sake!! There are no gun battles at the Met, or the Whitney, or the Museum of Art in Philadelphia. That’s not supposed to happen! That explains all the headlines. That explains all the attention. The incongruity of bullet casings and police crime scene tape strewn about alongside murals, sculptures, and oil paintings is too vivid not to end up on the news. Until its place in the news cycle is replaced by some new outrage or horror, no doubt.