We know a little bit more about the Eric Jackson Administration’s plan for this Thursday’s proposed Resolution #16-170. As usual, this being Trenton, what we are finding out ain’t good.

We first heard about this Resolution on Friday, as an Agenda item on the docket for the May 5 meeting of City Council. The item on the agenda calls for “an emergency appropriation” to pay the Internal Revenue Service for payroll tax deposits that had already been made by the City to its former payroll service, Innovative Payroll Services (IPS) in 2015, but which had been embezzled by IPS’ owner, John Scholtz. I had a lot of questions on Friday about that resolution. Among them were: “What are the actual amounts due to be paid to the Federal Government and the State? How are these emergency appropriations being funded?” Thanks to reporting by Cristina Rojas of the Trenton Times, we have a few answers.

The City of Trenton intends to sell a bond – long-term debt – worth $4.7 Million Dollars to satisfy the outstanding obligation to the Internal Revenue Service. For now, apparently, whatever obligation we have to the State of New Jersey – and we still don’t know how much THAT is – is being put aside for now. Uncle Samuel is probably getting very insistent that the City pay, again, what it owes from last year.

The method being used by the City – a municipal General Obligation bond – removes this $4.7 Million liability from the current year’s budget. This being the next-to-last month in the current fiscal year, the prospect of having to come up with nearly $5 Million would have meant an immediate, drastic, unwelcome special property tax assessment from the city’s beleaguered private property owners. This prospect likely scared Mr. Jackson and his colleagues, so they have essentially punted. Floating this obligation as a bond will string out payment of this liability over a period of many years – 10, 15, 20, 30. Cities (and states, and the Federal government) typically use this kind of long-term funding to finance items like buildings or roads, with a long-term life and benefit to the community. Spreading the cost of a new library (I wish!), for instance, over 20-30 years makes sense, if you expect people to use the library for 30 years or more. That’s what long-term financing is for.

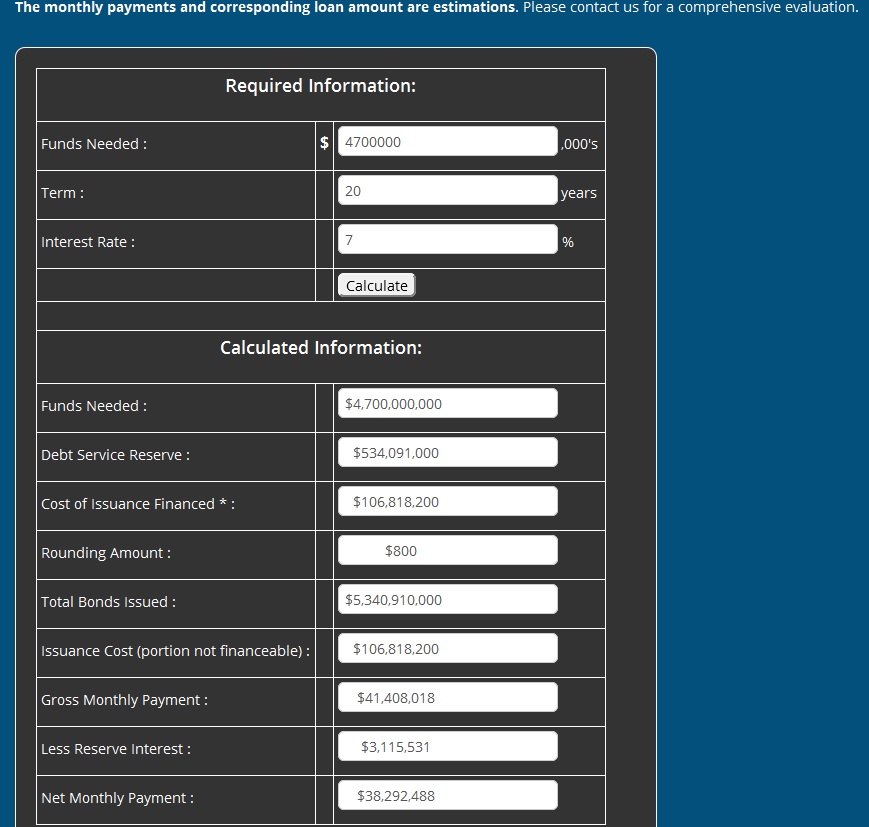

Financing a one-time cost, like the stolen taxes, this way does not make sense. For a lot of reasons. For one thing, it costs much, much more money over the long-term than it would if funded under the current year’s budget and appropriations. Here’s an example, from this website. I don’t know the specific terms the City plans to offer with this emergency issue, so I chose terms at random. I input this as a $4.7 Million Dollar 20-year note at 7% interest (I’ll talk more about that below). Adding in other costs associated with issuing the note, the monthly payments the City would make on that example would be $47,408. Over one budget year, that comes to $568,896.

That’s much more palatable to an annual budget than $4.7 Million in one hard-to-digest bite, true. But that would be paid every year for the next 20 years. In this example, future Mayors, Councils and city Financial Officers will be paying $568,896 each and every year for this 2015 fuck-up until 2036, for a total of $9,937,920.

Is it fair, to saddle future administrations and taxpayers for this failure of this, current Eric Jackson Administration?

I highly doubt it! Here are the numbers I used:

The actual terms the City may get for this may actually be more favorable than this. Of course, they might be worse.

Also, apart from the concerns with this one bond issue, there will be a ripple effect. The City’s bond rating, the reviews granted to all of the City’s long-term financing, has deteriorated greatly over the last several years. Trenton’s poor financials have been enough to sink the city’s bond ratings all by itself, but this trend has been badly exacerbated by the poor ratings given to the State of New Jersey for the last several years.

The lower a city’s bond rating, the riskier their bonds are considered to be by the investment community, and therefore a city with low bond ratings has to pay the bond buyers a higher rate of interest. The City of Trenton’s latest financings have been assigned a rating of Baa1 by Moody’s, one of the two biggest rating services. Baa1 is just a few short ratings above Ba1.

The common term assigned to bonds – and their issuers – rated Ba1 and lower (there are many ratings lower than that, but you don’t want to know about them), is Junk. Junk bonds. I don’t know what interest rates junk municipal bonds have to offer in order to attract buyers, but I don’t think the example I used above, 7 percent, is far off from what the real rate would be.

Changes in bond ratings to a city makes all of their borrowing, for whatever purpose, much more expensive. Over the last couple of years, the City has seen a few downgrades in its ratings, the most recent one by Moody’s in April of 2015. What might affect future changes?

Moody’s offers a few tips. In a notice issued in November 2015, the service said this:

WHAT COULD MAKE THE RATING GO UP

-Successful management of cuts in state aid with recurring budgetary solutions [Don’t laugh. It could happen!! OK, probably won’t! – KM]

-Improvement in Current Fund balance reserves and liquidity

-Decline in debt and pension burden

It also said this:

WHAT COULD MAKE THE RATING GO DOWN

-Reduction in financial flexibility and liquidity to offset potential state aid declines

-Failure to adequately and timely address additional state and federal aid reductions

-Need for cash-flow borrowing

Do those negative factors sound familiar? Yep, thought so.

One, Trenton is in no position to absorb reductions in state Transitional Aid. The State seems to agree, since it has continued to fund the City at roughly similar levels over the last few years. But the State’s finances are in the toilet as well. How much can we absorb a sudden reduction in state Aid? Not at all.

And, two: Moody’s tells us that using long-term bonds to solve a current cash-flow problem will make our rating go down. In other words, PRECISELY WHAT THE CITY IS PROPOSING TO DO WITH RESOLUTION #16-170. Using long-term financing in the way that the Administration is proposing for this Thursday will hurt us in the long run.

Seems to me the first impression to this news that I had on Friday is looking more and more accurate: “an attempt to sweep the whole distasteful episode of the missing IPS money under the rug.”

I wrote a note to Council on Friday expressing my opposition to this measure at this time, based on all that we still do not know. As has been typical with this Council, I received almost no replies. One member wrote to tell me that Council, at least as a body, had no prior notification that the Administration was seeking to solve the IPS/IRS problem by floating a bond. They collectively (it’s possible one or two members of the Cool Kids on the Council got a heads-up, but not all members apparently heard the news) found out in the newspaper, and from their copy of the Agenda for Thursday’s meeting.

On Friday, I asked many more questions about this whole matter that I feel need to be publicly addressed before Council approves ANY action to resolve this by emergency measure. Apart from the “How?” and “How Much?” we are still critically uninformed.

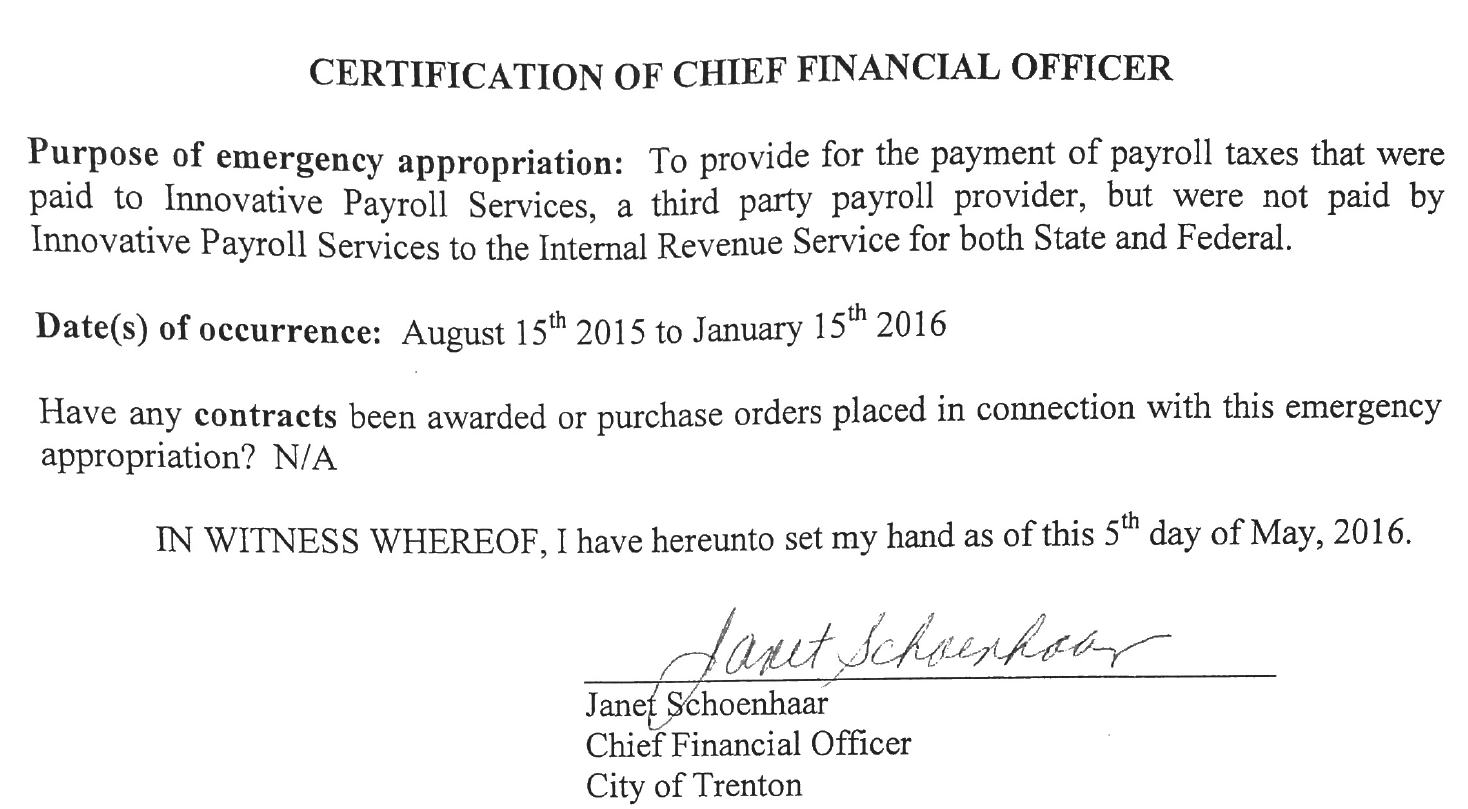

As of this morning, I have one more note. Here is the text of the Resolution, courtesy of the Times’ Ms. Rojas, that Council will deliberate on Thursday. In the text, the City’s Chief Financial Officer, Janet Schoenhaar, is directed to execute the emergency $4.7 Million Note, along with the Mayor. Ms. Schoenhaar is also directed to oversee the process by which the bond will be offered for sale. Here’s her signature on the Certification for the need for the Bond:

It was Janet Schoenhaar, you will remember, who was copied on all of the correspondence between the City of Trenton and IPS during the second half of 2015. The same correspondence that noted the frequent notices from the IRS and the State about missing tax payments. The same correspondence described by the Times as “red flags over Trenton’s payroll problems.”

If Ms. Schoenhaar is being directed to be part of the City’s proposed solution to this matter, then she needs to open up to describe and be held accountable for her role in missing all the “red flags.”

Even more so than I thought on Friday, I think this proposed Resolution is the wrong solution at the wrong time. The City is rushing to push this matter under the rug. Mayor Jackson and his Administration is still refusing to answer too many questions about how this whole matter came to pass. Their proposed “solution” is one that will burden taxpayers for the next 15 or 20 years to pay off. And the use of long-term bond financing to solve this one-time current cashflow problem threatens the City’s overall financial integrity.

Resolution #16-170 is nothing more than Junk.

[…] Junk […]

I think the word you are looking for here is ‘accountability’. Don’t taxpaying citizens have the right to ‘accountability’ when their tax dollars are involved? Or, is this once again a blank check solution? When no one can explain the charges on your cable bill, you’ll keep asking for someone else to talk to. ‘Can someone get a supervisor on the line?’

Christine – You are right. I did say above that Janet Schoenhaar = at least; I’m sure there are more than her – needs to open up about her role in this matter and be held accountable. In my letter to Council last Friday I asked the Members who in the Administration were assuming accountability on this.

That’s the key word, for sure. And one hat no one in City Hall seems to understand.