I hate to say “I told you so,” but…

Last Night’s Trenton City Council session was marked by several indignant commercial property owners complaining to the Councilmembers about their new tax bills received in the mail this week. These tax bills were based on the recently-completed property revaluation conducted for the City by Appraisal Systems, Inc. (ASI), the city’s first comprehensive revaluation since 1992.

They weren’t happy. As narrated by Trentonian reporter David Foster,

Numerous Trenton businesses said their taxes have tripled after an assessment was done at their properties.

“Mine alone was increased almost $33,000,” Brian Hawkins, owner of Hawk’s Towing told city council on Thursday night. “My son’s shop was increased $29,900, which is around the corner.”

A friend of Hawkins had his taxes shoot up an absurd $100,000, the owner said.

Yeah, I’m hearing you. I started writing about this back in January of this year, when the first draft residential numbers were released on ASI’s page. Even before the first commercial numbers were released I noted,

Who in the world will buy Trenton property at anything close to current market prices that come with a property tax burden so astronomically high? We already are burdened with some of the highest property taxes in New Jersey, and the value we get for those high taxes is abysmally low. If these tax valuations stand, sale prices for many neighborhoods in town will collapse. This will probably result in increases in foreclosures and abandonment in neighborhoods that – so far – have managed to avoid too many of either.

Nothing that has happened since has changed my mind on this. My feeling is that this entire ASI revalution process is fatally flawed, and will lead to the ruination of many of the City’s residential neighborhoods, and all of its privately-owned commercial base. Business owners get that, and made their feelings known to Council last night.

I also made my feelings known to Council months ago. On January 20, I wrote to each member of Council a long note, concluding with this urgent appeal:

Councilmembers, I urgently and respectfully ask you to look into the way the revaluation process was conducted. As I discussed above, we know for a fact that the process was delayed. We need to know that this delay did not produce – as my personal experience and many anecdotes attest – a rushed, incomplete and flawed process that will harm thousands of your constituents, and perhaps even many of yourselves.

If you find this to be a flawed process, please suspend it and if necessary, begin it again.

Apart from ONE note from ONE Council member, I received NO RESPONSE from any other member. Apalling. From January to this week, as suggested by the Trentonian’s article, NOTHING HAS BEEN DONE by anyone on Council or in the Administration to investigate or address a critically flawed revaluation process. NOTHING.

I really don’t know what happens from here. A number of residential and commercial property owners filed tax appeals, which are working their way through the system. Me, I got so dispirited and disgusted at the lack of accountability at City Hall I didn’t even bother to file. I figured, and based on last night’s meeting perhaps correctly, that once commercial property owners got their first bills, all Hell would break loose and that the entire revaluation would be thrown out. Either that, or the results would stand, businesses would fold left and right, residential property values would crash and we’d all end up walking away from our investments anyway.

So, here we are. Let’s see what happens now that the owners of Trenton’s last commercial property parcels have absorbed the impact of being told that their assessed values have increased by nearly 70% while residential property has remained, on net balance FLAT, even though individual residential valuations have mostly either been slashed or skyrocketed; also literally unbelievable results.

That this mismatched result is fundamentally both unfair and highly unlikely is something I discussed in depth in my post of January 26. I compared ASI’s analysis of other NJ towns comparable to Trenton that they had worked in recently, and found that Trenton’s revaluation results were, what’s the technical term, Real Fucked Up. Since the numbers reported then have remained almost exactly the same, this piece remains as current and relevant now as it did in January. I post it in its entirety below.

Perhaps THIS time someone in City Hall will pay attention???

Nah, that’s way too much to ask. These guys are useless.

— # —

“The Revaluation of La-La Land” – Originally published January 26, 2017

More information has come available about the current property revaluation and re-assessment process coming to a conclusion in Trenton. As is true of many things about this town, it doesn’t make a lot of sense to me. In fact, it’s downright screwy. The results that are coming online seem to indicate a massive economic disconnect in the City between its residential properties and its commercial/industrial ones, a disconnect that I can’t frankly believe. Either the company that has done the assessments, Appraisal Systems Inc (ASI), or the City of Trenton, think we are living in a fantasy town with limited connection to economic reality, a La-La-Land-on-the-Delaware. Compared to a number of other NJ towns with comparable property values, Trenton’s numbers are extremely odd.

So what else is new?

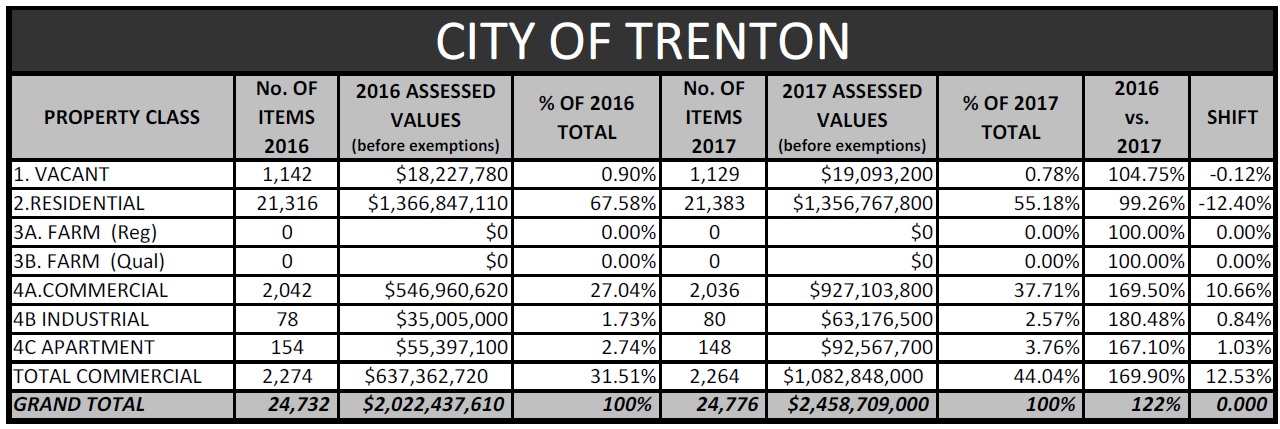

First off, ASI has updated the spreadsheet listing Trenton’s residential properties, from the one that was posted last week. This one now seems to be more or less complete, with 21,371 individual properties listed with a total current 2016 assessed value of $1,359,802,270. You can find the spreadsheet, called “Trenton Residential Proposed Assessments,” at this page. Or, along with a column calculating the % increase or decrease in assessed valuation for each property, at this location. The net result of this updated list shows, as was suggested from the data in the first version and as I wrote last week, that the change in valuation of Trenton’s entire residential property has been flat, without adjusting for inflation, since the last major assessment in 1992.That’s flat, flat, flat. Trenton’s residential property is worth 99.26% of last year’s value, which is largely based on the 1992 numbers.

OK? So far, that’s nothing new from last week. The substantial individual property valuation increases of 60%, 70% and more that we saw last week are almost exactly evenly offset with substantial valuation decreases, to end up with no appreciable impact to the city’s total residential values. We are, as in so many things, a town of extremes.

We now know – without any level of detail comparable to that of the 21,371-line residential spreadsheet, though – what the results are for the revaluation of Trenton’s commercial and industrial properties. Before I get to that, a few words of background and context.

Now, one shouldn’t expect residential and commercial properties to increase or decrease in value in any kind of synchronized way. There are a wide number and variety of different factors at work that determine if a given town is considered an attractive – and therefore, valuable – place to live compared with a place to do business. Those factors don’t change in lockstep for the residential and commercial/industrial side of things.

And yet., there are many ways in which both sides do relate somewhat closely with each other. Both residential and commercial properties are located, literally, in the same world. They share the same streets, utilities, access to highways and railroads, are protected by the same police and firefighters. The fortunes of businesses established to serve local residents – such as groceries, laundries, restaurants and bank branches – rise and fall in some direct relation to the rising and falling prosperity of their local neighbors.

So, even though you wouldn’t expect the numbers or the trends in valuation for commercial and industrial properties in Trenton to be identical to those of the city’s residences, you’d expect some correlation, right? That is, in the normal world, you would. And in most instances, even in New Jersey, you’d be right.

Welcome to Trenton. It’s a very special place all its own. The result of the very same property revaluation process that states that the total value of Trenton’s residential properties FELL by 00.74%, basically flat as we’ve seen, tells us that the value of commercial and industrial property in Trenton INCREASED by 69.50% in the same time period!

How can this be, you ask?

Damned if I know! But here, take a look!

This is an excerpt from another document on the ASI website, called “Trenton 2017 Revaluation Tax Impact,” which you can download by clicking on the link to the left, or view or download here. You can see in the excerpt above the differing valuations for the different classifications of property in the City, and how they have increased or decreased. The GRAND TOTAL for the City indicates an overall increase in the total valuation of property in the City as being 22% higher than the previous valuation. However, because residential properties have stagnated, the entire amount – ALL of it – comes from commercial and industrial valuation (plus some Apartment properties). As a result of that net increase of 22%, the provisional draft tax rate for the City – as seen in the full version of this sheet – has, for the time being until valuations have finalized after appeals, and after the new city budget (for the current year more than half over) has been adopted, dropped from $5.753 per $100 of valuation, down to $4.732.

In the hypothetical example shown on the sheet, a property owner previously assessed at $64,100 and now assessed at a lower $63,500 would come out owing $682.73 LESS in Trenton property taxes. If you are among the nearly 12,000 residential property owners whose valuation went down, Congratulations! You stand to save some tax money.

However, if you are among property owners – residential or commercial – whose valuations increased, Too Bad! you are going to pay. In my own case, my valuation increased by 44.68%, but my taxes will rise by a somewhat lower 20%. I stand to be paying about $2,100 extra under this scheme.Ouch.

For a hypothetical commercial property owner, the bite is likely to be much bigger. We don’t have a spreadsheet showing individual increases, but we know the aggregate increase is close to 70%. If you own a commercial property currently assessed at $100,000, a 70% bump will bring that to $170,000. Your tax bill will jump 40%, a bump of $2,300 per year. Yikes!

Of course, as we have seen in multiple examples of residential valuation, especially in the West Ward, some increases are as high as 80% or more, even though the city as a whole averages out to 0%. It’s safe to assume that several commercial property owners have been opening envelopes this week revealing individual increases WAAAY higher than the average 70% for that classification.

A lower tax rate by itself is generally a good thing, and may help draw in some new investment. But from what can be seen from the currently available numbers, it looks to me that the lowered tax rate was made possible only by massive residential property tax increases assessed on a small number (15% of the total) of residential property owners, and the entirety of the commercial and industrial sector.

The revaluation disconnect between the total residential and the commercial/industrial sector seems highly distorted to me. I can’t tell based on what we now know whether this process has been manipulated in any way, but we can see that this distortion – 0% increases in the residential sector and 70% in Commercial – is not seen in other New Jersey towns of similar valuation who were reassessed by ASI in the last several months.

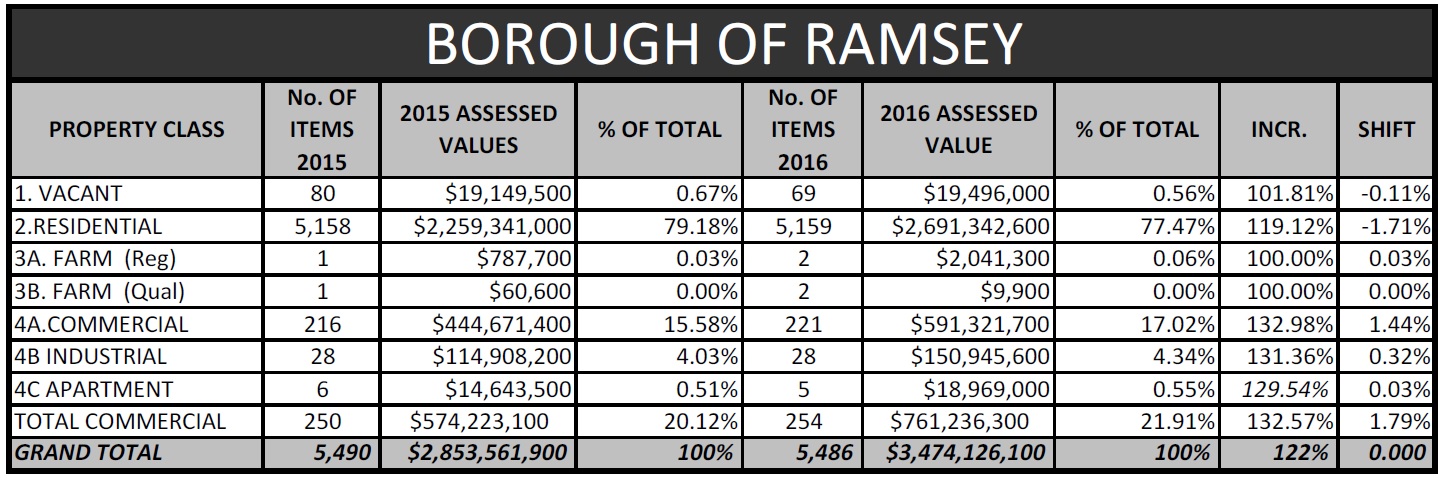

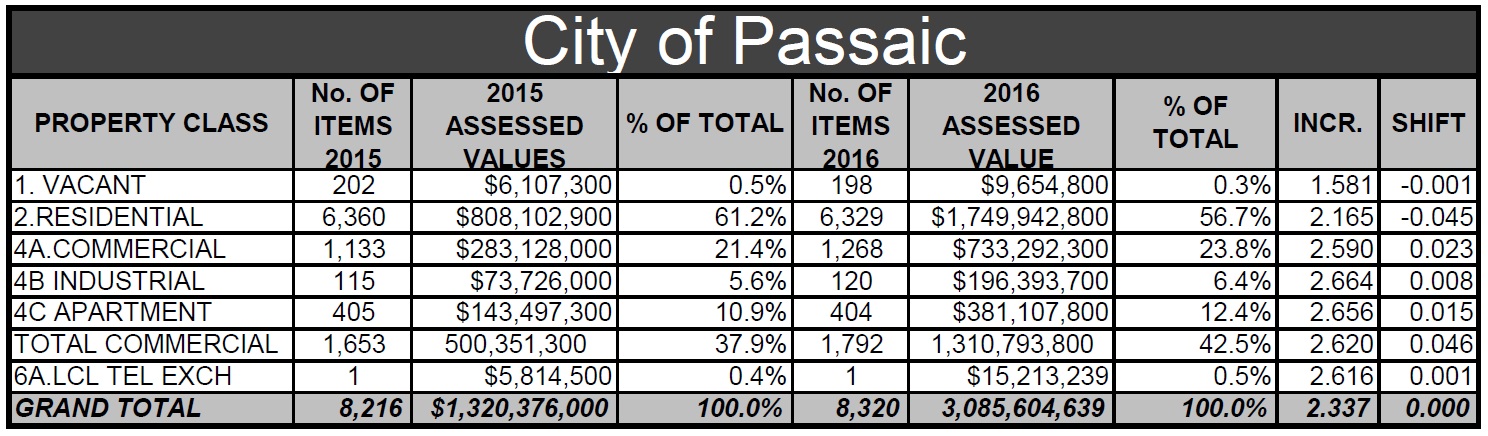

Below are charts for the Tax Impacts from the revaluation processes conducted in three NJ towns: Ramsey, Passaic and Maplewood. I chose these three samples for a few reasons. 1) they were all reassessed by ASI; 2) similar Tax Impact charts were available for them, as opposed to other ASI clients; and 3) their aggregate property values, as well as the residential/commercial mix, are similar to Trenton. Take a look. (Please note that ASI doesn’t format their sheets the same way for all their clients, which may cause a little confusion. Bear with it, though. These tell a story)

In Ramsey (you can see the entire form here), we see a town initially valued at $2.853 Billion, compared with Trenton’s $2.022. It was re-valued at $3.474 Billion, an increase of 22%. In this town, Residential properties went up by 19.12%, and commercial up by 32.57%. Not in sync, certainly, but hella closer to each other than 0% and 70%!

Passaic’s total valuation spiked, from $1.320 Billion up to $3.085B, a whopping 233% increase. Here again, though, the increase of the Residential sector, at 216%, bears some relation to the Total Commercial sector’s increase of 262%.

One more example, Maplewood:

The total valuation of Maplewood increased by 27%, with the residential sector going up by 25.92% and Total Commercial by 38.93%. Once again, and for the third of our examples, there is some correlation between the new values assigned to Residential properties, and to Commercial.

To look at these summaries for the results of the revaluation processes for Ramsey, Passaic and Maplewood, you can easily get a sense that the commercial and residential sides of these communities are located in the same towns. There’s a solid impression that you get that these numbers make sense, they come close to reflecting a credible reality in these communities.

When you look at Trenton, you see two different towns. One, economically struggling, town in which increases in residential property values are utterly flat – on average, but which individually careen wildly from decreases of -80% all the way to +100%.

And a second, pretty successful commercial and industrial city, with market assessments up by a healthily average 70%.

Do these look like the same town to you?

Which one is real?

Which one has been accurately recorded by the revaluation process coming to a conclusion in the next few weeks?

The residential one? The commercial one?

Both?

Neither?

Right now, to me, both Trentons depicted by this revaluation seem equally fantastic and not very credible. These are fairytale versions of the town we think we live or work in, thanks to ASI and the Jackson Administration.

Welcome to La-La Land.