I guess we know why it’s so difficult to get Trenton Mayor Eric Jackson to speak on record with the press. When he does, he doesn’t make sense. Either that, or he lies.

Case in point: On Wednesday of this week, the Trentonian published an article, based on information found and released by former Trenton resident Jim Carlucci, reporting that the Federal 501(c)(3) non-profit status of Mr. Jackson’s non-profit charity Moving Trenton Together had been revoked by the US Internal Revenue Service in May of this year because the Mayor had failed to file federal tax returns for three consecutive years. Ever since the charity was founded, in fact, in 2014.

Along with Mr. Jackson’s history of similar financial difficulties – failure to file required campaign finance disclosure reports with the State of NJ for three years after his failed 2010 mayoral run, failure to file similar reports for three years running after his successful 2014 campaign; numerous financial screwups in his Administration of the City of Trenton; and even allegations of personal financial problems including bankruptcies and foreclosures as charged by a campaign rival in April 2014 – the story of IRS problems didn’t put Mayor Jackson in a very favorable light. Presumably the man will stand for re-election next year, and bringing up all these related stories painting him as a deadbeat will not help his prospects. In normal times., that would be true, although similar tarnish and worse no longer precludes election to the Federal presidency. But I digress.

Anyway, by yesterday, Eric Jackson apparently realized that he has to start to address some of these issues. But only some of them, for now at least. He spoke by phone with Trentonian reporter David Foster, who wrote Wednesday’s story for his paper.

Frankly, he may have been better off not talking to Mr. Foster. His explanation of the situation with Moving Trenton Together and the IRS only, to me, digs himself deeper into his hole of denial and dissembling. Let’s examine what he said and unpack it a bit.

“With the [initial] filing [of nonprofit status with the IRS], you get an initial couple years to file it [ the annual tax return].” – I don’t know where he got that information. On the IRS website, one reads, “In general, exempt organizations are required to file annual returns, although there are exceptions. If an organization does not file a required return or files late, the IRS may assess penalties. In addition, if an organization does not file as required for three consecutive years, it automatically loses its tax-exempt status.” Mr. Jackson’s charity doesn’t appear to fall into any of the listed exceptions. Even if it had, Jackson would have had to file to qualify as an exception, which he doesn’t seem to have done. In that absence, he would have had to file a return for his first year of operation, 2014. Since that is the first of the three missing years for which the IRS yanked his exempt status, it sure sounds like he had any kind of grace period to file his return. He just missed the deadline.

“We had attempted to do it internally. There were some errors with it. It came back rejected and we didn’t get it back timely… It’s on a form that was completed wrong and we are putting it in the hands of people who do this all the time so that they can do it correctly for us and get us back on the right path. You can clearly see where the funds go.” – This doesn’t ring true with what the IRS rules state. Elsewhere in the article, we read, “Annually, Jackson said Moving Trenton Together brought in ‘$20-something thousand.’ Much of that money is used to put on his big Christmas concert held at Patriots Theater at the War Memorial.”

If that’s the case, and MTT is only around that size, the IRS rules say this:

“$20-something thousand” is comfortably under the $50,000 threshold, which means Mr. Jackson had to file using the Form 990-N. This has to be the form he used, and apparently had so much trouble with, right? It has to be a difficult form, since “There were some errors with it. It came back rejected and we didn’t get it back timely…It’s on a form that was completed wrong and we are putting it in the hands of people who do this all the time so that they can do it correctly for us and get us back on the right path.”

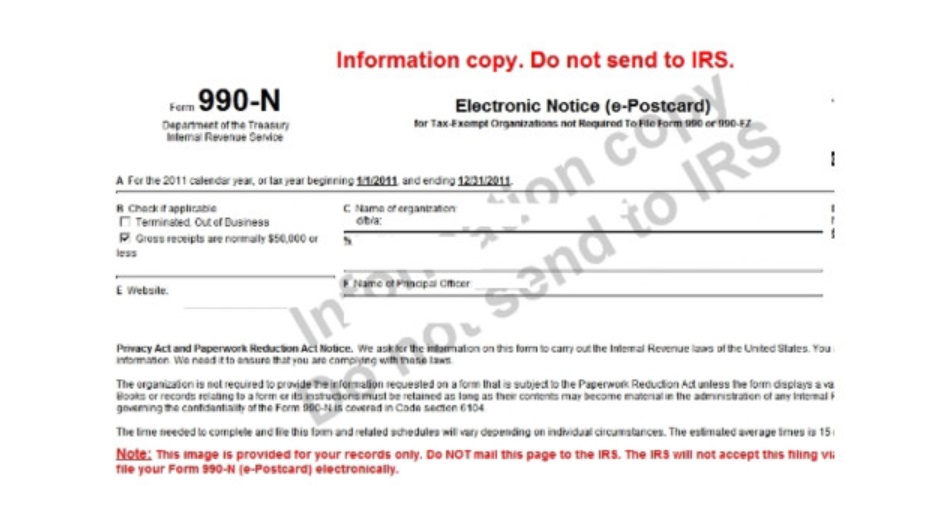

This Form 990-N really sounds like a beast, right? Has to be really hard. No wonder Mr. Jackson and his “people” had so many problems three years running?

Ladies and Gentlemen, I give you the IRS Form 990-N. In its entirety.

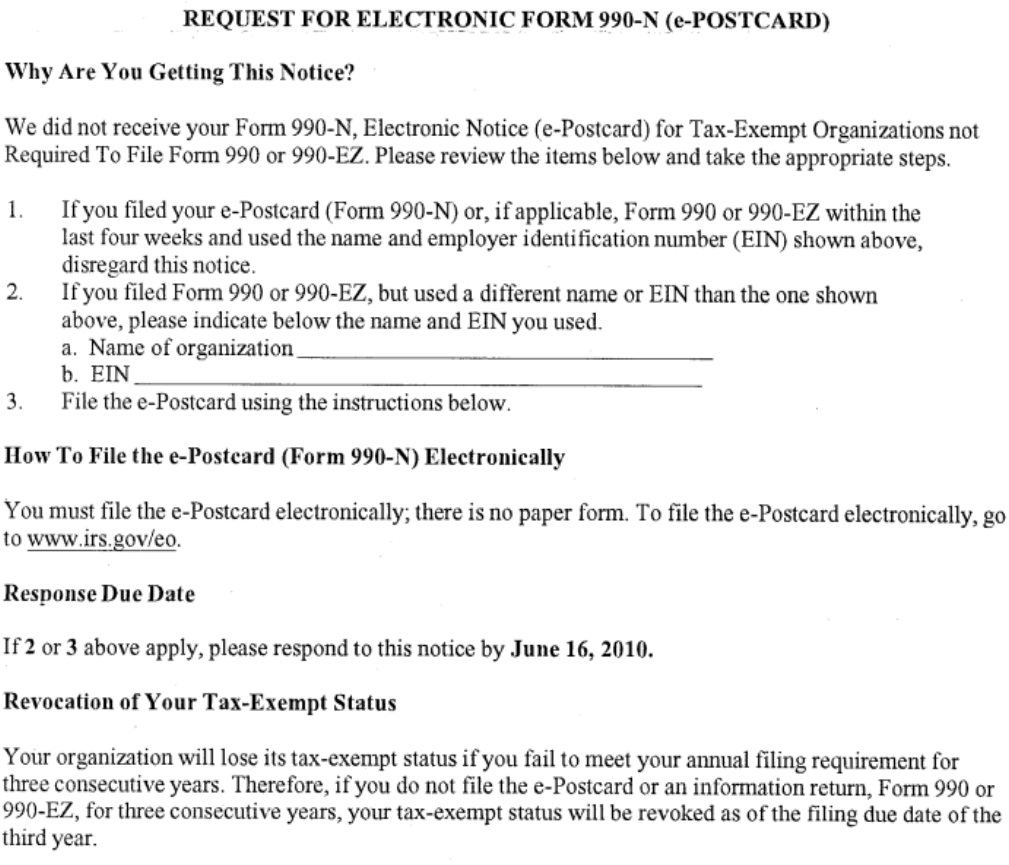

That’s it! That’s the entirety of the form you have to file, and you can only file it online. An “E-Postcard.” If you miss the deadline to file, this is the reminder that the IRS sends:

That’s it! That’s the entirety of the form you have to file, and you can only file it online. An “E-Postcard.” If you miss the deadline to file, this is the reminder that the IRS sends:

There is something I am not getting with Mr. Jackson’s explanation. If his charity was as small as he says, the sequence he lays out doesn’t make any sense. The IRS, despite its fearsome reputation, goes out of its way to make it easy for small charitable organizations such as Mr. Jackson’s to comply with the law.

All he had to do was file a postcard once a year, with the name and address of the organization. That’s about it. he didn’t even need a stamp or envelope.

Perhaps Mr. Jackson mis-spoke about the size of his charity. Maybe he didn’t bring in only “$20-something thousand.” Maybe it was more, in which case he gave incorrect and misleading information to the Trentonian’s reporter. That’s another problem.

For now, I just want to focus for now on the story that Eric Jackson told David Foster on the phone yesterday. As I hope I demonstrated above – and which you could probably figure out yourself by just reading through the article; hey, try reading out loud the mayor’s word salad in a Donald Trump voice, it’s a hoot – the Mayor’s narrative does not make sense. He couldn’t have had all that trouble with the annual filing requirements for his organization if it all is truly what he says it is. Maybe his group is larger than he claims. Perhaps there are financial improprieties and shenanigans.

Or, perhaps he unwittingly gave the real explanation for his troubles when he said, ““It’s not any question of improprieties but it’s a question of timely filing, and we’re not timely into filing, It’s a compliance issue. That’s really what it comes down to.” [Emphasis mine – KM]

“We’re not timely into filing.” Perhaps that’s just it. Perhaps he’s not a detail-oriented guy. Maybe he’s disorganized. It could be he doesn’t care about compliance. That could explain why he ignored three years of IRS late notices about his charity.

That could explain his three-year failure to file campaign finance reports after his 2010 campaign.

That could explain his three-year failure to file campaign finance reports after his 2014 campaign.

That could explain his failure to heed 9 months of IRS and NJ warnings about payroll tax problems in the City of Trenton, which led to a $5 Million Dollar theft.

That could explain his failure to take any steps to improve management of Federal grants, which led to losing $3.3 Million in future funding.

That could explain his failure to ensure that Trenton’s Water Works is managed well enough to ensure the safety if its customers throughout the County.

“It’s really a compliance issue. That’s really what it comes down to.” That could explain… a lot of things.

What that can’t explain is why in the world we would want to re-elect a guy like this to be Trenton’s Mayor. He is a mess!

I am glad to see the Mayor start to open up about this problem. But it’s not enough. After hearing about his IRS, and the current NJ ELEC investigation under way of his campaign, we cannot be satisfied by his confident assurances on the phone that “Those dollars go directly there to funds it for our community. We’re doing some good work.”

We can’t rely on these assurances anymore. He has to show us the numbers. He says he now has a CPA going over the books of Moving Trenton Together. The paper reports, “Jackson said he has all documentation ‘to the dollar… “You can clearly see where the funds go.”’ Good! Let’s see his CPA’s report!

Mr. Jackson says he’s had long correspondence with the IRS about the matter, forms sent back and the like? Well, let’s see that paper trail!

While the CPA is at it, can he catch up and file all of the dozen or so outstanding ELEC campaign reports, and can we see all of that dats “to the dollar?”

Because at this point, Mr. Jackson, we can’t trust a word out of your mouth unless we see the details in writing, in a form we can trust.

Because, at this point, we can’t trust you.