|

|

“We must hold our elected leaders to a higher standard and they must demonstrate they are worthy of the voters’ trust.” – Walker Worthy, as quoted in the Trenton Times, April 21, 2014

If we use the “higher standard” that he used against his then-rival, Eric Jackson, then we have no choice but to conclude that Mr. Worthy flunks his own test, and is not deserving of the public’s trust this Tuesday, May 8.

Here’s piece of last-minute campaign literature produced by the Worthy Mayoral campaign. There’s nothing subtle about it.

One of Us? One of Us? One of Us? One of US?

Sorry for the repetition, but this flyer uses that phrase no fewer than four times, just in case the message wasn’t being communicated strongly enough.

Who exactly is US, Mr. Worthy?

Yankees fans? Libras? Left-handers? Cookies and Cream Ice Cream fans?

If it’s that last choice, then I am definitely with you, Mr. Worthy! You and I, we are US!!!

Somehow, I really don’t actually think that’s what you’re going for here.

In this last. long week of Trenton’s city elections, conventional wisdom (and word on the street says so, for what that’s worth) seems to be that the three leading candidates are Mr. Worthy, Paul Perez and Reed Gusciora.

So, other than Mr. Worthy, that would mean that the other two presumptive contenders are a Hispanic male, and a gay white male.

Hmm, so your use of “Us” might mean…?

Look, I won’t go there. I don’t think I have to.

The use of the phrase “one of us” in politics in this country has a long and ugly past. There’s not a chance in hell that a political operative or consultant worth their salt would not know about it, and its baggage. But the Worthy campaign is using it here, they are using it now.

Mr. Worthy, and his campaign team and consultants, must be worried enough about his prospects on Tuesday that they feel it’s time to play the race card. I think it’s pretty infuriating, and yet one more demonstration that Mr. Worthy has been this year’s candidate least hesitant and quickest to take the low road and fling mud when it suits his purposes. So, I ask the candidate,

Is this what all that donated campaign money is supposed to pay for?

Is this the kind of campaign that your high-priced consultants planned out for you?

I sure as hell hope not, but that’s what I see with my own two eyes.

This approach may help him eke out some extra votes on Tuesday, perhaps enough to get him in to a runoff.

But to what end? It sure seems to me that playing the race card as obviously as this might earn him electoral success this week, and perhaps even in the runoff next month. Is that worth selling his integrity? Is that worth selling his soul?

Mr. Worthy, if you win the Mayor’s office using this kind of tactic, this kind of appeal, what happens on July 1?

You know, when you have to represent the rest of… us?

Whoever the new Mayor and Council will be, the outgoing officials will be leaving a very large present for them.

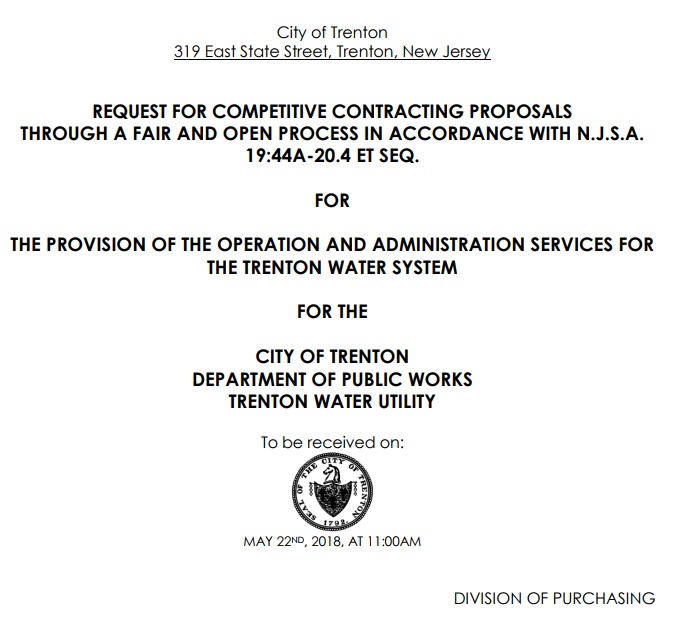

The City is soliciting proposals for vendors to provide “Operations and Administrative Services” for the troubled Trenton Water Works (TWW). This is in addition to the contracts in place with the Wade Trim and Banc3 engineering firms, who are providing personnel for technical operations with the utility. Unlike those two contracts, which were written for one-year terms, this Request for Proposals (RFP) envisions a three-year term for this proposed deal. The City is soliciting proposals for vendors to provide “Operations and Administrative Services” for the troubled Trenton Water Works (TWW). This is in addition to the contracts in place with the Wade Trim and Banc3 engineering firms, who are providing personnel for technical operations with the utility. Unlike those two contracts, which were written for one-year terms, this Request for Proposals (RFP) envisions a three-year term for this proposed deal.

As you can see from the image above, proposals are due to the City by May 22. Conceivably, a contract could be awarded and put in place by the end of June. The new Mayor and new Council may have no input into this contract, and may have to live with it for three years of their terms.

Clearly, much, much more work is desperately needed at the Water Works. Much of the day-to-day chaos at the Filtration Plant and other TWW facilities has died down since the beginning of the year when emergency contracts for Wade and Banc3 were hurriedly written and signed. The pace of water quality incidents and required notification letters has dropped off considerably from last year’s record-setting pace.

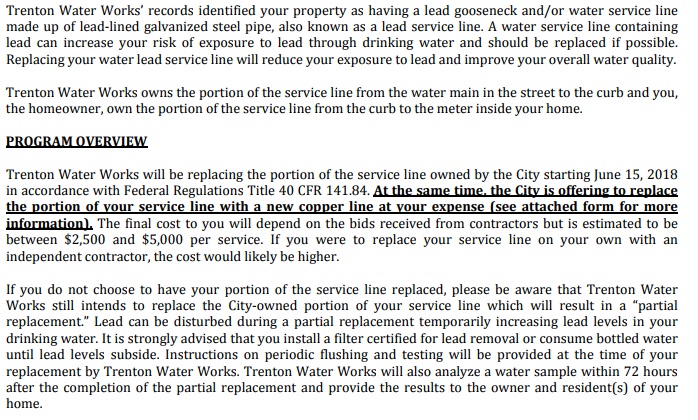

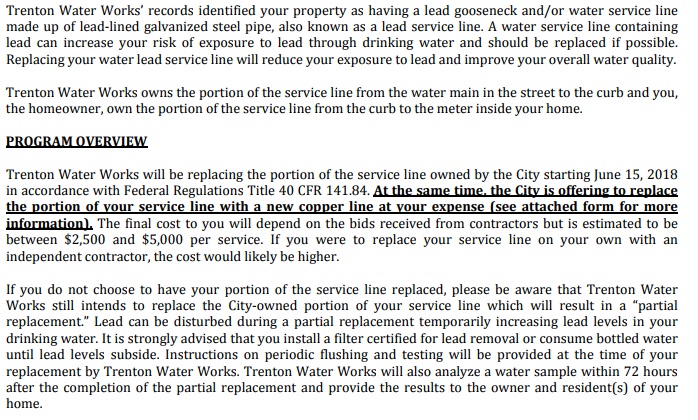

Dropped off, but not stopped. This week, some TWW customers in the Mercer County service area received rather alarming letters from the utility. The letter announced a “LEAD SERVICE LINE REPLACEMENT PROGRAM,” and said the following:

The prospect of putting out $2,000 to $5,000 is something that would scare the bejeezus out of any homeowner. It would scare me, although we didn’t get a copy of the letter. Presumably our service line is ok. Presumably. The prospect of putting out $2,000 to $5,000 is something that would scare the bejeezus out of any homeowner. It would scare me, although we didn’t get a copy of the letter. Presumably our service line is ok. Presumably.

However, there is some reason to think that not all of the households who received this notification actually have lead service lines. For one thing, I was tipped to this letter, and the RFP, by long-time reader and retired Water engineer William Pyle, who has contributed always useful information about the workings of civil water utilities since this space was started in 2010. He, in turn, found out about the letter, when a homeowner in the TWW service area who received one asked him what he thought. His reply, excerpted:

The letter will lead people to believe that they have lead lined pipes from the water main to the curb and also lead-lined pipes from the curb into their houses. It is unlikely that the utility pipes from the water main to the control valve, also known as a curb valve, are lead lined. There may be some lead-lined pipes but most of the older pipes are probably just unlined galvanized iron pipes. What is likely is that the galvanized pipe is connected to the water main by a piece of lead pipe, which is about 18-24 inches long and is sometimes called a gooseneck.

The property that received this letter does not have a lead-lined pipe from the curb valve to the meter in the house. It has copper. Nevertheless, the occupants wouldn’t necessarily know that and could sign on for replacement of a customer-owned service line that doesn’t need to be replaced. When the City’s contractor attempts to replace the line, hopefully, the contractor would recognize this and the contractor would not replace the line. However, the contractor would then be looking for someone to pay for the contractor’s time and lost profit. Or, the contractor would just replace the line and the homeowner wouldn’t know that it wasn’t necessary.

Although each homeowner’s situation may be different, anyone who received the letter should be concerned, but might not want to shell out thousands of dollars right away, until more details of this Program are known.

And more trustworthy information, too. Just in case Mr. Pyle’s advice isn’t persuasive enough, maybe this detail might suggest to you that this letter might not be 100% accurate: the version on the City’s website, the one linked above, is an online correction to the one TWW’s customers this week. The mailed copy of the letter listed the wrong area code for the Water Department. Yep, the area code given was 973, NOT 609. Oops.

If the folks in the Water Works can’t even get their own phone number right, maybe they do need help with their Operations and Administration. Which brings us back to the RFP. If the folks in the Water Works can’t even get their own phone number right, maybe they do need help with their Operations and Administration. Which brings us back to the RFP.

This is a very ambitious plan proposed by the City. There is a very long list of duties and obligations to be assumed by the successful bidder. The language in Section 5 on Pages 23-24 provides a good summary:

The Successful Responder shall be responsible for the direction of the operation, management, administration, maintenance and repair of the Water System in compliance with all permits and Administrative Consent Orders, in accordance with the Agreement. Meeting the terms of the Administrative Consent Order entered into by the City of Trenton and the New Jersey Department of Environmental Protection on February 5, 2018 shall be the priority.

It’s a very good sign that the City seems to be serious about complying with the terms of this year’s Administrative Consent Order (ACO), considering how it essentially blew off the last couple.

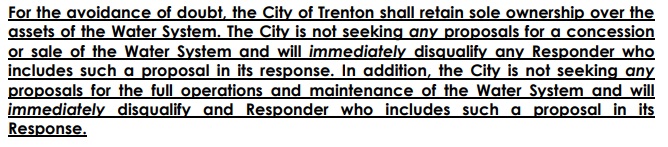

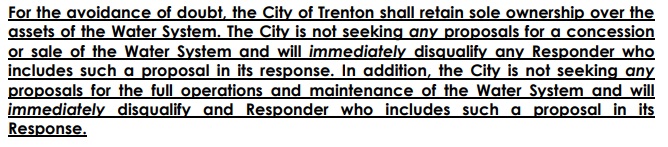

Another thing that the City is quite adamant about in this document is that even though operational and administrative responsibility is to be contracted out and privatized, the City of Trenton’s ownership is not in play. On Page 5,

To actualize this plan, the RFP envisions several management and operational personnel to be provided by the successful bidder. Below is the list of 20 positions as written on Page 33, in Schedule C. Eleven positions are anticipated to be filed at the very beginning of the contract, with another 9 following on in later weeks and months.

The existence of this RFP raises several questions. Among them: The existence of this RFP raises several questions. Among them:

This new vendor will be in place for at least several months alongside two others, Wade Trim and Banc3. Some of the positions to be filled by this new vendor, such as “Senior Operator” and “Operator” sound they may overlap with similar positions provided by the two existing vendors. How are all of these vendors intended to work together?

Will Wade Trim and Banc3 transition out of TWW at the conclusion of their one-year contracts, or will they continue, alongside this new vendor?

The current contractors appear, as far as it’s publicly known, to be providing its personnel from outside the city. Will this also be the case for these 20 new positions? After all this activity started during the last several months, how many city residents will be employed at the end of this process, compared to its start?

How will the addition of all of these commercial contractors and new personnel affect the utility’s rates and budget?

All of this activity – the 2 current contractors, the proposed new one, new initiatives such as this “Lead Service Line Replacement Program” – seem to be all parts of a grand new plan for the Trenton Water Works.

Does this current, outgoing Administration have any intention of letting the public – the residents and ratepayers of the City of Trenton as well as the tens of thousands of customers in the rest of the County – in on what exactly this plan is?

All of us, as well as those who are seeking to be the city’s next Mayor and Councilmembers, would appreciate – and frankly deserve, after the last several chaotic years – to know what the plan is before it is set in stone.

Right now, the only way we are hearing about these new plans is by unanticipated letters in the mail (with wrong phone numbers!), and being tipped off to important purchasing plans located in the depths of the city’s website.

As of today, it looks like this Administration is being consistent with its behavior over the last four years.

It’s taking care of major city business, and making crucially important contractual deals, while leaving its citizens and customers uninformed.

An update to last night’s piece:

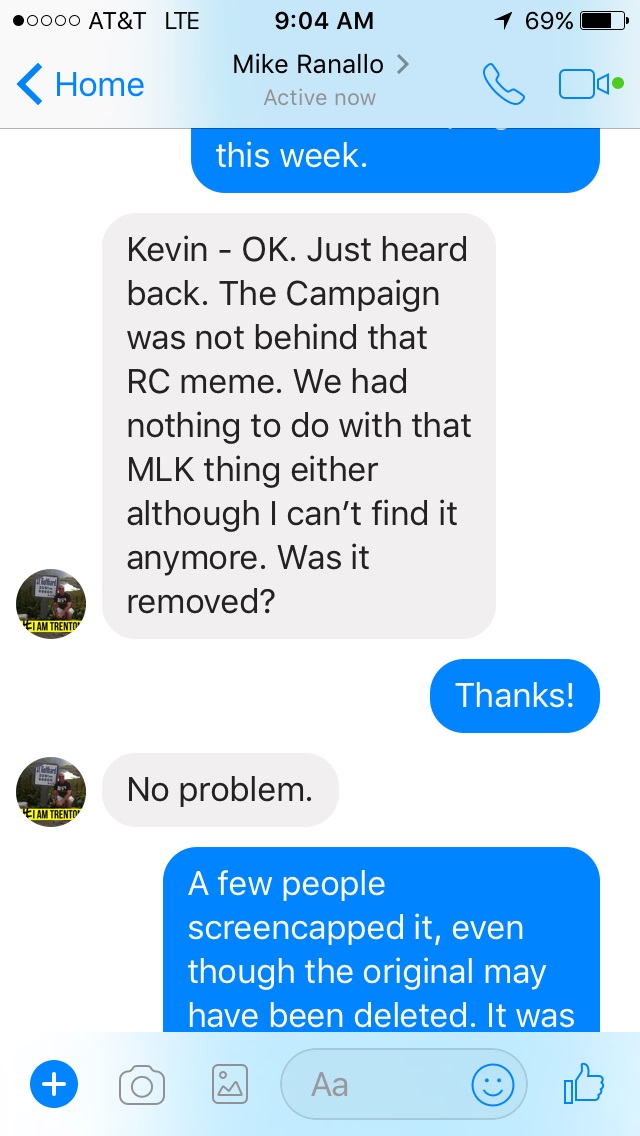

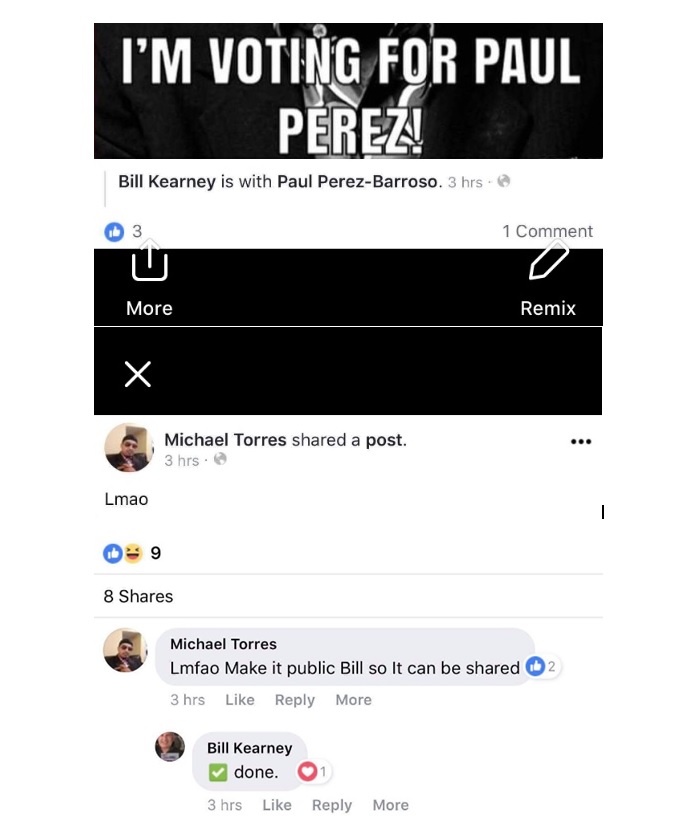

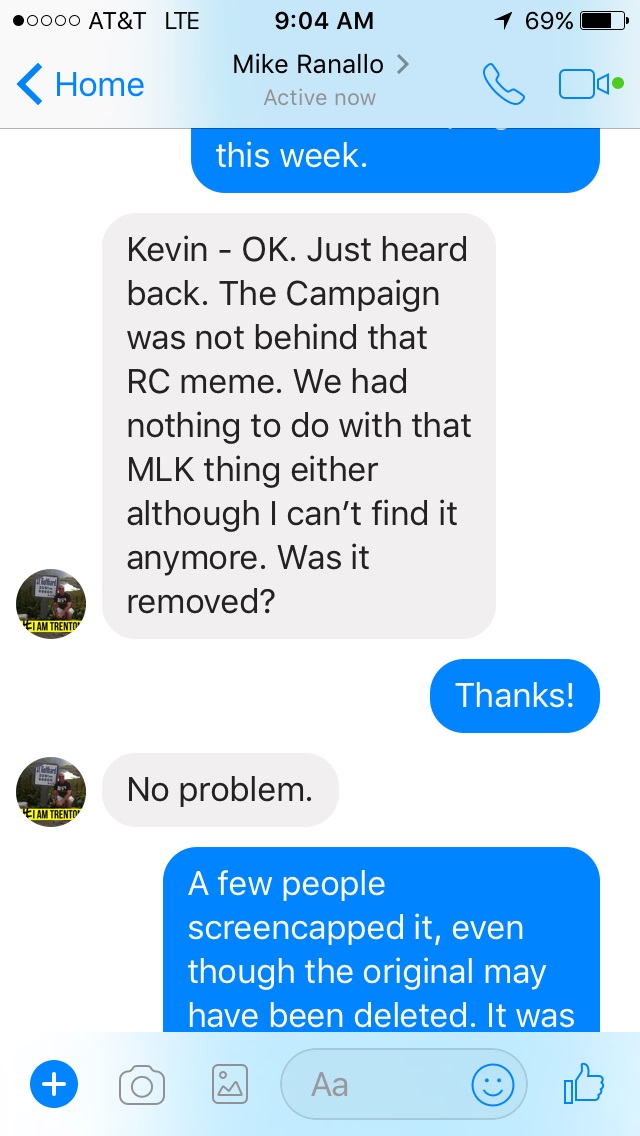

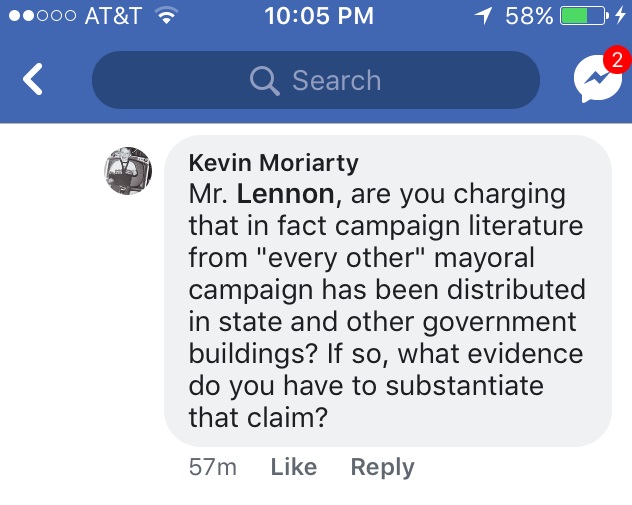

Based on assurances from the Paul Perez campaign last night, that the Perez campaign was not responsible for producing or distributing a tasteless graphic yesterday featuring the late Ray Charles “endorsing” Paul Perez’s candidacy for Trenton Mayor, I wrote the following: “A representative from Paul Perez’s campaign denied that they had anything to do with both the Ray Charles and the MLK graphics. So, as of this evening, this short-lived graphic seems to be a genuine dirty trick, produced by others to embarrass the Perez campaign.”

Sorry about that. I based my statement yesterday on the denial below from campaign representative Michael Ranallo, which appears to have been a false statement

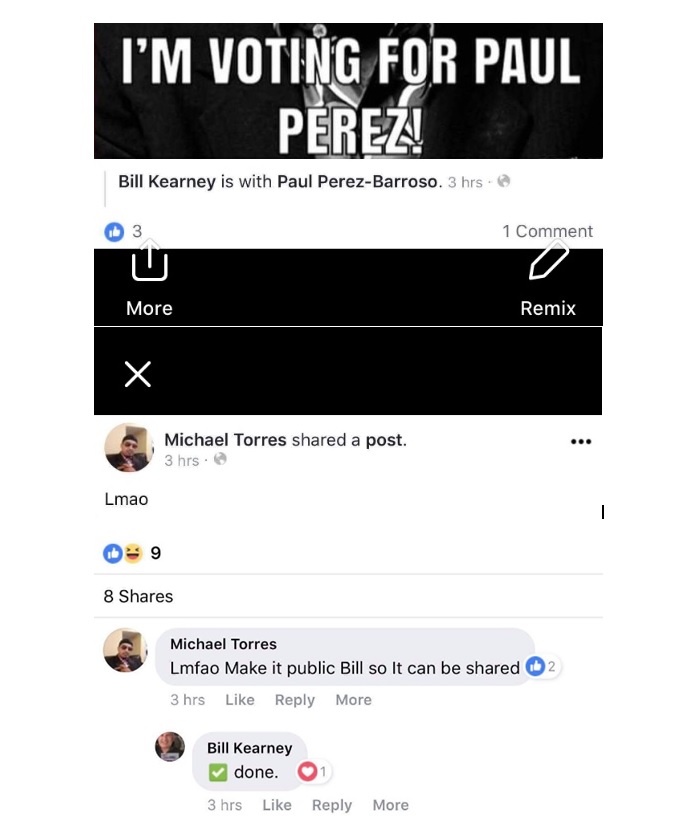

That was before another reader sent me the following screengrabs, made before the original posts were deleted from Facebook. Note: I will not post the full original graphic, so the image below has been cut-and-pasted. That was before another reader sent me the following screengrabs, made before the original posts were deleted from Facebook. Note: I will not post the full original graphic, so the image below has been cut-and-pasted.

Michael Torres, you may recall from yesterday, is the Perez supporter who reported the distribution of Walker Worthy campaign literature at the downtown Motor Vehicles office. Bill Kearney is a Perez supporter who has been producing a number of Perezz graphics for social media. Since Mr. Torres asked Mr. Kearney to make the RC graphic public, and he did so, one may assume that Kearney produced this graphic as well.

You will also note that the candidate, Paul Perez, was tagged in the original post.

This is really a small insignificant incident in the grand scale of Trenton’s election season. Except for a few things.

In my post yesterday, I wrote how Reed Gusciora owned up to and took responsibility for a probably more offensive campaign graphic that he told me was produced and distributed by a campaign supporter without his or his campaign staff’s knowledge. Subsequent to my post, by the way, Mr. Gusciora wrote a note on Facebook explaining the incident in greater detail.

I also wrote how Walker Worthy campaign manager Reese Lennon took responsibility, however awkwardly, for supporters associated with his campaign distributing their literature in the MVC office.

Of the three examples I cited yesterday, two campaigns took responsibility.

Paul Perez’s campaign responded by both deleting the graphic, and intentionally misled me about the role played by the campaign in the creation and distribution of yesterday’s graphic.

Not cool.

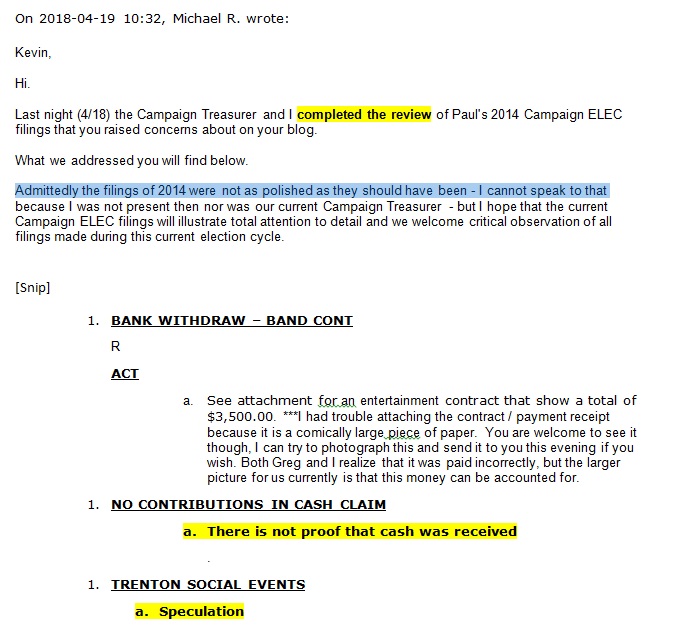

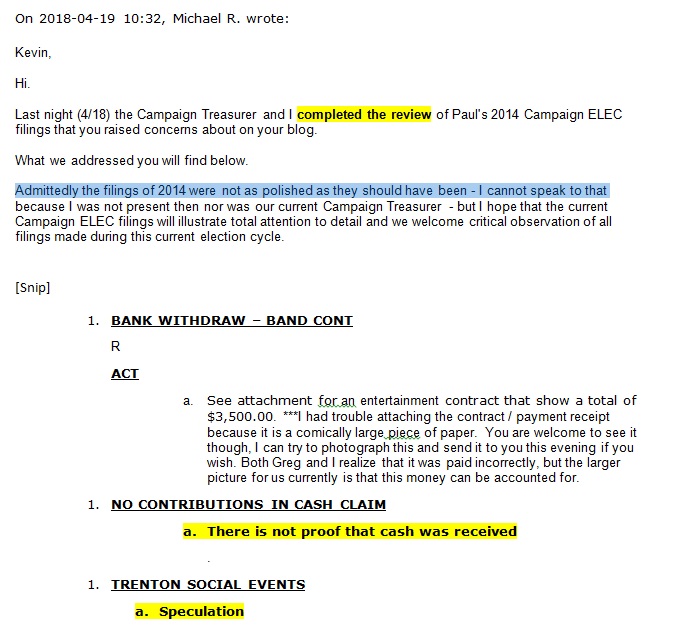

Michael Ranallo, responsible for yesterday’s written denial, is a senior campaign worker with whom I have been in contact on other matters, namely regarding the status of the outstanding and problematic campaign finance reports overdue from Mr. Perez’s failed 2014 mayoral campaign. On April 19, he sent me an email assuring me that work had nearly been completed on addressing these open questions. I excerpt that email below (Emphasis mine):

The candidate assured me, both by directly speaking to me and having his lawyer send me a letter, that he took “full responsibility” for both the mess created by his 2014 reports and for the clean-up. Which, as Mr. Ranallo told me several weeks ago, was “complete.”

As of this morning, however, there are no updated, revised reports from 2014 posted to the Election Law Enforcement Commission (ELEC) website. Although both Mr. Ranallo and Mr. Perez offered to have me review all of their documents, I told them I looked forward to seeing the updated reports on the ELEC site. Looking through a campaign’s internal reports proves nothing, not until the candidate signs a report and sends it to the State.

Which has not been done.

Which means all of the questions I raised in February – about improper cash expenditures, the total absence of cash receipts, missing in-kind income and/or expenses – are still open. None of them have been answered.

As far as the campaign is concerned, wrote Mr. Ranallo, there’s “no proof” any cash was ever received by the campaign. Any thought that cash may have been received or spent around the many campaign events held around town, is just “speculation.”

We are only six days from the election. Paul Perez’s 2014 campaign reports are as elusive as Donald Trump’s tax returns. We are not likely to see them before the election.

In February, I gave them the benefit of the doubt. I trusted Mr. Perez, Mr. Perez’s lawyer, Mr. Ranallo, and the Perez campaign, when they promised to clear up serious campaign finance questions. They haven’t done that. They fooled me once.

Yesterday, about what should really be a silly insignificant matter, relative to much bigger issues, the campaign chose to intentionally mis-state their involvement. On the basis of the written reassurance given me by Mike Ranallo, I wrote that the Perez campaign wasn’t involved. And that does not seem to be the case. They fooled me twice. Shame on me.

The Ray Charles graphic is a throwaway, a stupid idea stupidly executed, laughed over by their creators like junior high school students’ first experiment with Photoshop. Yet they lied about it to me.

The graphic yesterday is not important. That Paul Perez has not answered four-year old campaign finance questions six days before the election, is.

The failure of Donald Trump to release his personal tax returns during of after the 2016 Presidential election was one of many indicators during that election that he was the kind of person that he has proven to be in office: venal, duplicitous, not to be trusted. It was there for all to see. Not enough people believed what they saw. And the man is doing incalculable damage to this country and its democracy.

Paul Perez and his campaign are showing us the same types of indicators of what he may be like in office. It’s there for all Trentonians to see.

Will we believe what we see? We’ll find out May 8.

Yesterday, a couple of graphics were making the rounds on Facebook, appropriating the image of Ray Charles to promote Paul Perez, and a picture of Martin Luther King, Jr. to promote Reed Gusciora. The first seemed to appear only online. The second was apparently printed onto handbills that ended up as handbills appearing in several Trenton neighborhoods.

Both are in pretty bad taste, certainly not very funny in the Ray Charles case, and more than a little condescending in the King graphic. Appropriating any historical or cultural figure, especially one who is deceased, to promote a candidacy is to implicitly claim a specific political endorsement where none exists. That’s not ethical at all. It’s not even smart, considering the cheesy way in which these late greats were used.

As of today, one of the graphics has already been pulled down from Facebook, but copies abound. The Internet is forever, folks. Whatever goes up, even for a short time, lives forever. I won’t post links to either of them.

In fact, the both of these pictures are in such bad taste that it is actually hard to believe – at least that’s what I think – that they were actually the products of the campaigns they supposedly favor. Each of them seem more like trolling efforts by other campaigns seeking to make their candidates look bad, than legitimate graphics commissioned and approved by the campaigns. I reached out to representatives of both the Perez and Gusciora campaigns to ask for clarification.

A representative from Paul Perez’s campaign denied that they had anything to do with both the Ray Charles and the MLK graphics. So, as of this evening, this short-lived graphic seems to be a genuine dirty trick, produced by others to embarrass the Perez campaign.

This afternoon, Reed Gusciora called me. We spoke for a while. Reed told me that neither he nor his campaign commissioned the graphic. Neither did he or the campaign approve it. It is nothing that he ever would approve, and it doesn’t fairly represent the kind of campaign he’s run in the past. That being said, he did say that the flyer with the King graphic was produced by a supporter, working outside of the campaign, who thought he would be doing the campaign a favor by doing this on his own. He regrets that his name is associated with this flyer, and that something like that could be associated with his campaign.

He didn’t name the person who produced it, nor did I ask him to. Mr. Gusciora could have easily disavowed any knowledge of or responsibility for the flyer, but he didn’t. He did say that when he distributes his campaign literature it’s all professionally written and printed, features the “Paid By” language with his name, and he’s sure it’s consistent with the way he’s presented himself as a candidate and public person throughout his career. He regrets that something like this attracts attention at this late stage in the campaign rather than the issues that matter.

On their own, each or both of these graphics on their own likely wouldn’t have seemed so grievous. But since they popped up at the same time as another questionable move, this one made by the Walker Worthy campaign yesterday, it seemed like a sudden rash of suspicious campaign behavior that should be resisted and stopped before it gets any worse.

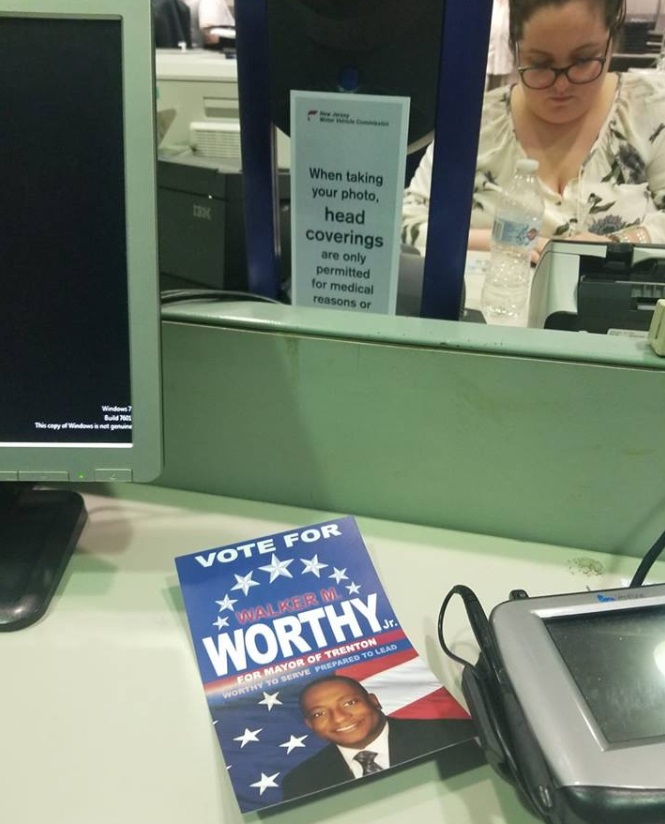

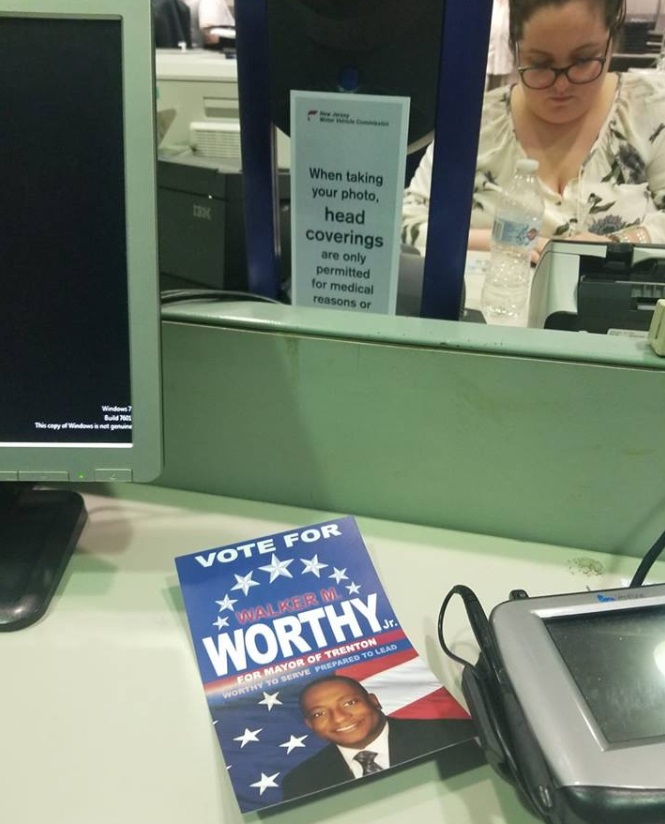

Yesterday, local resident (and Paul Perez supporter, in the interest of full disclosure) Michael Torres, visiting the downtown state Motor Vehicle Commission (MVC) office, saw apparent Walker Worthy workers handing out Worthy campaign literature to people, inside the MVS premises. He didn’t take any pictures at the time when the alleged Worthy campaigners were actually distributing the literature before he left, but did go back to record some smartphone video and take some still photographs. This afternoon, another person posted a picture taken at MVS yesterday, adding to the plausibility of this story.

Here is a still photo and screeengrab from Michael Torres’ footage:

The video indeed does indeed show, as the pictures above do, the main customer seating area of the downtown MVC office. And sure enough, there are a number of Worthy circulars featured in the video, on seats, floors, customer service windows, and in a garbage can. Now, NJ State law explicitly prohibits solicitation of campaign contributions anywhere on government property. That’s not what’s alleged here. There may be no state law (that I could find) against distribution of campaign lit at MVC offices, but there are MVC office rules and regulations against any kind of solicitations on their property. Otherwise one would be fighting off hordes of lawyers and insurance companies the whole time you’d be there. Whether or not there are specific legal prohibitions on doing so, it’s generally understood that campaigns

The video looks legit, but since there was no actual distribution of campaign lit seen on camera, it appeared inconclusive as of yesterday that the Worthy campaign was actually responsible for electioneering in a government office.

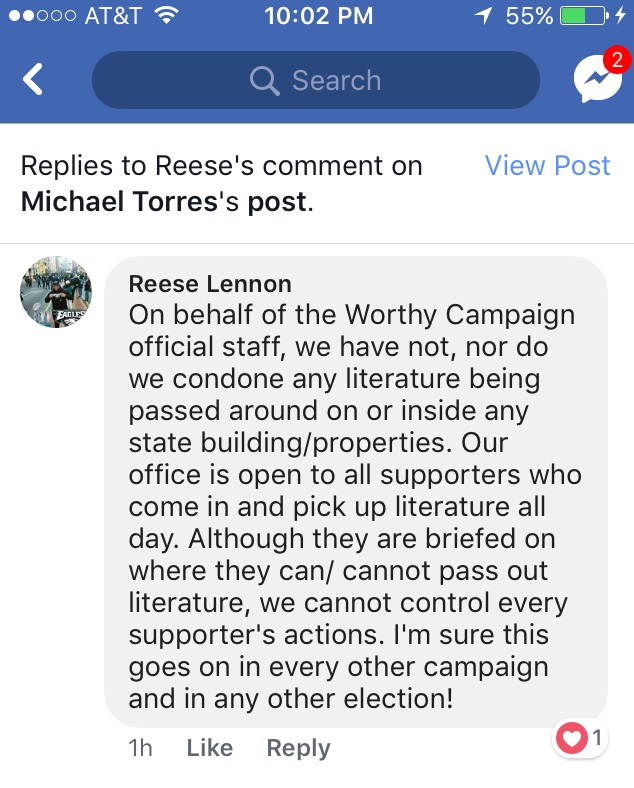

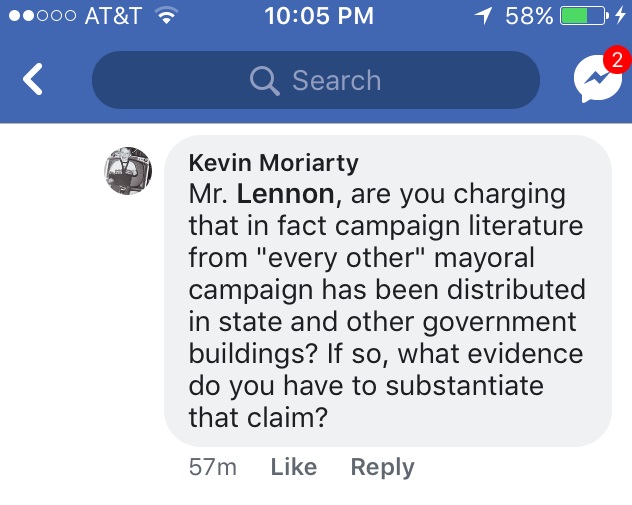

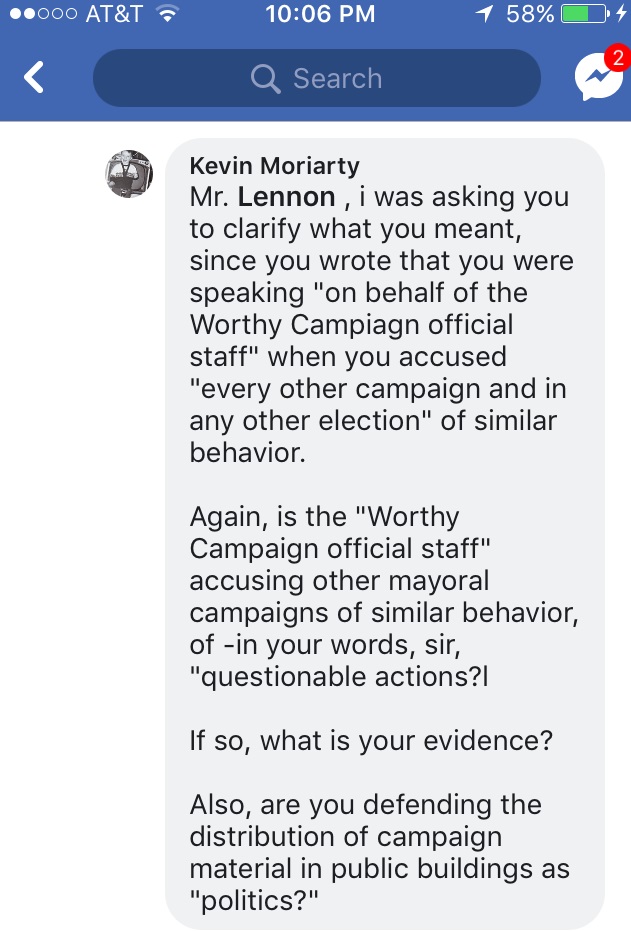

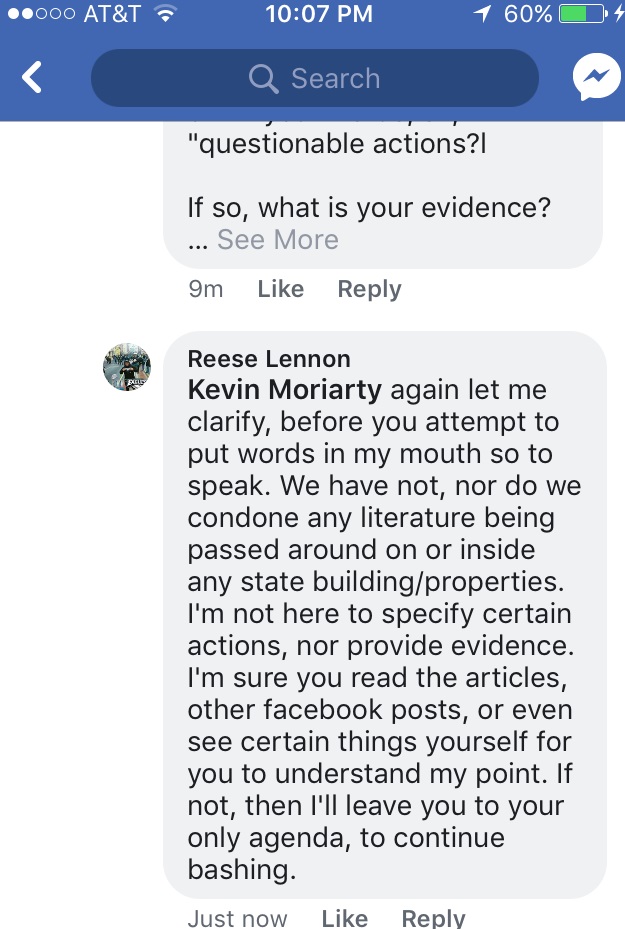

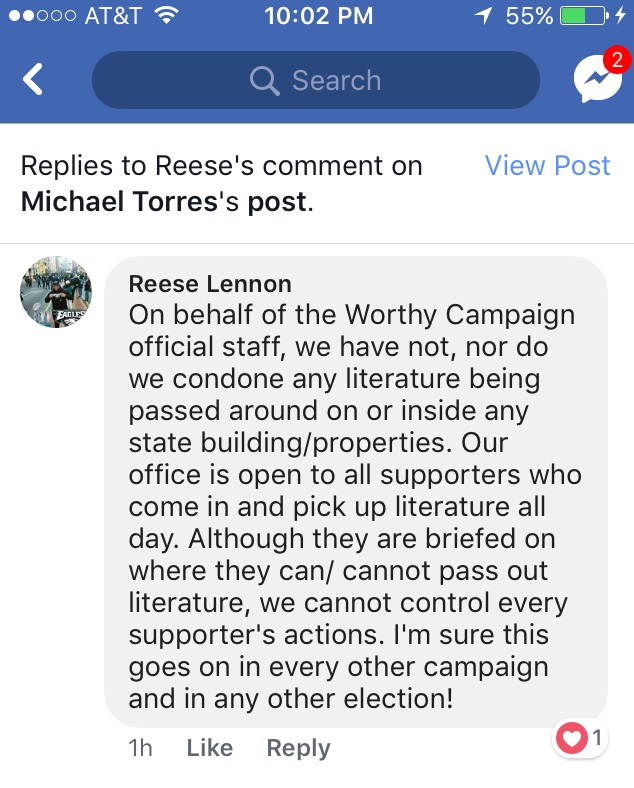

However, in the evening, a person by the name of Reese Lennon posted a Facebook comment that seemed to admit that it was the campaign that distributed the handbills at MVS. But in the same statement, Mr. Lennon gave what sounded like an “Everyone Does It” excuse.

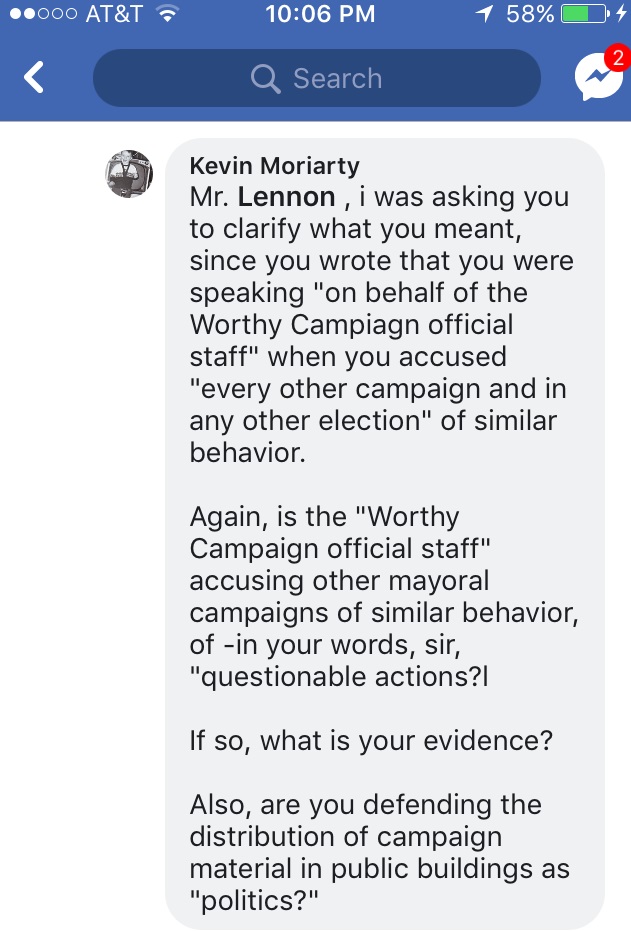

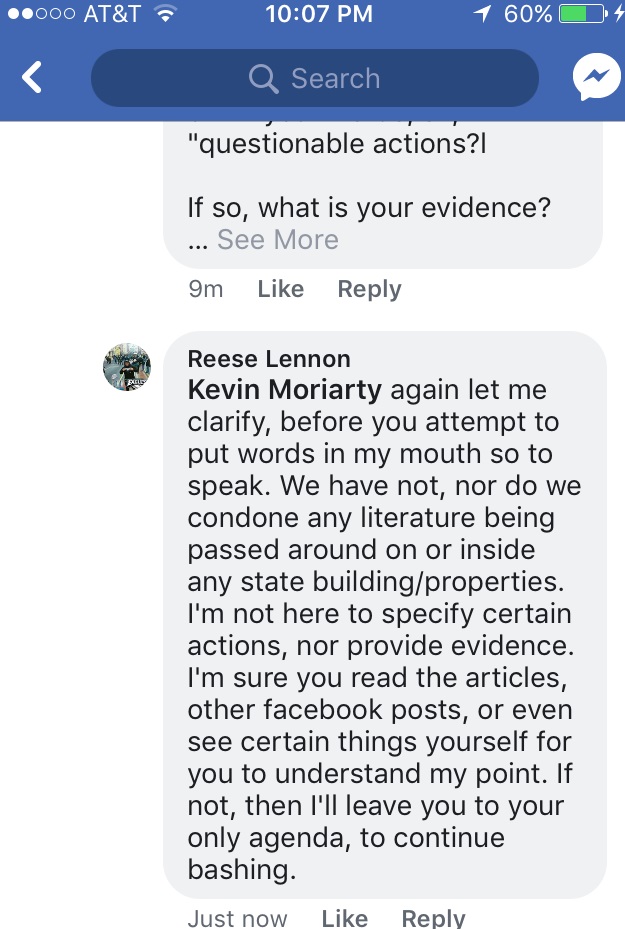

I followed up on this post with a question. I followed up on this post with a question.

The rest of the conversation didn’t go that well. The rest of the conversation didn’t go that well.

And, with that, we were done. By this morning, the entire thread containing Mr. Lennon’s and my comments has been removed from Facebook.

This afternoon, I called the Worthy Campaign headquarters. The person answering the phone confirmed that Reese Lennon works for the campaign, with the title of Campaign Manager. That answered my other question, which I did not have to ask. As manager, he certainly can and does speak officially on behalf of the campaign.

The fact that someone associated with the campaign admitted that the MVC visit was indeed made by someone associated with their campaign showed a level of honesty and accountability that was appreciated. It’s too bad that this accountability was negated in the next sentence when he wrote “I’m sure this goes on in every other campaign and in any other election!”

Well, I’ve never been in a Motor Vehicles office, or any other government office, and been given campaign literature! In fact, I found it very unusual. Whatever good will Mr. Lennon earned in his first comments drizzled away as he got more defensive.

Mr. Gusciora was genuinely regretful. He took responsibility for the act of someone using his name and his campaign even though the person didn’t have his candidate’s knowledge or approval. He owned this incident.

What Mr. Gusciora did not do was blame the incident on “politics.” He didn’t say that “this goes on in every other campaign and in every election!”

This is the last week of Trenton’s every-four-year Silly Season. I do hope that yesterday’s three separate instances of unpleasant campaign stunts are the only ones we see during this next week. Let’s try to stay classy for the rest of this election, and through a likely runoff.

Is that too much to ask?

Last week, the Trentonian – the only one of the two remaining daily newspapers in town reporting Trenton non-sports news on a regular basis, published a kind of non-story story. The April 18 story by David Foster reported on the news that four City Council candidates – At-Large candidates Elvin Montero and Rachel Cogsville-Lattimer, East Ward aspirant Taiwanda Terry-Wilson, and South Ward candidate Jenna Kettenburg – had made campaign-to-campaign donations totaling $6600 to a fifth, current Council President and West Ward rep Zachary Chester.

According to Mr. Foster’s article, Councilmember Chester explained that the pooled funds would pay for a Get Out The Vote, as of today unannounced, close to the May 8 election. On the basis of information in the article, there appears to be nothing wrong or suspicious about the funds transfer, or the plans for the event. Mr. Foster found out about the transfers from campaign finance reports submitted by each candidate to the state’s Election Law Enforcement Commission (ELEC). It’s public information, properly disclosed.

Mr. Foster quoted South Ward Councilmember George Muschal, against whom Ms. Kettenburg is running, voicing his suspicions that there were some unspecified ulterior motives at work. “There has to be something in it for the people involved in it. You don’t have to have blinders to see what they’re gonna do if they get on. It’s a bad start,” he said to Mr. Foster. However, what that “something” could be remained unspoken by Muschal, and unsuggested by Foster. The rest of the April 18 article reported on the contents of the ELEC reports of all five candidates, discussing amounts raised and naming some of their donors.

So, as I said above, pretty much a non-story.

However, on the day the article was released, there was some chatter on social media that seemed to indicate that many people in Trenton have either never heard, or have forgotten, a story involving Mr. Chester going back to 2012. When he ran for re-election in 2014, no one mentioned it, not even his opponent. Perhaps it wasn’t relevant, then. Perhaps voters considered it ancient history.

Maybe it is. I think, though, that for this election there is legitimate reason to discuss it.

I speak of the crime of embezzlement committed by Mr. Chester’s now ex-wife. In 2012 Alysia Welch-Chester was the Chair of the Trenton Democratic Committee. Mr. Chester served on the Committee as an elected District Representative from the Hiltonia neighborhood, along with his wife. At the time I was the parliamentarian for the committee. In June of that year, other members of the committee discovered that a sizeable amount of money was missing from their bank account. Available evidence pointed to Ms. Chester.

The following month, in the words of a newspaper account of the time, Ms. Chester “agreed to enter a pretrial intervention program on Thursday after being charged with stealing from the political organization.” The terms of that program were 200 hours of community service, maintenance of fulltime employment, 6 months of supervision, and payment of court fees, per the Trenton Times article by Jenna Pizzi. As part of that deal, “Welch-Chester paid $6,249 in restitution to the committee yesterday and turned over keys to the committee’s mailbox and storage unit.”

As one could imagine, this incident rattled the Trenton Democratic Committee. A new slate of officers was elected. I agreed to serve as Treasurer to help get the finances of the organization back in order. I agreed to do so on a forward basis only. The books and records for the previous several years were frankly a mess. The Committee hadn’t filed a quarterly ELEC report since I had filed the last one from a previous stint as Treasurer in 2007.I served as Treasurer from July 2012 until October 2013, resigning due to work commitments. In that time, I moved the Committee’s financial records to Quickbooks, and filed the quarterly reports for that period, up until the period ending September 2013.

I mention this in order to provide some context to these following statements:

I have seen, in detail, all the items and their amounts, that Ms. Welch-Chester stole from the Trenton Democratic Committee. I could not believe, and still cannot believe, that her behavior could have gone on as long as it did without the knowledge, or at best suspicion, of her husband, Councilmember Zac Chester. The only two explanations that I could come up with then, and now, is that: 1) he knew what she was doing, and stayed silent. Or, 2) he remained entirely oblivious to what was being done by his wife.

To be clear, I never thought that Mr. Chester was involved in Mrs. Chester’s embezzlement, then or now. But, after excluding that possibility, the remaining two alternative scenarios surely didn’t make him look good.

In the Spring of 2014, as I mentioned above, Mr. Chester ran for and won his re-election, and was elected to serve as Council President for the next four years. The record of his wife as Municipal Democratic Chair, and the circumstances of her departure never came up during that election. It truly was ancient history to voters, even though the events were barely two years old.

Why bring this up now?

Because in early 2016, it was announced that the City of Trenton’s payroll services vendor had embezzled nearly $5 Million Dollars in taxpayer money, over a period of at least several months over the previous year. And Zachary Chester’s actions – and inactions – before, during, and after this theft are eerily similar to his actions and inactions during the time of his wife’s embezzlement.

During the months in early 2016 as this theft developed as a huge local news story, City officials – including Mr. Chester – shared very little information about the circumstances of the theft. What meager information they did share was incomplete and often conflicted with facts as revealed by the publicly available evidence. As Chief Executive of the City of Trenton, Mayor Eric Jackson was the public face of the Administration’s dissembling. And, as President of City Council, Zachary Chester participated in what amounted to a cover-up.

There are relatively few overt and public statements made by Mr. Chester that attest to this. On February 19, 2016, feigning ignorance, he told Philadelphia TV WPVI reporter Nora Muchanic, ““Not knowing what the amount is, whether it’s a million (dollars), $800,000, that’s a million or $800,000 that we don’t have in our budget.” That explanation lost all credibility when it later came out that on that very same day the City filed a lawsuit in federal court against the payroll vendor and its owner. That complaint clearly stated that the loss to the city wasn’t “a million or $800,000” but closer to five million dollars. That complaint could not been filed without the prior knowledge and approval of the Mayor and Council, over which Chester presided.

Mr. Chester’s on-camera comment can only have been meant to dissemble and dismiss the crime as far less significant than it was, and less significant than he surely knew it was.

For several months before the discovery of the theft, there were multiple warnings and notices sent by both the federal Internal Revenue Service (IRS) and NJ State Taxation to the City, which were summarized in the Trenton Times by reporter Cristina Rojas, based on documents released by the City to me in response to an Open Public Records Act (OPRA) request. During the same month that the City received no fewer than five urgent notices from the IRS, Chester’s Council actually renewed the contract with the payroll service.

Remember, City Council is supposed to review all check registers of payments made by the City, as well as review important correspondence to the City. Did Council fail in their obligations to oversee the Administration’s operations during the time it was being robbed blind? We don’t know, but from all available evidence, it doesn’t look good.

In the period after the discovery of the theft, basically from January 2016 to the present time, we have seen nothing public from the City to indicate that whatever failures led to the theft of $5 Million Dollars, they were being fixed. The Mayor made no announcements, and City Council convened no hearings or investigations to show that action was being taken. A year later, Mayor Jackson made some vague statements about administrative and procedural changes.

But as of today, there still has been No News or information about how the City intended to prevent future similar robberies. It’s as if this incident is Ancient History, even though it’s only been two years since the Great Payroll Heist.

As for Mr, Chester’s role as President of City Council – before, during, and after the Great Heist – I can only think of two likely scenarios: 1) he knew, or had an idea, that something was wonky with the City’s tax payments, based on hearing about or seeing any of the tax warning notices; but did nothing about it. Or, 2) he remained entirely oblivious to what was going on for months.

Again, just as I have never had any reason to believe that Mr. Chester or any other city official or employee was involved in the payroll tax embezzlement, the other two remaining scenarios do not make him look good. At all.

And that’s why I now bring up the crime committed by his ex-wife six years ago. Because his behavior in his personal life in 2012 – likely either a knowing detachment, or innocent obliviousness – was the same behavior he exhibited in his public life in 2015 and 2016.

And this behavior is something that Trenton cannot afford for another four years. Zachary Chester does not deserve another term on City Council.

Because all this is NOT Ancient History. It’s Trenton’s future we are talking about.

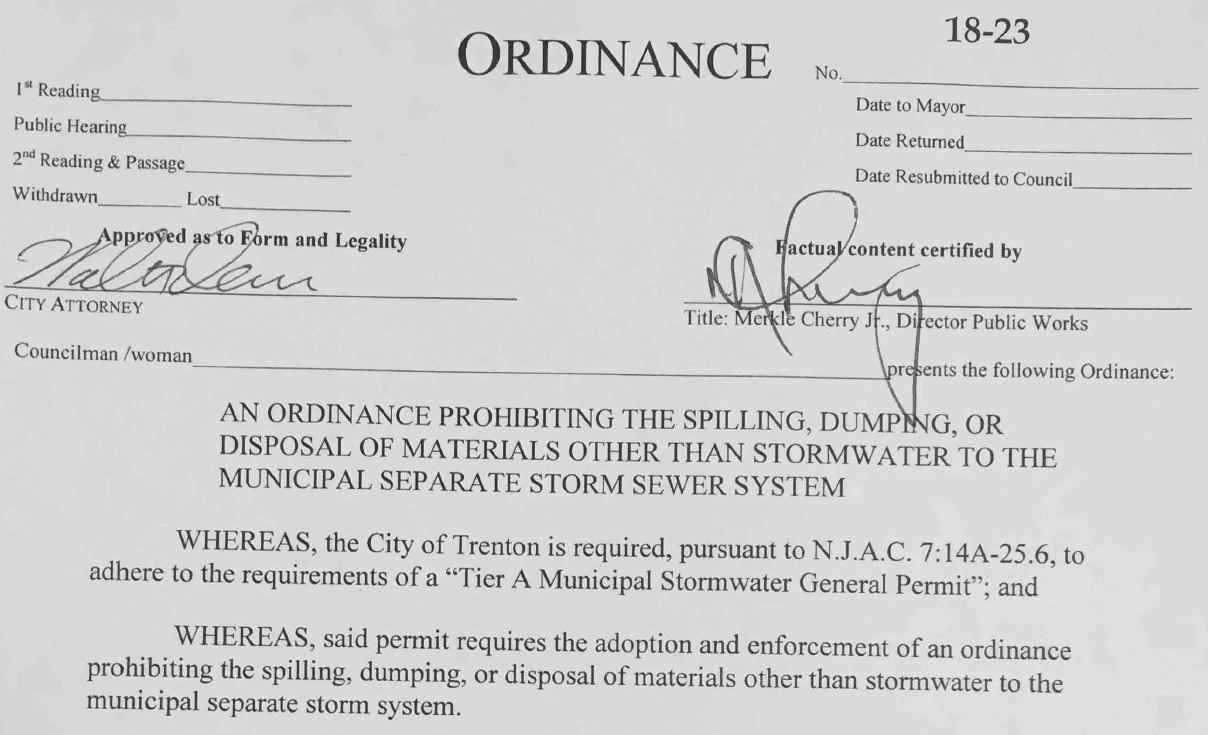

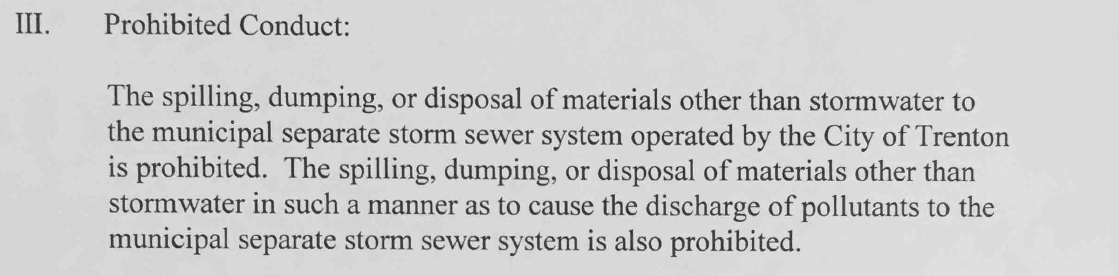

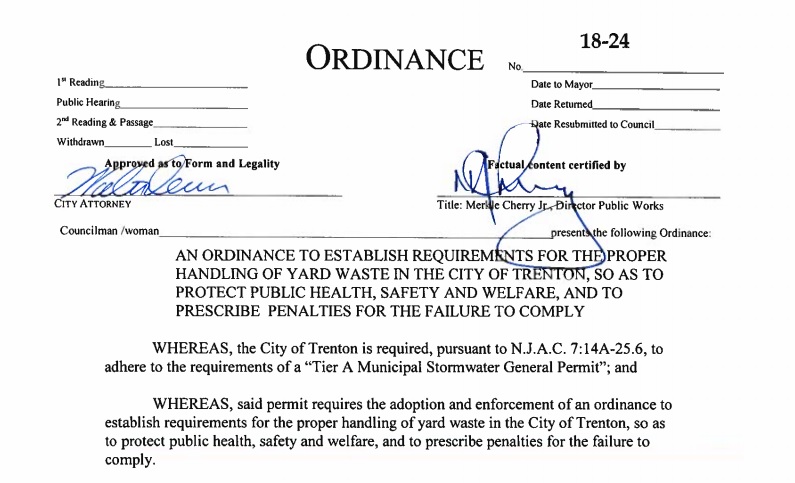

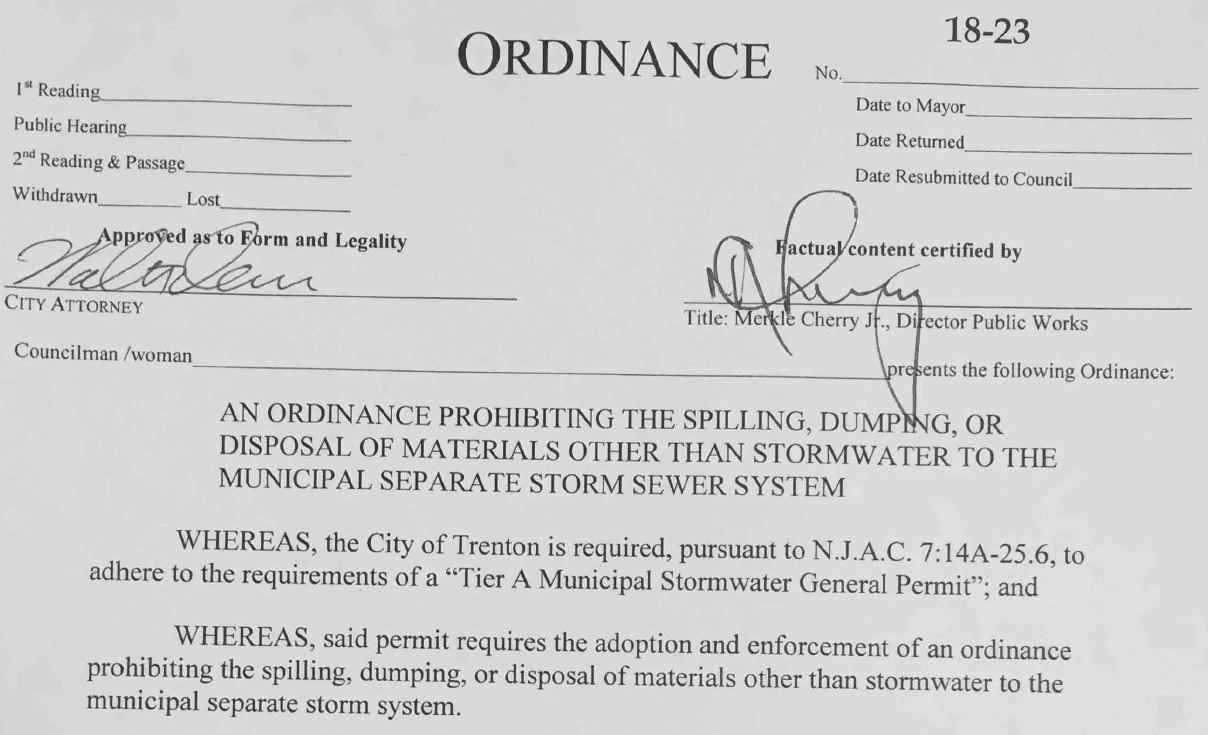

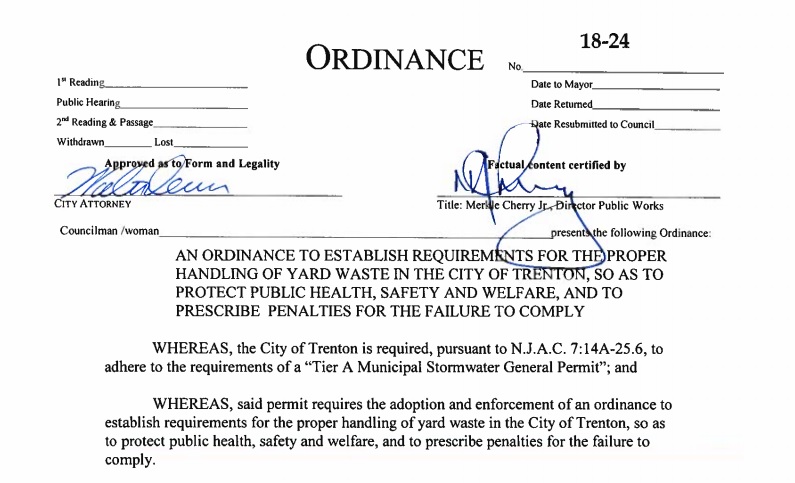

In my last piece posted on Friday, I wrote about a proposed Ordinance #18-24, dealing with residential Yard Waste. This Ordinance, one of three presented to Trenton City Council in order, as explained by Public Works Director Merkle Cherry, to bring the City into compliance with Federal Environmental Protection Agency (EPA) regulations concerning stormwater maintenance. This particular Ordinance was unanimously tabled, removed from consideration to be re-written. The other two passed their First Reading unanimously. Second Reading and final voting for passage is scheduled for May 3.

Perhaps Council might want to send the other two back to be reviewed, in order to make sure they really do what they are intended to do. Because the City’s Law Director Walter Denson, and in this instance Director Cherry, don’t seem to be taking much care in the drafting of the City’s legislation.

In my Friday piece, I wrote this near the end:

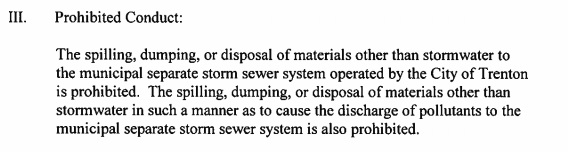

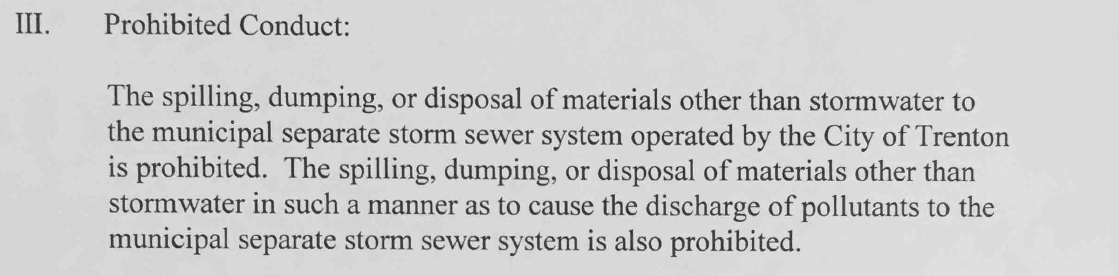

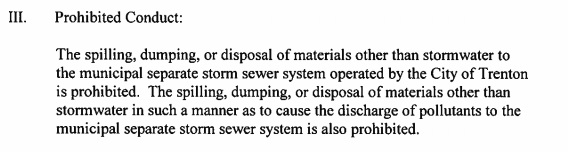

A little bit later, at another opportunity for public comment, I added to my comments that the Ordinance was very poorly drafted, drawing their attention to the fact that although the first page and a half of the measure discussed and defined things like “yard waste” and “containers,” in the section that actually defined the actions to be prohibited by the new law (Section III) the language seemed copied from another Ordinance, #18-23. This language prohibited “The spilling, dumping, or disposal of materials other than stormwater.” Not a single word in this section about leaves, yard waste or bags. This was very sloppily drafted and edited not at all.

At the time I said that to Council, I was only speculating that the language in #18-24 seemed a little wonky. I hadn’t yet seen the texts of the other two proposals, and so couldn’t be absolutely sure that there was any mixup.

Yesterday, I received copies of the other two stormwater Ordinances passed by Council. Number 18-21 can be read in its entirety here. Ordinance 18-23 can be seen here. Below are a few excerpts.

You will notice that this Ordinance is intended, as stated in the header, to prohibit “the Spilling, Dumping or Disposal of Materials Other Than Stormwater.” That intention is spelled out in Section III, which lays out what this bill actually prohibits. You will notice that this Ordinance is intended, as stated in the header, to prohibit “the Spilling, Dumping or Disposal of Materials Other Than Stormwater.” That intention is spelled out in Section III, which lays out what this bill actually prohibits.

It has been duly signed by the City’s Chief Lawyer, Walter Denson, who attests that it is “Approved as to Form and Legality.” Director Cherry signature verifies that the “Factual content” of the legislation has been “certified by” him.

Here’s #18-24, the subject of my last piece and of my comments to Council.

This proposal, as described in its header, is to “Establish Requirements for the Proper Handling of Yard Waste.” Here’s the relevant section explaining what will be prohibited by this new Ordinance: This proposal, as described in its header, is to “Establish Requirements for the Proper Handling of Yard Waste.” Here’s the relevant section explaining what will be prohibited by this new Ordinance:

Yes, you read this correctly. As I had suspected last week, the exact same language in Section III of Ordinance 18-23 was cut and pasted into Section III of #18-24. Yes, you read this correctly. As I had suspected last week, the exact same language in Section III of Ordinance 18-23 was cut and pasted into Section III of #18-24.

The Exact. Same. Language.

Let me briefly describe the probable path these documents took before they were deliberated in Council lat week.

Since, as Merkle Cherry told Council, these laws are intended to bring Trenton into compliance with EPA regulations, those regs probably were sent to the Public Works Department. They may have also been sent to the Law Department, since city compliance would require writing new local laws. The EPA material sent to Trenton probably also included sample language the City could use in its own Ordinances.

After receipt of the EPA requirements by the City, Mr. Cherry and Mr. Denson probably communicated about what would be needed to meet ther Federal regulations. After those communications, the Law Department wrote these three draft Ordinances. Whether or not Mr. Denson wrote the ordinances himself isn’t known. We do, however, see his signature on all three of the bills. Remember, his signature means these bills were “Approved as to Form and Legality.” Public Works Director Cherry added his signature, approving them for “Factual content,” meaning he is saying that these ordinances will do what they are supposed to do.

After both Mr. Denson and Mr. Cherry literally signed off on these bills, they were sent to each member of City Council, probably at the end of last week, in order that they could review them prior to their Conference Session of April 17. In those working sessions, Council openly reviews all of that week’s Docket in detail, reviewing each matter before them and discussing the legislation and any attachments. Directors and other members of the Administration attend these sessions in order top answer whatever questions Council members may have, and offer any additional relevant information that may be needed by Council that might not be contained in the materials sent to them. The Agenda for last Tuesday’s Conference Session indicates that both Mr. Denson and Mr. Cherry were scheduled to attend last Tuesday. I don’t know if they actually did so.

So, after all this: 1) Law Department drafting and review; 2) Public Works review; 3) review by individual Council members prior to their Conference Session; 4) review by all the relevant parties – Council, Denson, and Cherry – at the Conference Session; 5) two full business days following the Conference; and 6) the Council Session of April 19; not one person noticed that the language for one bill was identical to another, that it had been actually copied from one Ordinance to another.

Oops.

I think it’s safe to say that, had public objection to that particular Ordinance not been made by Charlie Leeder and myself, this Ordinance would have approved unanimously along with all the rest, and would be on track to become City Law after May 3.

It’s pretty mind-blowing that something like this can happen. And if it almost happened on this occasion, it’s likely that it’s probably happened before. Who knows what kind of landmines exist in other legislation and other matters proposed by this Administration and approved by this Council that might blow up in the future, causing unknown amounts of mayhem and damage to the City and its residents in the Future?

It’s impossible to know.What we do know is that in this instance – because you can see the proof above – both this Administration and this Council failed the most basic tests of their jobs. They failed to read what was put before them, when they had more than ample time do so. And they failed to pay attention.

Look, a lot of what’s done by the City, and any City, can be very complex and complicated for laymen to understand. There are a lot of highly technical systems and procedures that a City is involved with. And to codify all these technical systems often means translating them into legalese, having its own arcane and dense language needing translation for Council. I get all that. It can be hard.

But that is not the case here. This is an instance of three bundled Ordinances of no more than 3 or 4 pages long, with fairly uncomplicated definitions and language. An instance when no one in the chain – Not One Person – noticed that one of the three ordinances was a word-for-word cut-and-paste job from one of the others.

Sheesh.

Keep this in mind over the next couple of weeks. The Brain Surgeons on Council who almost let this go by who are running for Re-Election on May 8 are Marge Caldwell Wilson, George Muschal, and Zachary Chester.

And two of these Rocket Scientists – Alex Bethea and Duncan Harrison – are so proud of the work they’ve done on Council, they think they should be Mayor!

As you stand in the Voting Booth on May 8, remember that, in addition to Cutting and Pasting, you can also Delete.

On Tuesday of this week, the Trentonian – the only one of the two newspapers in town that still prints news about Trenton – published a story about an Ordinance that Trenton City Council was due to discuss and consider for 1st Reading at its meeting last night. The Ordinance, #18-24, according to the piece by David Foster, “would require residents to place leaves and grass clippings in a trash can, bucket, bag or container to prevent the yard waste from entering the street or storm drain. If a resident does not obey, they can be fined up to $2,000.”

That got my attention. I live on a property graced and cursed by a LOT of trees. Each year, from August until December, those trees drop an ungodly amount of dead deciuduous matter, which I blow and rake to both curbs (I live on a big corner lot in the West Ward), several times throughout the fall. From there, the City Public Works periodically vacuums them up, as they do all over the city according to a published schedule that the City more or less follows. The prospect, for me as well as many other property owners in the West Ward and elsewhere in the City, of having to deal with a veritable mini-mountain of leaves by bagging them or facing a $2,000 for each violation kind of grabbed my attention.

I went to Council last night and spoke about the proposed Ordinance. My comments are below. On the face of it, and compared to other matters that the City deals with, this seemed like a small, insignificant matter. But, as often happens with anything to do with Trenton, pulling on the little string of this Ordinance unraveled a much bigger ball of municipal yarn. First, my comments. I’ll then relate what came after.

I would like to speak tonight about Proposed Ordinance #18-24, which would establish requirements for the proper handling of Yard Waste.

I am here tonight neither to support nor oppose it, not yet, but to ask several questions.

Namely, why is this needed at the present time? The language of the Ordinance states that this measure is required by New Jersey Administrative Code 7:14A-25.6 to adhere to the requirements of a “Tier A Municipal Stormwater General Permit,” and that “said permit requires the adoption and enforcement of an ordinance to establish requirements for the proper handling of yard waste in the City of Trenton.”

I ask for further information about this because a reading of NJAC 7:14A-25.6 does not contain any reference to “yard waste,” nor to “leaves” nor to “grass clippings,” which is how your Ordinance tonight defines yard waste.

Further, NJAC 7:14A-25.6 refers back to the subsection of the Administrative code discussing the Tier A Municipal Stormwater General Permit., NJAC 7:14A-24.2. In that particular subsection, Paragraph 9c reads, “The following stormwater discharges are exempt from the requirement to obtain a NJPDES permit” and goes on in subparagraph 9 c 3 to state that some of those exempt discharges are “Stormwater DGW that are from municipal separate storm sewers, residential areas (including residential streets, parking lots, easements, and open space, commercial areas other than areas of high pollutant loading” as defined elsewhere in the code.”

That sounds like it describes the entire city of Trenton!

So, from this layman’s reading of the legislation on which Ordinance 18-24 relies for its justification, I don’t see where there is a mandate to require the kinds of new restrictions that are under consideration tonight. Can Council please tell me if I’ve missed the relevant mandatory language requiring these measures? I would appreciate it.

So, I will ask again why this Ordinance is needed at the present time? Specifically, I ask why will there be a new requirement to bag ALL yard waste? This will be an onerous obligation to several homeowners, including myself, who annually have to deal with an inundation of leaves from curbside trees, many of which were planted not by previous owners of the property but by the City of Trenton.

On top of the recent property revaluation that added thousands of dollars to my annual property tax bill, and on top of the ceiling on the deductibility of state and local taxes no in effect thanks to the United States Government, such as it is these days, I cannot but help but consider this proposed ordinance a new tax imposed on me and my neighbors in the West Ward who also have many trees on their property and who have also been screwed by the recent revaluation. Because in all likelihood, I will not be physically able to keep up with all the leaf production on my property, which starts in August, not tapering off until December, and picking up again in the spring. I will probably have to hire a lawn service to bag leaves, a much more tedious manual; process than the lawn cutting they do for me and many in the Ward right now. The cost of that additional service will be to me nothing less than another tax.

Another question I have is, why will the City require bagged leaves? Looking at two other municipalities in New Jersey, Clifton and Hamilton, I read the following:

From Clifton (261-40):

“Sweeping, raking, blowing or otherwise placing yard waste that is not containerized at the curb or along the street is ***allowed during the seven days prior to a scheduled and announced collection and shall not be placed closer than 10 feet from any storm drain inlet.***

Hamilton (420-28B) has similar language:

Leaves that are not placed in containers described in Subsection A above shall be placed at the curb or pavement edge no more than seven days prior to scheduled collection and no closer than 10 feet from any storm drain inlet.

So, I ask this question as well: Why are open leaf collection – only at specified times tied to scheduled collections-allowed in Hamilton and Clifton, but not in Trenton?

I also ask why the Proposed fine for Violations is so high, at up to $2000 per occurrence. The City’s current Stormwater Ordinance, Chapter 254, allows fines up to $1000 per occurrence, and that is for major violations on “major developments” in the City. Tonight you want to fine homeowners twice that for not bagging leaves?

In the State Code, Section 7:14A-25-6(b) says, “The permittee [the City] shall, at a minimum, comply with applicable state and local public notice requirements when providing for public participation in the development and implementation of the permittee’s stormwater program. This measure tonight appears to be one of the steps being taken to implement this program. Can you describe the process by which the public participated in its development? I don’t recall any announcements in connection with this initiative.

Also, language in the State statute refers to several deadline dates in 2004 for various actions to be taken. Why has this been delayed until now?

I only became aware of this proposal yesterday, when I read about it in the newspaper. I have heard that yesterday was the first time that some in the Administration, including those who have responsibility for the Department that would be responsible for collection of the yard waste this Ordinance covers. I have not been able to do much research on this matter, but should be able to do better by the second reading, with the additional information I look forward to receiving from Council.

Thank you.

After I spoke, City resident Charlie Leeder also spoke against the proposed Ordinance, stating his belief that this measure would violate the federal Americans With Disabilities Act, something I hadn’t considered. He told Council that by not including any language in the bill allowing for reasonable accommodations to those disabled and elderly residents physically unable to bag their yard waste, this bill would violate federal law.

After Mr. Leeder’s comments and mine, Council asked Public Works Director Merkle Cherry to answer some of their own questions as well as those raised by us. As is often the case with Mr. Cherry, he seemed to be unprepared and ill-equipped to explain and defend this proposal.

He started off by saying that this Yard Waste Ordinance was one of three measures presented to Council last night. The others were #18-21, “Prohibiting Illicit Connections to the storm sewer system” and #18-23, “Prohibiting the Spilling, Dumping, or Disposal of Materials Other Than Stormwater” to the storm sewers. Those other two measures were passed last night for First Reading, Second Reading and final action scheduled for May 6.

Director Cherry explained how all three of these measures were actually required to comply with US Environmental Protection Agency (EPA) rules, not the State regulations mentioned in the language of the ordinance itself. Well, this kind of confused everyone in the room, especially since Mr. Cherry couldn’t explain what the EPA actually required, and couldn’t say exactly would happen as a result of this proposal were it to pass.

Council President Zachary Chester asked Mr. Cherry if the City would actually discontinue the current practice of vacuuming leaves in the neighborhoods. Mr. Cherry stumbled through an answer that seemed to say both that vacuuming would continue and that it wouldn’t.

Council asked Mr. Cherry what the impact of this proposal would be on Public Works manpower, since the mechanized process of vacuuming loose leaves would be replaced by manual wrangling and disposal of hundreds upon hundreds of separate bags and other containers.Mr. Cherry answered that he thought that, at the very least overtime would jump. He told Council that he should have more information by the time that Council had its Second Reading of the bill prior to approval.

Since Mr. Cherry’s answers were not very informative, and that what he did say seemed to indicate that this whole subject was a bigger and more complicated matter than the very short and poorly-drafted Ordinance indicated, Council seemed disinclined to pass this measure for First Reading at all last night.

It took a few times for Council to get across to Mr. Cherry that this Ordinance as drafted wasn’t going anywhere last night. A motion was made to table the Ordinance – postpone it for further review and re-drafting. It was seconded and passed unanimously.

A little bit later, at another opportunity for public comment, I added to my comments that the Ordinance was very poorly drafted, drawing their attention to the fact that although the first page and a half of the measure discussed and defined things like “yard waste” and “containers,” in the section that actually defined the actions to be prohibited by the new law (Section III) the language seemed copied from another Ordinance, #18-23. This language prohibited “The spilling, dumping, or disposal of materials other than stormwater.” Not a single word in this section about leaves, yard waste or bags. This was very sloppily drafted and edited not at all.

This was a very overly long story, I will admit, showing how this Administration – even now – struggles and fails with seemingly the simplest and least complicated of tasks. In short, they screwed up trying to do something about piles of leaves. I think it’s very likely that had Mr. Leeder and I not made our comments to draw attention to this item, it would have passed unanimously, as the other two related proposals did.

This experience demonstrated to me once again how critically important it is for the public to pay attention to what its local officials are doing and speak up to them. Because way, way too often, they just do not know what they are doing.

I can’t wait for them to be gone.

All seven Trenton mayoral candidates appeared on the same dais yesterday, in a town hall event produced by The Trentonian, and held at the downtown campus of Mercer County Community College. It was billed as “a debate,” but like most events labeled that way, it really wasn’t. Limited by the rather confusing and frustrating format, candidates were allowed one minute opening statements, and one minute answers to questions addressed at random to no more than two or three candidates at a time. One round of questions allowed the candidates only single word yes-or-no answers. There were no opportunities for the candidates to address each other, and none of them chose to even reference

So, if you are of a mind that all of Trenton’s issues can be boiled down to 60-second soundbites, you would have been in your element yesterday. If, however, you may have hoped against hope that the format would allow a little more substance, you’d have been disappointed.

The event was both streamed live on the website of the Trentonian; it was also recorded, and can be found posted in today’s online version of the Trentonian story on the event. I won’t discuss what each candidate was asked yesterday, nor their answers. A summary of that can be read in the Trentonian, and you can see the whole thing on video. One tip, though: the video runs 2:49:43, but the actual event doesn’t begin until the 1:10:00 mark.

There were two main issues I had wanted to hear discussed in at least some detail, but I was disappointed that they were both raised – by audience questions, not by the event moderators – only close to the end of the event. As a result, these two topics were only addressed by one candidate each.

The first question was, as I discussed in my last post, the crisis at the Trenton Water Works (TWW). One candidate mentioned clean water as a priority in his opening remarks, but the issue was not raised again until very late in the process. Unfortunately, the question went to two-term At Large Council member Alex Bethea. At 2:36:20, Mr. Bethea was asked for his policy proposals to deal with questions about the water quality and administrative leadership at TWW and its riverside filtration plant. I will quote his entire answer here. Remember as you read this, or even better watch this, that this answer was given by a man who has been a member of Trenton City Council for eight years, and an educator for many decades before that!

We’ve had some issues with our water situation over at the plant, and it’s still unclear about who, what, when. But let me say this. Our water situation is very serious, and I will take that very serious. And we will have top quality water as we used to have before this debacle became apparent. And we will change that.

Now, one of the things that we can do is reach out to the high school, and we can fill those so-called “vacancies.” And we should have had them filled twenty years ago. We’re a little late getting to the party. But, we can do this! And we have to make sure our residents are a part of the solution. And we can do this.

And I don’t see a problem with getting in, assessing that situation, and correcting it within the first 90 days. Thank you.

Got that? All of the problems of the Water Works – all of the Quality violations, the late projects that have led to no fewer than three Administrative Consent Orders and now two contracts with third-party engineering firms to provide several licensed operating personnel – you know, the “who, what, when” – can be solved in the first ninety days of a Bethea Administration. Kids right out of high school can fill these “so-called vacancies.”

Ladies and Gentlemen, I give you Alex Bethea, talking out of his ass for eight solid years. And the Trenton Education Association gave this fool their endorsement?!?! Probably because they figure they could get anything they want from him! The rest of us, though, should be very afraid to think Alex Bethea could end up the latest in the recent line of mayors including Doug Palmer, Tony Mack and Eric Jackson.

The other issue that barely got any attention was that of the city’s local property tax burden and the recent tax revaluation of residential and commercial properties. No questions asked by the moderators directly referenced this problem. The closest the moderators came was a question posed to Walker Worthy, Paul Perez and Annette Lartigue. They were asked how they would spur more small business in Trenton. Not, mind you, support small businesses that were already here and struggling. Nope, they were asked, at 1:31:00 how they would bring in new small businesses.

It wasn’t until the end of the session that we returned – however very briefly – to any discussion of property taxes. Another audience-written question, at 2:37:38, asked Assemblyman Reed Gusciora how he would finance his agenda. He initially answered, “Go to the government.” He described himself as a new mayor who would not have to be introduced the new Governor, Lieutenant Governor, or head of the NJ Department of Environmental Protection, having worked with them, or endorsed them, for a long time. And then, for the only time anyone went there during this event, he said,

We just went through a revaluation. There were some losers and some winners. But the State has to kick in [additional revenues]. Fifty percent of Trenton is tax-exempt properties, and unless they make up for that, we’re going to have to go back to our own residents.

And that was it, folks. An issue that affects everyone who lives or works here has, throughout the entire election cycle so far, has been discussed about one-tenth as much as the pending legalization of marijuana. Disappointing is the very, very mildest word that could be used here. I am disappointed in all of the mayoral candidates to address this with the attention the matter deserves.

Remember, the process that Mr. Gusciora described as producing “some losers and some winners” saw thousands of commercial and residential property owners getting revaluations that doubled and tripled their taxes. At the other extreme, many other residential properties were revalued at reductions of 60% to 80%, with massive tax reductions. The geographic impact of these changes were highly localized, with West Ward neighborhoods such as Hiltonia, Glen Afton and Berkeley Square getting much higher tax bills and East and South Ward neighborhoods getting smaller ones.

Back in January of 2017, when the first revaluation results became available, I speculated about what the citywide impact might be:

Who in the world will buy Trenton property at anything close to current market prices that come with a property tax burden so astronomically high? We already are burdened with some of the highest property taxes in New Jersey, and the value we get for those high taxes is abysmally low. If these tax valuations stand, sale prices for many neighborhoods in town will collapse. This will probably result in increases in foreclosures and abandonment in neighborhoods that – so far – have managed to avoid too many of either.

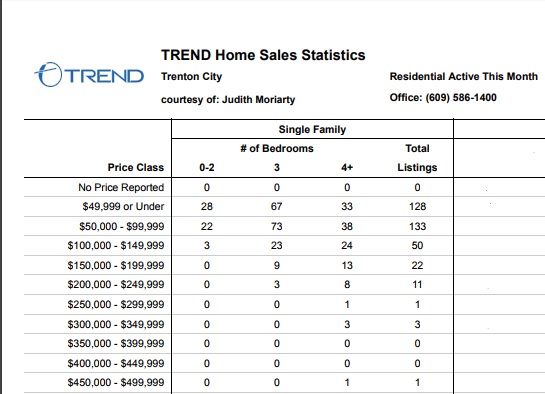

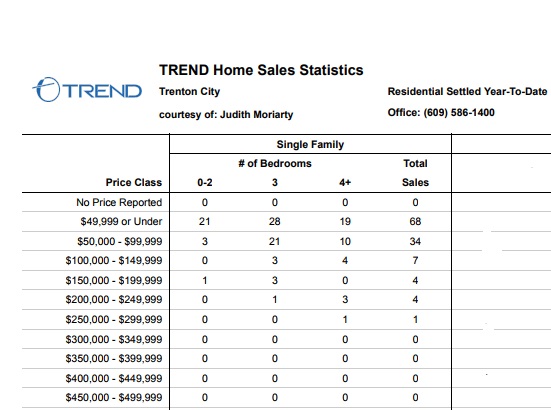

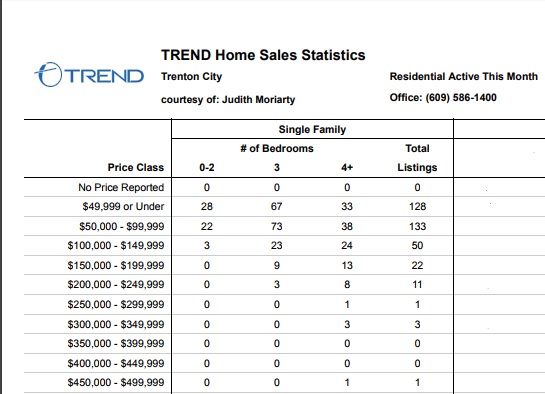

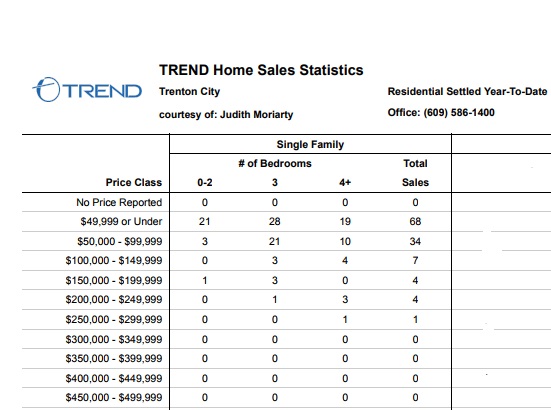

We are now starting to see some of the initial impact of that revaluation reflected in the Trenton Real Estate market. I have the good fortune to be married to one of the leading residential real estate agents in New Jersey. Judy has provided me with some current information about current residential properties (single-family homes) offered for sale, as well as closings, for the first three months of 2018. She has data for Condos as well, but since only only a handful of those show up in the data, and are economically insignificant, I have not included them.

First let’s look at properties offered for sale as of the end of March, as compiled in the TREND MultiListing Service.

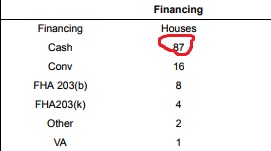

We see here a total of 350 active properties for sale in the City, their total value (not seen here) totaling $29.1 Million Dollars, the vast majority of them offered for under $100,000. That’s where the sales have been happening as well. Here’s a table of settled (sold) properties in the City for the first three months of 2018.

This table shows 118 properties, totaling $7.094 Million (not seen on the chart), were settled in the first quarter of 2018. Here again, the large majority of properties sold were valued at $100,000 and under.

In fact, the sales activity for the lower-priced properties far outpaced those in the higher range. As a percentage of properties being offered, the number of settled properties under $100K is 40% of those offered for sale. The comparable rate for houses over $100K is less than half, 18%.

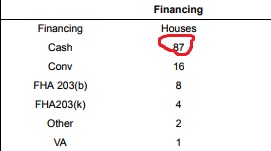

According to Judy, the following is a key piece of information, showing how the purchases were financed.

Of the 118 properties sold so far in 2018, by far the largest of them – 87 – were purchased for Cash, as opposed to the other main sources of financing – Conventional mortgages, Federal Housing Administration, Veterans Administration, or Other.

According to Judy Moriarty, a Cash Purchase is one mark of a real estate investor purchasing the property, not an owner-occupant.

What’s the conclusion here? Based on the data so far, it looks like the most active sector of residential Trenton Real Estate sales is in those houses whose value are under $100,000. Those residences are largely in areas that benefited greatly by the lower assessments made last year, and their lower tax bills.

These houses are selling at roughly double the rate of more expensive houses. And their method of financing suggests they are being sold to investors who, in Trenton, typically have operated them as rental properties.

To the extent that any of them spoke about such things yesterday, the candidates were uniformly opposed to more outside property investors taking more control of Trenton’s residential market, creating more renters and crowding out owner-occupants.

Yet, the very policies and actions taken by the City over the last four years – chief among them the disastrous revaluation – are making this trend worse, and more likely into the future. We are now seeing this in the data.

If you, as Judy and I do, own a property worth more than $100,000, you’re basically SOL. You’ll have one hell of a time selling it, in large part – I speculate here, but base it on the data – to the greatly increased property tax bill, and the poor value of the services we get for our money.

In December of last year, I wrote – and presented to Council – that a homeowner with a residence in Trenton worth about $210,000 will get socked with a tax bill of $10,000. In other cities, the burden is a lot lighter on homeowners. In New York City, for example, you wouldn’t pay a tax bill that high unless your property was worth $almost $850K. Even here in New Jersey, your house in Newark would have to be worth $468K before your tax bill would be five figures.

Heavily owner-occupied neighborhoods such as Hiltonia, Glen Afton and Berkeley Square are, in short, getting screwed. So, to hear a candidate yesterday say, as Reed Gusciora (an owner living in Hiltonia, by the way) did, that if the State doesn’t significantly assist the City of Trenton by upping its fair share of payments in lieu of taxes, “we’re going to have to go back to our own residents,” with greater taxation, is pretty scary.

At some point, homeowners in those neighborhoods will start walking away from their properties. They won’t sell at amounts their owners will need to recoup to break even, and price cuts will be forced by what new buyers there may be, to offset the crushing tax burdens.

Have we heard ANYTHING about that yet, at length, by our candidates for Mayor. Nope, not nearly enough. This is likely the only chance we’ll have to be heard on this matter for the next four years. Perhaps during the inevitable run-off election we can get the final two candidates to talk about this?

For longer than sixty seconds, maybe??

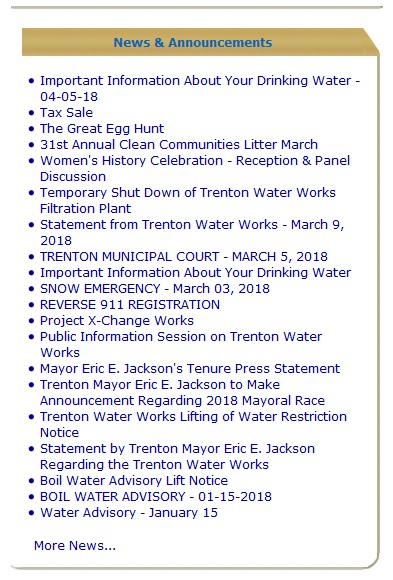

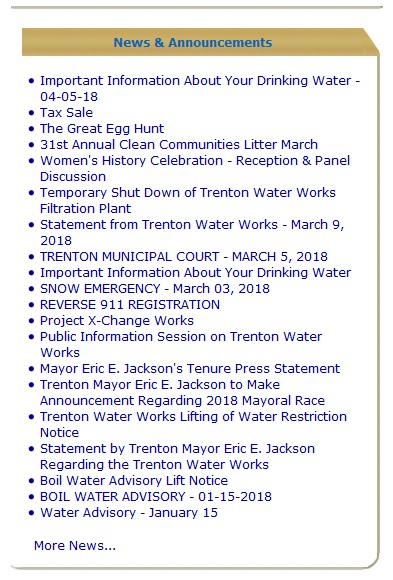

The picture above is from the front page of the City of Trenton’s official website, as sceencapped at 4:30PM this afternoon. This “News and Announcements” section headlines the Twenty Most Important Things that the City wanted its citizens and the rest of the world to know over the last 90 days or so.

You will note that of this list of the Twenty Most Important Things, no fewer than Ten – Half – concern the Trenton Water Works (TWW) and the water supplied by this utility to the City and much of Mercer County. The other Ten notices cover everything else.

Trenton’s Water Works and its problems continue, seemingly unabated. As recently as this week, the City sent out two new service notices to the utility’s customers, only one of which (for some reason) you can see from the City’s News and Announcement page.

So, why is it that since the beginning of the year up until today, NONE of the seven individuals running for Mayor see fit to discuss, or even mention as far as I can tell, the crisis at the Water Works?

Take a look at the policy and issues pages of each candidate. You won’t see anything. If any of them have addressed the issue at any forum or town hall, they haven’t followed up to formalize a position or ideas on their websites. The Trentonian’s copy-and-paste “Election Rumblings” haven’t carried any campaign press release on the subject. The only public officials who seem to talk about the Water Works are outside the City.

The present conditions and future prospects of the Water Works is a top-priority issue for the next Mayor and Council of Trenton. The City is now bound to an Administrative Consent Order, signed in February with the NJ Department of Environmental Protection as the third in a series going back to 2009, obligating the City to do a LOT of things to safeguard our drinking water over the next several years.

The City failed to observe the first two. Will we have any better luck with this one? What do the candidates think about this? What can they tell us, not only the residents of the City, but the tens of thousands of customers in the rest of Mercer County who have a vital personal interest in the result of this upcoming election?

All the candidates talk about the need to revitalize neighborhoods and attract economic development. Do none of the candidates see how anything they intend to do in this City requires clean drinking water and dependable infrastructure to provide it?

We can’t do squat without water.

Is anybody going to talk about this? Anyone?

Check out the websites below. See that there’s nothing anywhere about the Water Works. Ask the candidates at every remaining public event between now and May 8, “Why don’t you talk about our water?”

Alex Bethea

Darren Green

Reed Gusciora

Duncan Harrison

Annette Lartigue

Paul Perez

Walker Worthy

This is an issue that is as close as your kitchen sink. Why is no one running for Mayor talking about it?

UPDATE BELOW

This election season, Trenton voters seeking to become or stay informed about local election goings-on are at a severe disadvantage. Our two local newspapers, on which Trentonians have traditionally looked for information, are taking two very different approaches to covering this campaign season.

The Trenton Times, by and large, is ignoring the election. In fact, they seem to be ignoring most things in Trenton not sports-related. Perhaps if our candidates wore jerseys and hats??

The Trentonian, on the other hand, is providing a lot of coverage, on or pretty close to a daily basis. The trouble is, it’s pretty near impossible to figure out who writes their reports. Because of that, a reader cannot know whether an article is reported news or campaign propaganda.

For the last several weeeks, the Trentonian has been featuring a frequent column called “Trenton Election Rumblings” and consist of mostly short vignettes, policy announcements, or news about individual campaigns and candidates, mostly the mayoral ones. The pieces are never bylined – attributed – to specific Trentonian writers or editorial staff. That’s the first warning sign that there may be something up with these. If you browse the “Trenton Elections” page of the paper’s website, you can see that these “Rumblings” are variously credited to “Trentonian Staff,” or “TRENTONIAN STAFF REPORT,” or “For the Trentonian.”

What do these various bylines tell us? Who knows! The newspaper doesn’t provide any explanation for these various credits, frankly making it difficult for the casual reader to evaluate what it is they are reading. Is this a report story based on actual research and reporting by a Trentonian writer? Or is this simply a press release written by a specific campaign, with who knows how much spin, slant, exaggeration or outright lies baked in? There’s no real way to tell, and the Trentonian doesn’t help the reader in not providing any notes or disclaimers.

Unfortunately, there’s no common journalistic industry standard for credits and attribution. This link will take you to a piece on the website of the Poynter Institute, a well-respected journalism school in Tampa, Florida, in which several newspaper editors from around the country describe how their papers and news services handle their policies for things like Bylines (authorship attribution), Datelines, and the like. They’re all roughly similar, with some variations on a theme.

I like Caesar Andrews description of the policy used by the Gannett News Service. For him and his colleagues, “Bylines go to the reporter or reporters who contribute significantly to story. Other credits may be used when someone else participates in gathering the news.” [Emphasis in the original.]

OK, that seems pretty clear and uncomplicated. Let’s apply it to “Election Rumblings.” In an installment I’ve already described, from March 16, Councilmember and mayoral candidate Duncan Harrison is extensively quoted on the occasion of the passage by Council of his proposal to allow Trenton citizens and customers to use credit and debit cards to pay for City services and charges. Except, as you know from reading this space, all that Council actually approved was the method by which vendor proposals for those services would be sought and evaluated.

That article included several remarkable claims, not in quotes, so not directly attributed to the candidate. By not being in quotes, the author – in this case “By TRENTONIAN STAFF REPORT” is implicitly presenting these claims as reported fact. Take this one sample:

Accepting credit and debit card payments will cost the city nothing and will make it more convenient for Trentonians to pay bills and fees. It will also expand the city’s budget by making it easier for those who live outside Trenton to pay their bills and fees on time.

There’s nothing in that quote to indicate that these features of credit card processing are only wishes by the Councilman, that don’t yet appear in any actual proposal by potential vendors, let alone features specified by an actual negotiated, signed, approved contract. There may never be an adopted proposal, and even if there is one – eventually – iot may not feature all of these items. To be frank, these are only Wild-Assed Campaign Promises, nothing more. But the Trentonian, by placing it in its newspaper with no individual byline and no disclaimer of any kind, lends this its journalistic endorsement.

So, who wrote this? The Trentonian, or the campaign? You can’t tell! There is simply no way to know just who has “participated” in gathering this “news.”

Take a more recent example. This one “By Trentonian Staff,” datelined yesterday at 5:22 PM. The piece leads off, “The campaign headquarters of Mayoral Candidate Walker Worthy Jr. has been burglarized three times in recent weeks. The incidents took place the night of March 29, Easter Weekend and April 5. The campaign filed police reports and is in the process of purchasing surveillance cameras.” The article goes on to include a lengthy quote, actually more of a lengthy statement, by the candidate, and finishes with the advisory, “For more information about Worthy and his campaign, visit” followed by the URL of his campaign.

This piece frankly reads like a press release written by the campaign, and published by The Trentonian verbatim and without any effort by the paper to verify the claims made with any other sources, including Trenton Police.

A HUGE clue to this is this line: “When Trenton Police complete their investigation, Worthy intends to share the information publicly.”

So, The Trentonian will rely on a Candidate to directly provide to the newspaper further information from the Police!

That’s not how this is supposed to work!!! A real news article, written by a real reporter, would include lines such as, “When contacted the Trentonian, a Trenton police spokesperson had no further information but promised to provide it,” or “This reporter visited Worthy campaign headquarters and saw evidence of forced entry.”

You know? THAT is what reporting reads like. “Election Rumblings” reads like unfiltered, unedited campaign propaganda.

What has really been going on at Walker Worthy campaign headquarters? I don’t know, because I do not trust one word in this article.

You shouldn’t either.

When you come to this page (Thank you!), you know who writes it. There’s no vague byline like “By ‘And Another Thing.'” My name is on my website, and I stand by what I write. That’s the standard I hold myself to.

That’s the standard you should hold our local “professional” media to, as well.

It’s sad that the Trenton Times seems to be largely Missing In Action during this election season. The sole remaining daily reporting this election in detail, The Trentonian, by default needs to work to a higher journalistic standard. It should openly disclose the sources of the “Election Rumblings,” whether the work of a specific staff individual, or of a partisan campaign office. It should explain the meanings of their various bylines.

In the absence of those things, you simply cannot trust what you read in this newspaper when it reports on Trenton’s candidates and campaigns.

– By Kevin Moriarty

UPDATE: 2:30 PM, 11 April 2018

Thanks to reader Dennis Waters, the Walker Worthy piece in the Trentonian discussed above, bylined “By Trentonian Staff” has been found. It can be read on the website newjerseyglobe.com, and the Worthy campaign spokesperson Dan Knitzer is listed as the Contact. Presumably Mr. Knitzer or a colleague actually wrote this piece.

Folks, it’s the exact same article published in the Trentonian and bylined “By Trentonian Staff.”

At a time when legitimate journalism is being unfairly attacked as “Fake News,” it’s very disheartening to see an actual example of it.

Shame on the Trentonian!

|